The massive buildout of battery storage in the ERCOT, Texas market and the risk of market saturation was a huge talking point at Energy Storage Summit USA last month.

Taking place over two days in the capital Austin, the ERCOT market and its soaring battery storage market naturally dominated conversations. There is a little over 2GW online today but that is set to nearly quadruple to just under 8GW by the end of 2023, and the implications of this for revenues is clear according to at least one speaker.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

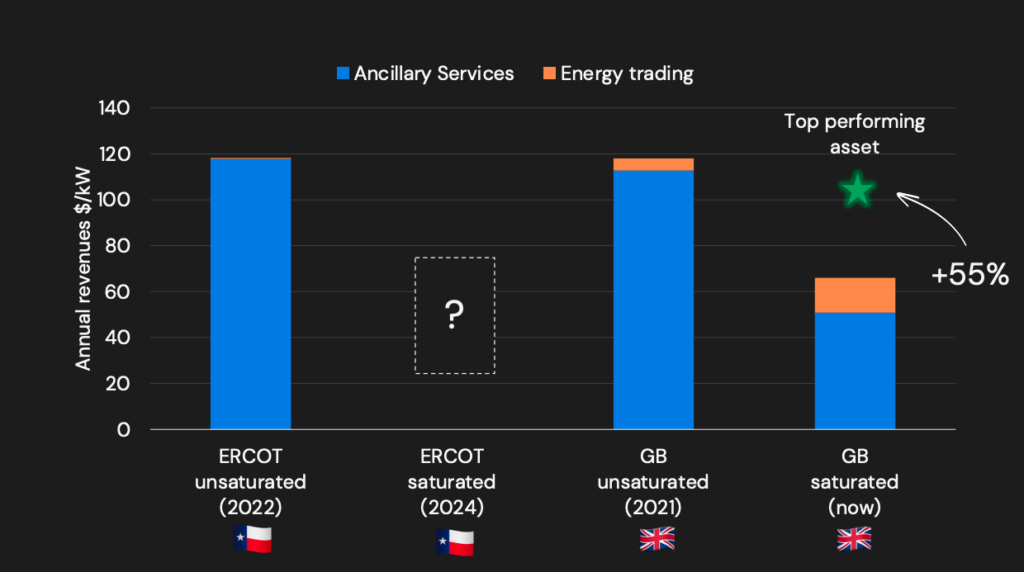

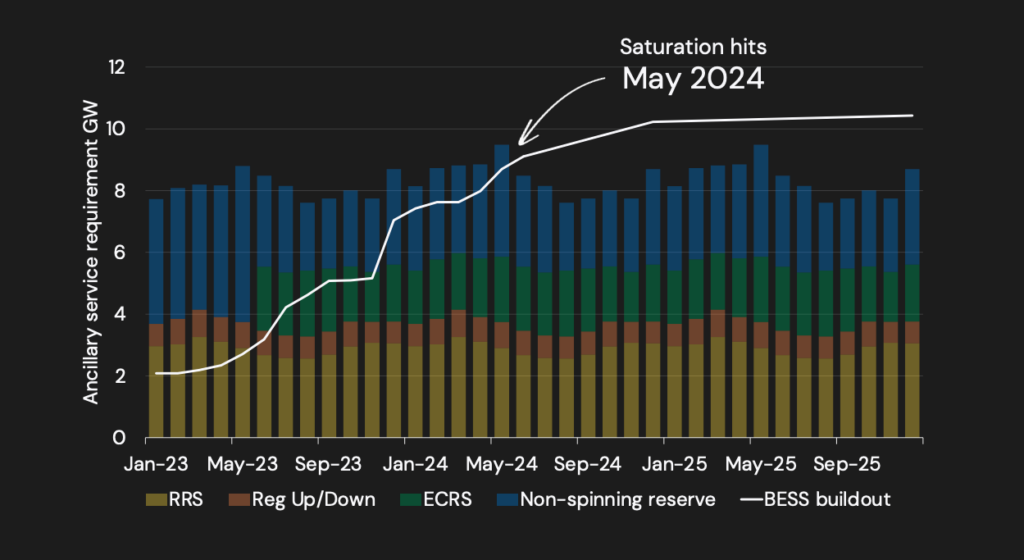

“By next summer, we will have saturation because there’ll be more batteries than there are contracts in ancillary services. This means we in the battery world need to think differently and figure out where the rest of the revenue is going to come from,” said Quentin Draper-Scrimshire, CEO of Modo Energy during a presentation, in which the slide above was shown. The UK-based battery analytics firm is expanding its platform to cover the US, starting with ERCOT.

Other delegates and speakers interviewed by Energy-Storage.news at the event gave varying views. Speaking in the context of the firm’s strategy to mitigate against this risk, developer Available Power’s VP business development Alex Krass said:

“And we know that there’s a bit of a timeline on the market for standalone battery storage before it gets saturated, so we’ve focused on it in order to get projects in the ground.”

“The idea is that there are a lot of standalone battery storage projects in the queue, the market will saturate, and ancillary service revenues are going to fall off a cliff for some companies in this market in the next couple of years and make the revenue side a little harder.”

Nick Dazzo, head of trading for Spearmint Energy which only launched last year (when its CEO guest blogged here) and recently acquired a 900MW pipeline in ERCOT, disagreed strongly.

“What that forecast doesn’t seem to do is account for an increase in or a constant need for those services as more renewable resources are added to the system. There’s a tonne more solar coming in the next decade, and once there’s more intermittency in the generation stack, then arguably the need for ancillary services continues. So a static comparison of battery deployment against today’s need for ancillary services doesn’t capture the full picture,” he said.

Ravi Manghani, director of strategy and market analytics for BESS firm LS Energy Solutions, agreed that the market would saturate but only temporarily.

“My personal take on that saturation story is that there will be a saturation point, but I think it’s not an indefinite saturation. I think it’s a saturation for now until we can get to a point where we get to increasing renewable penetration and then the market opens up again, because there are again revenue streams that you can tap into,” he said.

“I think batteries have caught up with all the slack because we didn’t see meaningful amounts of storage being deployed in Texas up until a couple of years back.”

Comparing the development of the ERCOT market with the UK, Draper-Scrimshire pointed out that although revenues per kW have fallen compared with 2021 due to growth in battery storage, top-performing assets could maintain closer to the same levels.