More than two-thirds of the planned lithium-ion battery production capacity in Europe is at risk of delay, downsizing or cancellation mainly due to the Inflation Reduction Act (IRA), according to a new study.

The study by European Federation for Transport and Environment AISB found that 68% of the planned annual production capacity on the continent was at risk. Significant volumes of this are at risk of being lost to the US as companies consider capitalising on the incentives provided by the Inflation Reduction Act, which went into effect on January 1.

The study, titled ‘How not to lose it all’, corroborates anecdotal evidence of companies launching gigafactory projects switching interest over the Atlantic reported by Energy-Storage.news earlier this year. Its publisher is a continent-wide non-profit umbrella organisation promoting sustainable transport solutions.

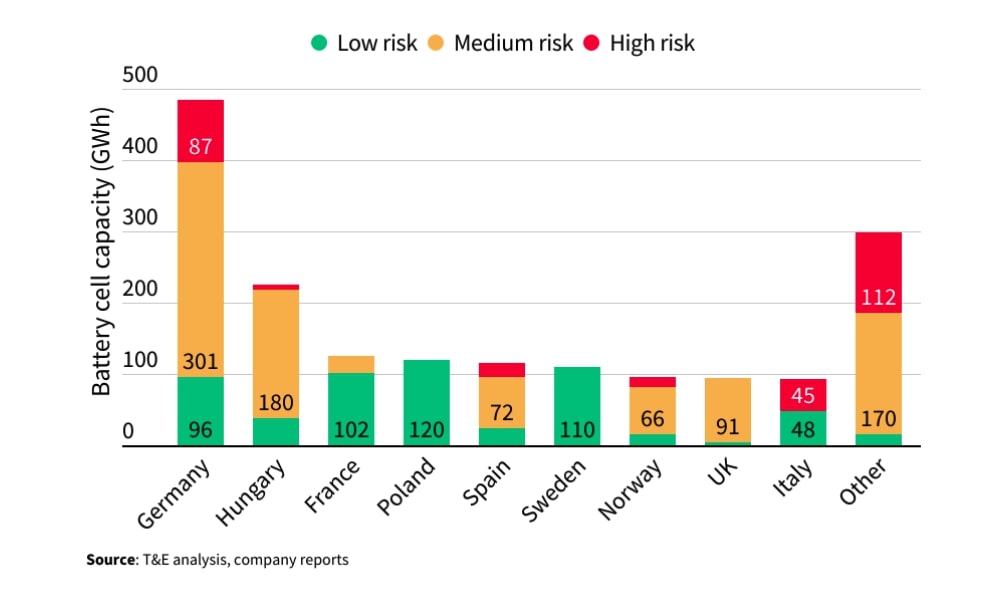

Of the 1.8TWh of planned lithium-ion production capacity in 2030, the study designated 16% or 288GWh as at ‘high risk’, 52% or 936GWh as medium risk and the remaining 32%/576MWh as low risk. See the country breakdown below.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

It didn’t define each category but said it was based on a calculation looking at the following factors:

- Secured funding

- Secured location

- Construction status & permits

- Investments from European OEMs or support from the EU institutions

- Already planned projects in the US

- Cooperation with the US OEMs.

It said the biggest risk was for those projects which have not yet secured financing or permits, started construction, secured offtakers or, in some cases, even chosen their battery chemistry, because these can be cancelled entirely.

“The simplicity, volume and bankability of the production credits available to battery cell, module and component manufacturing, as well as metals processing makes the US a highly attractive destination to build battery factories in,” the study said.

The projects most at risk of losing volumes to the US identified by the study are Tesla in Berlin, Northvolt in northern Germany and Italvolt near Turin. Northvolt said its Germany plant, the Dreit gigafactory planned in the town of Heide, was at risk of delay due to high energy prices late last year.

Energy-Storage.news meanwhile spoke to an analyst in August who said that all projects would be delayed to some extent.

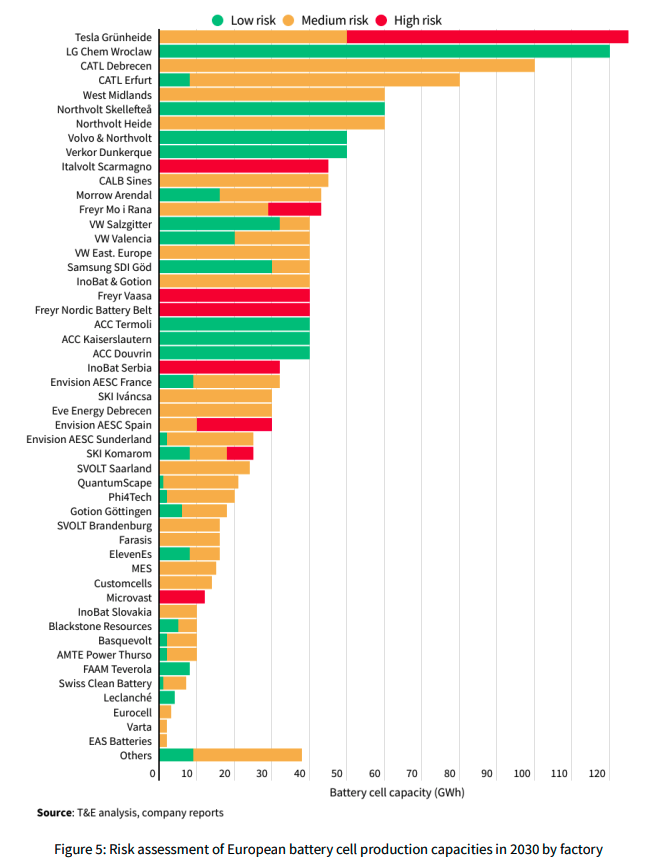

The study assessed the risk by individual project too, assessing how much of each’s volumes are at risk. See the chart below and access the full study here.