Form Energy has raised US$450 million from investors including ArcellorMittal, bringing the multi-day battery startup’s total investment to date to US$800 million.

The tech company announced the successful Series E funding round yesterday, led by TPG Rise Climate, an impact investing platform for alternative asset manager TPG’s TPG Rise fund, which itself closed in April with US$7.3 billion to invest.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Form Energy is developing and commercialising a novel battery technology based on iron and air, with which it is targeting applications that require 100 hours of energy storage, possibly even more.

The basic principle behind it is the reversible oxidation aka rusting, of iron as the battery discharges, while applying electrical current to it as it charges converts the rust back to iron, emitting only oxygen.

That means it could enable renewable energy to be a direct replacement for fossil fuels on the grid, helping energy suppliers ride out quiet periods of wind and solar PV generation, company CEO Mateo Jaramilo, a former executive at Tesla, told Energy-Storage.news in a 2021 interview.

The company’s first pilot project was announced in 2020, with Form set to supply a 1MW battery system with up to 150 hours duration to Great River Energy, a Minnesota utility aiming to radically lower its dependence on coal. Discussions were also said to be underway with Georgia Power for a potential pilot with the southern US utility a few months ago too.

At the recent RE+ 2022 clean energy industry event in Anaheim, California, Form Energy senior business development manager Molly Bales appeared in a panel discussion on long-duration energy storage and its role in the market.

While long duration is itself an loosely-defined term, with some definitions talking about systems with four-hour duration or longer, fellow panellists Kiran Kumarasamy of Fluence and Sara Kayal of Lightsource bp both said they felt the term applies to eight hours or longer.

Bales noted that while there will be a need for diverse storage technologies on the modern electricity grid, including shorter duration and diurnal (daily) storage playing roles to help balance the grid, Form Energy’s technology aims to answer a different value proposition around resiliency and reliability for utilities with a need for multi-day use cases.

Answering a question referencing the latest hurricane damage inflicted on Puerto Rico’s energy sector, Bales said that Form’s battery could also “be that asset that can either kind of sustain throughout the disaster, or eventually start back up the grid”.

According to Bales, Form Energy is seeing “serious interest” from utilities around the North American market that the company is focusing on.

“We are working closely with our utility partners to do capacity expansion planning models and things like that, to actually show the value [of multi-day storage], and we’re finding a compelling focus. I think that these opportunities are very real,” Bales said.

Bales noted that while two of the US’ leading energy storage markets, ERCOT in Texas and CAISO in California have very different dynamics today, both are going to need that diversity of energy storage technologies and durations. Broadly speaking, as renewable energy penetration increases on a grid, so does the need for storage and as those levels go up even higher, the need for more hours of storage does too.

A team from Form Energy recently contributed a Guest Blog for this site on how long-duration and multi-day energy storage could support California’s energy transition goals.

Form Energy factory announcement expected this year

Form’s Series E round was oversubscribed and follows a 2021 Series D round that raised US$240 million, US$40 million more than the company was aiming for. ArcellorMittal invested US$25 million into that Series D and followed up with a further US$17.5 million participation in the latest round.

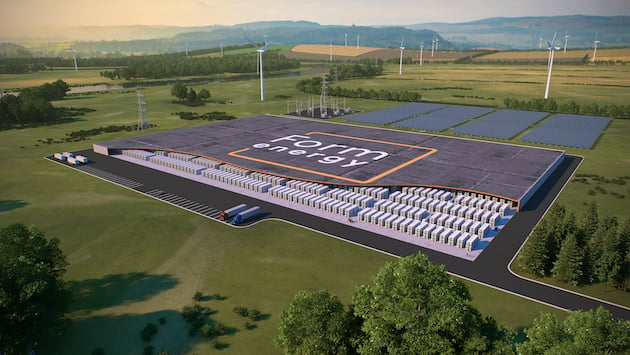

ArcellorMittal and Form have signed a joint development agreement to see whether the metals company could supply direct reduced iron (DRI) for use in the batteries, which Molly Bales pointed out the tech company plans to build domestically in the US. Form has apparently narrowed site selection for its production lines down to three possible sites in the US from a longlist of 100 and is expected to make an announcement before the end of this year.

Other Series E investors include institutional investors GIC and Canada Pension Plan Investment Board (CPP Investments) which joined for the first time along with existing Form investors like Bill Gates’ Breakthrough Energy Ventures, Energy Impact Partners, Coatue, Temasek, Prelude Ventures and others.

“The development of reliable, long-duration energy storage technology is critical for the global transition to renewable energy. By introducing new storage solutions to the market, Form Energy can contribute to the energy transition process while also providing attractive risk-adjusted returns for the CPP Fund,” CPP Investments managing director and head of growth equity Leon Pedersen said.

“Form was founded with a unified mission to develop a multi-day energy storage battery that would unlock the power of extremely low-cost renewable energy to transform the electric grid. Over the last five years, through rigorous R&D and product engineering, our 100-hour iron-air battery product is ready to scale,” Form CEO Mateo Jaramillo said.

“The Series E funding will accelerate our ability to responsibly build a globally competitive US battery manufacturing supply chain and advance American innovation.”