Battery storage companies raised 159% more corporate funding in 2021 than in 2020, with funding activity reflecting the “significance of battery energy storage in the energy transition,” analysis group Mercom Capital has said.

Mercom Capital’s latest quarterly reporting of funding and mergers and acquisition (M&A) activity into battery storage was published last week, along with its collation of activity in the smart grid and energy efficiency sectors.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

With the new Q4 2021 edition bringing together stats for the whole of last year, total funding across the three sectors reached US$19.5 billion, up from US$8.1 billion in 2020 and largely driven by a huge uptick in activity in battery storage.

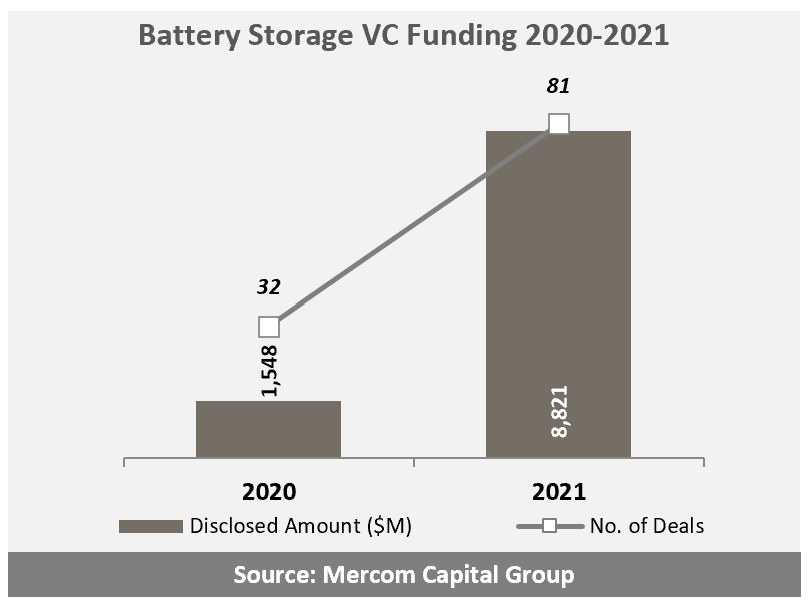

For example, venture capital (VC) funding in battery storage totalled US$8.8 billion across 81 deals, compared to US$1.6 billion in 2020 across 32 deals. Total VC funding across battery storage, smart grid and energy efficiency was US$10.1 billion for the year — again a big jump from 2020’s US$2.6 billion.

“VC investments into battery storage companies exploded in 2021, and for the first time, funding activity reflected the significance of battery energy storage in the energy transition,” Mercom Capital Group CEO Raj Prabhu said.

“We expect funding activity to remain robust as substantially more investments are needed to get battery technologies off the ground and into commercial stages at scale.”

159% increase over 2020

Battery storage firms raised a total US$17 billion from 101 corporate funding deals during the year. This was the highest level of funding seen since 2014, with almost double the number of deals announced over 2020, when a US$6.5 billion total was reported by Mercom.

With the group’s last report from Q3 2021 having found that corporate funding in the first nine months of the year for battery storage had totalled US$11.4 billion, including US$5.5 billion VC funding, Q4’s performance was particularly strong.

As noted by Energy-Storage.news at the time, the COVID-19 pandemic had appeared to be among factors limiting battery storage investment activity in the early part of 2020, with just over half a billion raised in H1 2020.

The sector did however rebound strongly in the second half of the year, with nearly US$6 billion raised in six months, more than double the amount raised for the whole of 2019.

Mercom also noted that 2021 saw 24 M&A transactions executed, five more than the 19 recorded in 2020. There were also 37 M&A transactions relating to battery storage projects.

There was also an increase in debt and public market financing for battery storage companies, with US$8.2 billion raised by 20 deals last year. In 2019, that had stood at US$1.1 billion across 10 deals and US$5 billion across 22 deals in 2020.

Lithium-ion battery tech companies got the most VC funding for 2021, led once again by Northvolt, the Sweden-headquartered startup building gigafactories in Europe. Northvolt raised US$2.75 billion through the year from a diverse range of VC investors from Goldman Sachs Asset Management, Volkswagen and Baillie Gifford to music-streaming service Spotify’s CEO Daniel Ek and numerous others.

Northvolt is targeting the stationary energy storage industry, in addition to the electric vehicle (EV) market and production has begun at its first gigafactory, Northvolt Ett, this winter.

Chinese battery cell manufacturer SVOLT, focused largely on the EV space, was second — and third — in Mercom’s list of top five VC deals with US$2,580 million raised across two investment rounds.

US silicon anode startup Sila Nanotechnologies and Taiwan-headquartered solid-state battery developer ProLogium raised US$590 million and US$326 million respectively.

Meanwhile, just outside the Mercom top five but with notable VC-funded deals were solar and energy storage project developer Nexamp (US$240 million) and long-duration energy storage battery tech innovators Form Energy (US$240 million for its iron-air battery tech) and Ambri (US$144 million for its liquid metal batteries).