Goldman Sachs Asset Management has more than US$2 trillion of assets under supervision through more than 30 offices around the world.

Its reach goes far and wide into many areas of financing and investing, including the ownership of two of the world’s largest solar projects featuring battery energy storage, through its subsidiary Goldman Sachs Renewable Power.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Meanwhile, Ontario-headquartered energy storage company Hydrostor has been taking “very limited funds,” learnings from a few megawatts of projects in operation and “placing bets” that a technology it calls advanced compressed air energy storage (A-CAES) can scale up to multiple gigawatt-hours of long-duration storage around the world.

Earlier this month, Energy-Storage.news reported that Goldman Sachs has chosen to invest a quarter of a billion dollars into the Canadian startup. The funding will be paid out in tranches, depending on what sort of progress Hydrostor can make in executing three projects it has in development in California and Australia, totalling 1.1GW/8.7GWh.

Energy-Storage.news heard from Hydrostor’s CEO Curtis VanWalleghem on how the company believes it has improved compressed air to be competitive and a key part of the future energy system. The CEO explained more about the Goldman Sachs Asset Management investment and why A-CAES is “reliable capacity which can be located where you need it”.

The Hydrostor story begins in 2010, VanWalleghem says, when the company “figured out a new way of improving compressed air” and then built a small pilot system to prove the physics worked. Its first 1MW system was built, connected to the grid by utility Toronto Hydro and put into service in 2015.

Hydrostor’s first commercial facility then went online in Godereich, Ontario, in 2019. The CEO says it made it possible for the company to offer performance insurance and wrap the technology solution into a solid offering, as well as demonstrating a commercially operating facility in action.

“We had very limited funds at that time as we were still proving out the technology. So I gave my team a handful of millions of dollars and said, ‘let’s start developing large-scale systems and place some bets.”

Before we go further, it’d probably help to understand what it is that Hydrostor defines as ‘advanced compressed air energy storage’.

What the ‘A’ stands for in ‘advanced compressed air’

VanWalleghem says Hydrostor has made two main improvements to compressed air storage, a “conventional asset class” which has been running at sites in Alabama, US and Germany for four or five decades.

Those plants, which total about 400MW between them, have run very reliably for all that time, but are not without major drawbacks, he says.

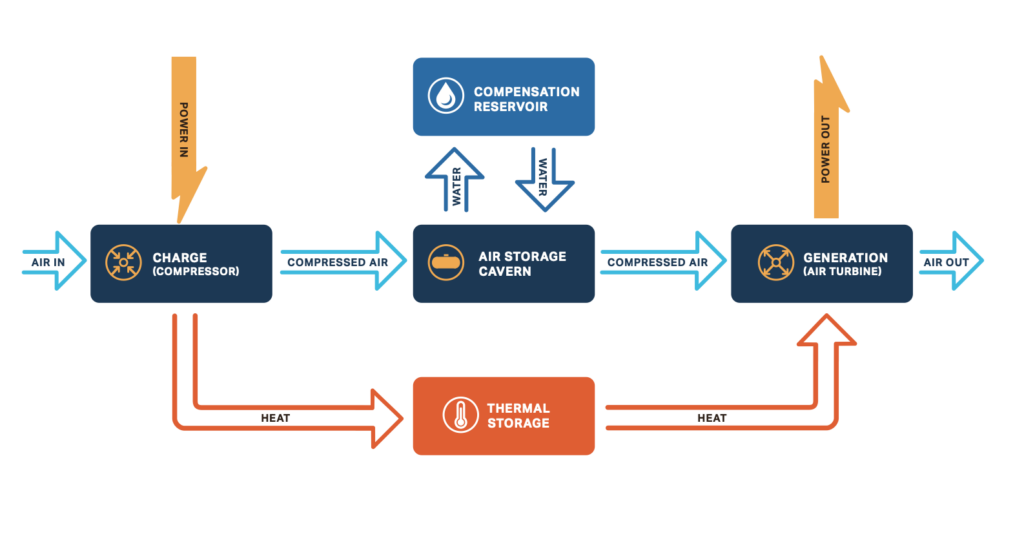

“The first one was they produced emissions because the system would burn some natural gas in the process to preheat the air before expanding it. So what we put in was a very simple and reliable thermal management system, that when you compress air, instead of venting the heat to the atmosphere, store it in hot water, and use that hot water to preheat the air before expansion.”

Doing that eliminates fossil fuels as well as emissions, as well as improving the round trip efficiency of compressed air considerably, from 40% to almost 65%.

“The second innovation that we brought to it was to not use salt caverns [to store the air], but rather use this hard rock cavern from the mining and the hydrocarbon storage industry and flood it with water, which means it’s hydrostatically compensated. So when you put air in, it lifts water out and by doing that, you need far less space.”

Instead of needing to look for underground salt caverns to site the plants, Hydrostor’s caverns can be dug into “almost any rock,” which means A-CAES plants could be built “anywhere,” he claims.

“Unlike pumped hydro or conventional compressed air, that are very limited where they can go, we have far more flexibility on where we can site. Obviously not to the same extent as a battery, but leaning a lot more that way than leaning towards pumped hydro and conventional compressed air.”

Hold the salt, add flexible siting capability

The air in conventional compressed air storage is kept, like natural gas or butane, in underground salt caverns, because the salt forms an impenetrable seal in the rock walls, preventing leaks. In those industries, their gas is also stored under very high pressure.

Meanwhile Hydrostor has looked at the problem a little differently and stores air under “pretty low pressure, and at the same pressure as the groundwater that’s coming in”.

“Because we’re only storing atmospheric air, if a little bit leaks out, it doesn’t provide any environmental concern. That allows us to go in pretty deep — we go 600 metres deep. You go 600 metres deep in rock and you put in low pressure air, not very much leaks out, if any.”

This ability to site projects flexibly is “tremendously important,” VanWalleghem says.

“In the energy storage industry, it’s one thing to say ‘I can give you storage’ — and it’s going to be in the middle of nowhere. Or you can say ‘I can go right to your substation where you’ve got a real urgent issue and it’s a high price node, and I can build that right there’. That’s what we get by using this type of cavern.”

The technology offers a “nice combination” of less than five minutes response time, higher round trip efficiency than some other cheaper solutions, and can provide synchronous inertia to the grid, in addition to its role as a large-scale capacity resource.

Cost of a compelling value proposition

Excavating caverns 600 metres below ground level sounds like it requires expertise, and of course it does. However, VanWalleghem says, it’s no different to what the hydrocarbon and mining industries already do and Hydrostor can lean on those decades of collective experience.

“It’s a very conventional form of underground construction, you essentially sink a shaft which is an 8 metre, or perhaps two metre diameter shaft, sink it 600 metres down, lower down workers, drill, blast, muck and bring up rock and create rooms, or little tunnels down there.”

That ethos or methodology of taking existing technologies or engineering techniques permeates Hydrostor’s entire system design, meaning the company doesn’t have to make any of its own components, or deliver any specialised services.

Basically, anything you find in the A-CAES technology already exists in oil and gas, or mining, it’s just combined in a different way. Hydrostor’s compressors are used for natural gas, its turbines are the same as those used in LNG expansion terminals, and of course, there’s the caverns.

All those components and services can be delivered by “big players,” like Bechtel, Fluor or Schlumberger and the like, along with different EPCs, or equipment and service providers. Hydrostor has the overall design patented and knows how to put it all together, having already done so — albeit on a smaller scale to what’s planned.

This approach to design has also helped the company to win the confidence of financiers, although only after A-CAES was proven out at its demonstrator and Godereich plants, the latter of which is a 2.2MW / 10MWh+ system.

The project finance community, VanWalleghem says, didn’t ask whether Hydrostor could build caverns at scale or demonstrate the workings of a 100MW compressor, because those things already exist. The company was asked instead to show the whole system working together, at the promised round trip efficiency, response times and required level of safety.

“That’s really what those small-scale facilities got us: proving that that energy storage process works, and the safety mechanism and the fact that you can get those systems online and the physics prove out in the numbers,” he says.

“We know how it works and we can underwrite the performance of it, and now we’re effectively a developer that has this special ‘mousetrap’ about how to do energy storage,” he says.

“It’s a pretty compelling value proposition from a storage solution [perspective]. It’s much, much more compact than pumped hydro: we only require about 5% of the space and water compared to pumped hydro, which makes it a lot easier to permit, faster to construct. And, very low cost and strong performance relative to the other options out there.”

The CEO discloses that the capital cost for Hydrostor’s Gem project, which it is developing in Kern County, California, a 500MW, eight-hour (4,000MWh) project will be just below US$1 billion on a fully installed, turnkey basis.

Along with these other advantages of siting flexibility and low-cost, with regular maintenance and machinery overhauls, an A-CAES system could last 50 to 100 years in the field too, Hydrostor believes.

It’s also commercially-ready too, unlike some other long-duration energy storage technologies out there, VanWalleghem adds.

“Obviously, the storage industry needs lots of different solutions — but we think this one definitely has a role to play in that wholesale bulk load shifting, the eight to 24-hour market, 200MW and larger.”

Convincing Goldman Sachs of the potential

Hydrostor has been speaking with the Goldman Sachs Asset Management team for about two years prior to this month’s investment announcement, the CEO says.

“It was on us to convince them that the technology had a very strong value proposition, and was bankable, and that our projects are very well advanced and can be expected to get some financial close, in the next 10 or 12 months.”

Getting that commitment from Goldman Sachs involved “a lot of detailed questions and a lot of advisors to please”.

“I’m really proud of the team because before this transaction we weren’t overly well funded, didn’t have a huge team. Yet we’re operating plants, we’re developing projects in multiple different continents and running a business and trying to raise money.”

The US$250 million investment figure was arrived at by mapping Hydrostor’s plans to go global over the next few years as well as its need to execute on the three large-scale plants already in development.

The team has to grow considerably, while so far only “very limited development money” has been available to spend on its three projects. Hydrostor also has a number of other projects at the pre-sale stage, where utilities are wanting to own and operate the plants themselves. In those cases Hydrostor will play more of a technology provider role, as opposed to its California and Australia plants which the company is also developing.

The Goldman Sachs transaction will help make sure Hydrostor has what VanWalleghem describes as the “financial wherewithal to participate in our projects and put our money behind it (the technology’s deployment) as well, in collaboration with infrastructure funds and banks and others at the project level”.

“It’s obviously going to be easier to project finance once you have five or 10 of them running for 10 or 20 years, but the bottom line is that with the climate battle that we’re all in, we got to get moving, and you can’t wait to do everything in serial.

“So you do have to build a couple of them and get them running. And that’ll be good enough for some banks and some customers and not good enough for others — those folks will wait until it’s a little bit more of a commodity. But we’ve got into a good position, certainly relative to a lot of the other storage technologies that are out there today.”

Read our previous coverage of Hydrostor’s three late stage development projects:

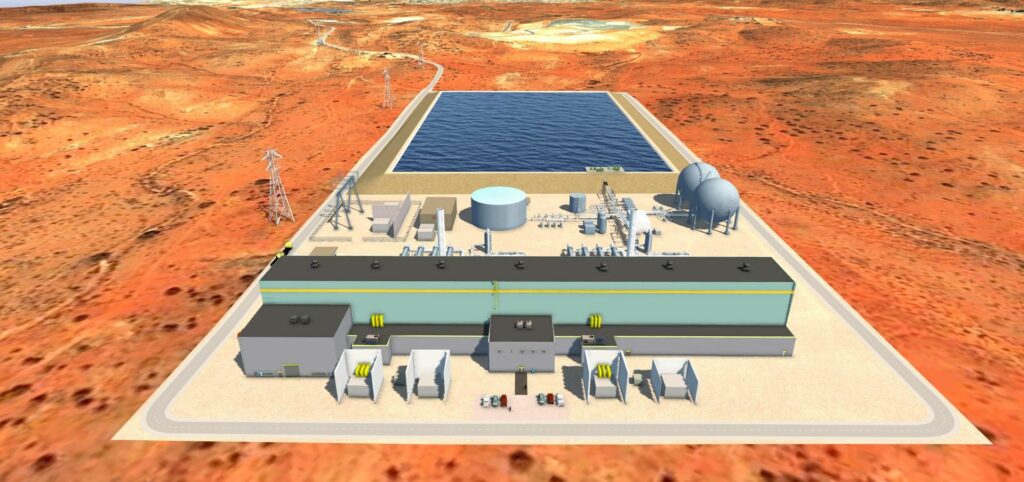

200MW/1,600MWh Broken Hill project, New South Wales, Australia

400MW/3,200MWh Pecho project, San Luis Obispo, California

500MW/4,000MWh Gem project, Kern County, California