Form Energy has closed its Series D financing round, with investors including steel company ArcelorMittal putting US$240 million into the Boston-headquartered iron-air battery startup.

The energy storage company also counts Bill Gates’ Breakthrough Energy Ventures among its investors. Earlier this year, Form Energy ended a period of stealth mode operation by finally disclosing the chemistry and technological principles behind its battery, intended to enable bulk storage of energy for as much as 150 hours.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Such a device could bring about an age of renewable energy as baseload power for the grid, making wind and solar fully competitive with thermal generation, Form Energy CEO Matteo Jaramillo told Energy-Storage.news in an interview in April. Essentially, the battery oxidises iron, turning it to rust as the battery discharges, then application of an electrical current as it recharges converts the rust back to iron, emitting only oxygen.

Jaramillo, former director of Tesla Motors’ powertrain business and director of Tesla Energy, co-founded Form Energy to pursue what he called “the biggest opportunity on the grid for energy storage”: creating a battery that when paired with renewables can cost-effectively replace fossil fuels at scale.

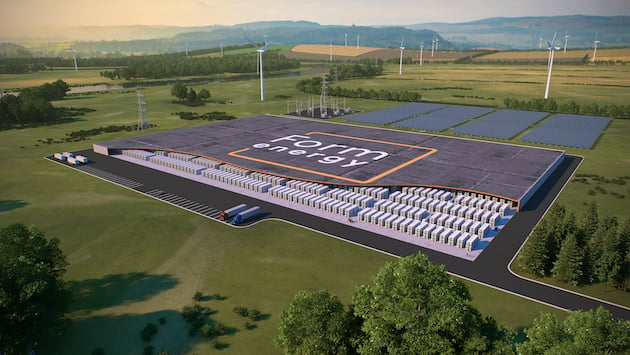

The company’s first contract for a pilot project has been signed with Minnesota utility Great River Energy. That 1MW system is expected to be online in late 2023 and Jaramillo told this site wider deployment of the iron-air technology will be possible the following year.

Form Energy said in a press release sent to media including Energy-Storage.news yesterday that the new financing will accelerate the company’s market entry. Leading the round was ArcelorMittal’s XCarb innovation fund. One of the world’s biggest steel companies, employing nearly 170,000 people globally, ArcelorMittal launched the fund to invest in breakthrough technologies that can enable low carbon steelmaking.

Form Energy and ArcelorMittal are also working to jointly develop iron materials which would be supplied for use in the battery systems. Form said it plans to source iron domestically, for manufacture close to where they will be sited. The company believes its reliance on the low-cost and abundant metal as well as its technological advances enable storage of energy at a tenth the cost of lithium-ion.

That said, Jaramillo has previously said that rather than replacing lithium, the Form Energy iron-air battery can play a complementary role on the grid to the more ubiquitous technology, which could perform applications that require higher power and higher energy density. The Form Energy battery storage systems store and output much larger volumes of energy at lower power and density.

Working to ‘meet the urgency of demand for scalable climate solutions’

Form has now raised more than US$360 million, with its previous Series C round that closed in late 2020 having been worth US$76 million. Also participating this time out were impact investment funds TPG Rise Climate and NGP Energy Technology Partners III, private equity firm Perry Creek Capital, investment manager Coatue, Singapore government-owned investment group Temasek, impact VC funds Energy Impact Partners, Breakthrough Energy Ventures and Prelude Ventures, as well as MIT’s The Engine, mission-aligned investor Capricorn Investment Group, Eni Next — the VC arm of energy company Eni, and Macquarie Capital.

“We are thrilled to back the company as it develops its state-of-the-art, multi-day energy storage technology in order to rapidly decarbonise the electric grid and foster growth of renewable energy across industries,” TPG Rise climate investing team member Marc Mezvinsky said.

Form Energy also created a means for underrepresented groups in the VC investment space to participate in the round, such as black, Latinx, LGBTQ+ and women though joining the Cap Table Coalition. The coalition was formed by high-growth startups, VC firms and emerging fund managers to help make a fairer investment landscape for all.

“This is a critically important and exciting time at Form Energy and we look forward to collaborating with our diverse coalition of leading investors as we accelerate development and prepare for commercialisation to meet the urgency of demand for scalable climate solutions,” Mateo Jaramillo said.

Form Energy recently made some key hires, including RJ Johnson, one of Jaramillo’s former colleagues at Tesla, as senior VP of commercial operations. Jaramillo had held roles at Tesla including director of powertrain business and director of Tesla Energy, while Johnson had let Tesla Energy operations after time in senior management positions at NextEra Energy Resources.

“Since leading the Series C, we have been impressed by the company’s pace of execution and quality of hiring,” Coatue senior managing director Jaimin Rangwalla said.

“We look forward to continuing to work closely with Mateo and the others on the Form Energy management team as the company moves into the next growth phase of preparing to scale for market entry.”