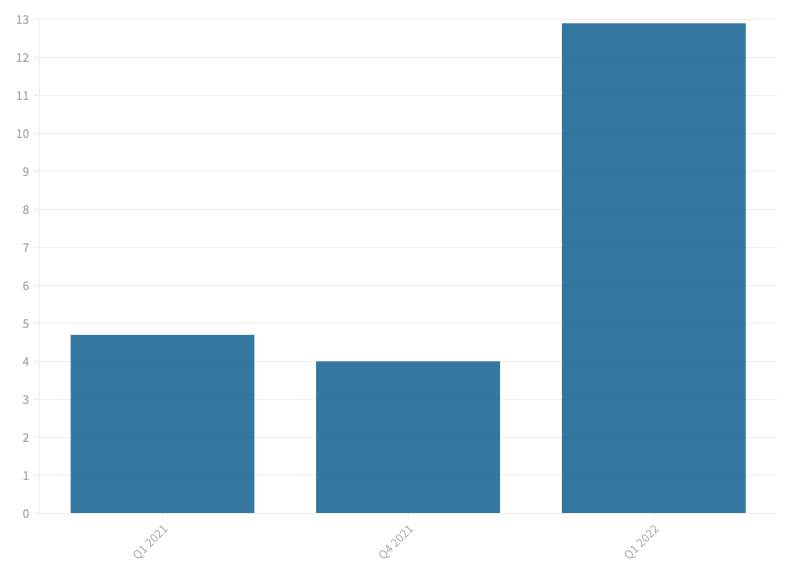

Battery storage companies raised US$17 billion in corporate funding during the whole of last year — a significant leap from US$8.1 billion in 2020 — but in the first quarter of this year alone have raised US$12.9 billion already.

The figures come from market intelligence group Mercom Capital’s latest quarterly report into the battery storage, smart grid and energy efficiency sectors and the corporate funding — including venture capital (VC), debt and public market financing — that goes into them.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The US$12.9 billion amount attracted by battery storage companies across 26 deals during the first quarter of 2022 included US$1.1 billion of VC money and US$11.7 billion in debt and public market financing. It utterly dwarfs the total US$316 million for smart grid companies and US$109 million for energy efficiency in the same period.

In the previous quarter (Q4 2021), battery storage’s total corporate funding came to US$4 billion across 27 deals, implying that average deal sizes have ballooned.

After the sector had seen a 159% increase in funding from 2020 to 2021’s full-year totals, Mercom Capital CEO Raj Prabhu had said that battery storage’s significance in the global energy transition was finally being reflected by investment activity.

It seems likely the continued robustness in funding activity Prabhu predicted at the end of 2021 will be maintained.

Mercom Capital noted that last quarter, VC funding into battery storage dipped quarter-on-quarter and remained largely flat year-on-year: in Q4 2021 VC investors put in US$1.6 billion (28% up over Q1 2022) and in Q1 2021, US$1 billion (15% less than in Q1 2022).

But debt and public market financing soared from US$2.4 billion in Q4 2021 and US$3.7 billion in Q1 2021.

Hydrostor tops VC funding top five list

As with previous editions of its report, Mercom Capital revealed the top five recipients of VC funding. This time out, it makes for interesting reading due to the mix of different technology and company types that made the list.

Canadian company Hydrostor, which has a proprietary advanced compressed air energy storage (A-CAES) technology and is also developing several gigawatt-hour scale projects in California and Australia, got the number one spot.

This was due to a US$250 million investment commitment from Goldman Sachs Asset Management, about which Hydrostor CEO Curtis VanWalleghem spoke at length with Energy-Storage.news at the time it was announced. Yesterday, this site also reported that the company has freshly attracted US$25 million in institutional investment from the Canada Pension Plan Investment Board (CPP).

Second in the list was German industrial electrolyser company Sunfire which raised US$215 million in a Series D funding round from investors Copenhagen Infrastructure Energy Transition Fund I and Blue Earth Capital. US solid-state battery company Factorial which raised US$200 million, also in a Series D from carmakers Mercedes-Benz and Stellantis, came third.

Viridi Parente, also a US company, which claims it is developing ‘fail-safe’ lithium-ion battery technology for heavy industrial and grid applications raised US$95 million from a consortium including National Grid Partners in a Series C to land in fourth place.

Our Next Energy (ONE), another US company, was fifth in the list, after raising a total US$65 million in a Series A funding round, with the company claiming its battery tech could double the range of electric vehicles (EVs) using cobalt-free chemistries that pose no thermal runaway risk.