The asset management group of investment banking firm Goldman Sachs is making a US$250 million investment into advanced compressed air energy storage (A-CAES) company Hydrostor.

The preferred equity financing commitment comes from Goldman Sachs Asset Management’s Private Equity and Sustainable Investing businesses. It will be paid out in tranches tied to project milestones being achieved by Ontario, Canada-headquartered Hydrostor.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Hydrostor is commercialising its proprietary compressed air energy storage technology, claiming it can be a cost-effective long-duration energy storage solution. While the company has to date only built one commercially operating 2.2MW / 10MWh+ system which came online in 2019 in Ontario, it currently has 1.1GW / 8.7GWh of projects in Australia and California which are claimed to be “well underway”.

The fresh investment will support the development and construction of those projects, and expand Hydrostor’s global development pipeline.

As early as 2017, consultancy Deloitte identified the company’s Ontario pilot scheme as an example of innovation and technological improvement in the energy storage space, as Energy-Storage.news reported at the time.

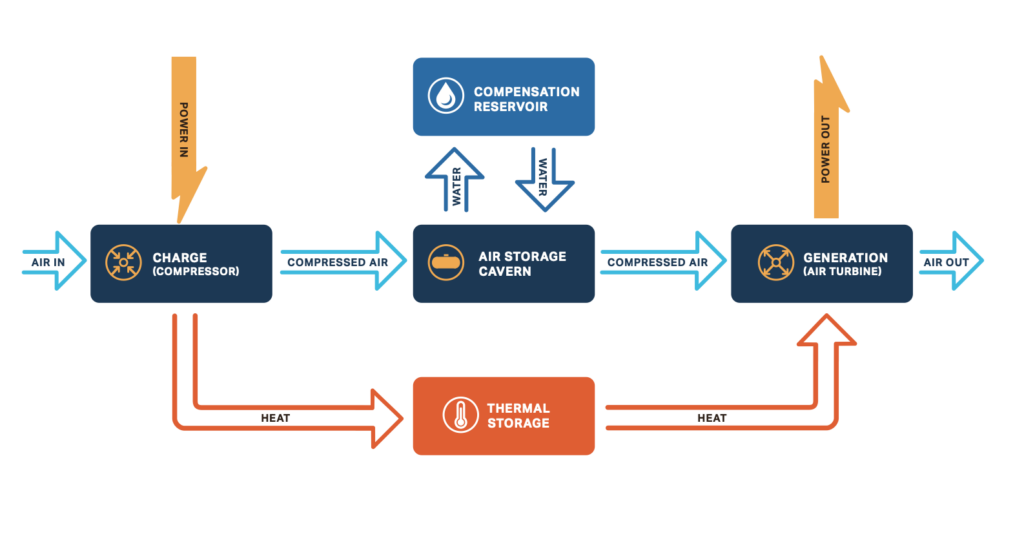

Later that year, Hydrostor unveiled Hydrostor Terra, its energy storage system solution aimed at providing bulk long-duration storage at a cost competitive with natural gas plants. Basically, the compressed air system turns off-peak electricity into compressed air, stored in an isobaric underground cavern.

As it charges, it also stores heat generated by the compression process in an adiabatic thermal management system. This use of thermal energy is part of the ‘A’ in A-CAES, giving it better round trip efficiency than other compressed air technologies, according to Hydrostor. The existing Ontario project serves multiple applications, including peaking capacity and ancillary services.

Hydrostor got some funding from the Australian Renewable Energy Agency (ARENA) and the South Australian government’s Renewable Energy Technology Fund in 2017 and last year Energy-Storage.news reported that the Canadian government had pledged financial support to the company for a planned 300MW – 500MW project at an unnamed location.

The A-CAES company secured CA$10 million (US$8 million) of growth capital last summer and filed applications with the California Energy Commission (CEC) to get licensing approval for two California projects, one of 400MW / 3.2GWh in November and another of 500MW / 4,000MWh in December.

A report by ACIL Allen, a consulting group, completed a third-party study last June which found a 200MW / 1,600MWh A-CAES project proposed in a remote part of South Australia could contribute more than half a billion dollars to the local economy while making local electricity networks more stable.

Interest in long-duration energy storage

Goldman Sachs Asset Management’s investment, which is thought to be among the largest commitments by a single investor into a long-duration energy storage company, will help Hydrostor accelerate project execution through development, construction and operations, together with the company’s existing investors and partners.

The funds will also be used to support Hydrostor’s development and marketing activities in markets which have identified a near-term demand for long-duration energy storage.

Last year, Form Energy, a startup with a novel iron-air chemistry long-duration energy storage technology raised US$240 million in a funding round, while gravity-based storage startup Energy Vault raised US$100 million in a Series C funding round. Energy Vault last week added Korea Zinc to a list of investors that includes Saudi Aramco and Softbank Ventures.

Other recipients of investment in the long-duration energy storage space include various flow battery, thermal and mechanical energy storage technology companies. Last year at COP26 the Long-Duration Energy Storage Council was launched representing 16 of those companies among its 24 founding member organisations.

In Energy-Storage.news’ ‘Year in review 2021’ series of recent articles on the state of play in the industry, EPC firm Burns & McDonnell and developer Recurrent Energy — key players in the downstream deployment end of the sector — highlighted the rising interest in and expected growth in demand for long-duration energy storage.