Continuing to look back over 2021’s year in energy storage, it has undoubtedly been a year of big successes as well as challenges for the industry. Big successes in terms of megawatts and megawatt-hours deployed, against big challenges in terms of global supply chain disruptions and the wait for policy and regulations to catch up with technology.

Following our first instalment, in which executives at energy storage system technology providers Fluence and Powin Energy offered their views, we take a look further downstream this time out.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The views below come from various staff at Burns & McDonnell, a full-service project design and construction company and one of the US energy storage space’s leading engineering, procurement and construction (EPC) contractors.

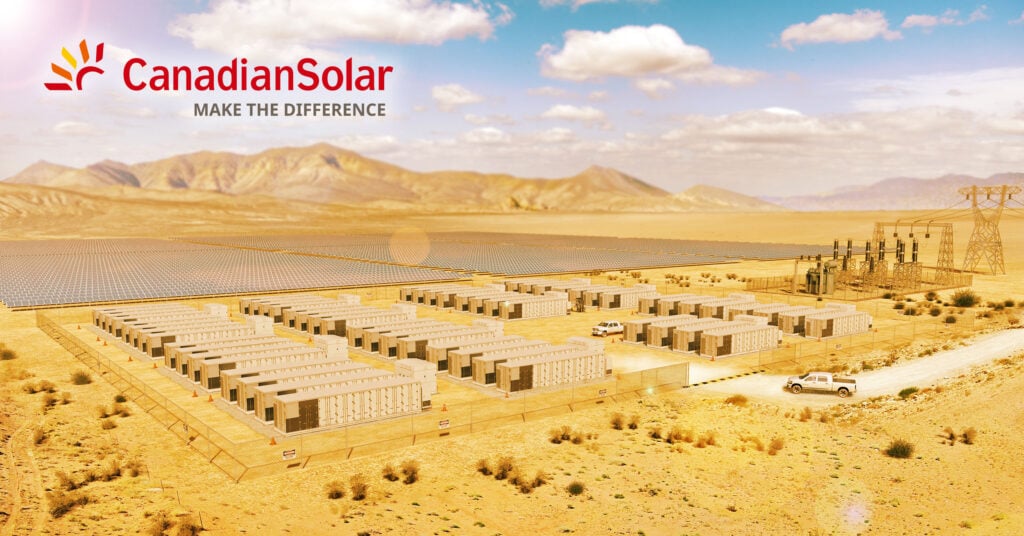

Also responding is Mike Arndt, president and general manager at Recurrent Energy, a solar developer owned by Canadian Solar which has recently expanded its presence in the battery storage space.

Burns & McDonnell

Various staff

What did the energy storage business in 2021 mean for your company and how did it compare with previous years?

In 2021 we saw a lot of growth internally to Burns & McDonnell, in the industry as a whole, and in the size of the EPC energy storage projects that we’re executing. This year we have significantly increased the number of staff working exclusively on renewables and look to continue growing for the foreseeable future.

Next year we’re projecting that more than 50% of our power generation revenue will be in renewables and will continue to grow year-over-year, with nearly half of those projects being in energy storage.

Doug Riedel, senior VP, renewables

How are the business models for energy storage evolving?

We’re starting to see a separation between integrators and EPC/General Contractors. Integrators are modularising containers, putting control systems together and compiling the equipment package to be hired out by a construction firm to put in the ground.

Then there are the integrated EPC contractors who can do everything from upfront studies and permitting to engineering, construction and startup/commissioning under one roof.

We anticipate there will be some consolidation in the market and owners will consolidate between control systems, like we saw in thermal generation. Especially once you start building 100MW and larger storage facilities, you’ll want more well-known/established control systems with cyber security measures in place.

The potential for a standalone storage investment tax credit (ITC) in the Build Back Better bill will rapidly accelerate the adoption and expand the customer marketplace for those who deploy storage.

We’re starting to see the number of utilities with interest in adding storage to their renewable portfolio pick up. They’re starting to understand energy storage performance and how to model that into their integrated resource plans (IRPs).

Adam Bernardi, renewables business development lead

What are some of the technology or industry trends you have observed: which of those are the most exciting and conversely are any of them fads that you think will be gone within the longer term?

Solar-plus-storage. As companies strive to achieve ESG goals by adding renewables – like solar and wind — the need for dispatchable generation will be vital to provide reliable energy to their customers and operations. Adding storage to charge from the solar plant or be DC-coupled with solar assets is something we’re planning for and consulting customers early on.

Right now, we’re still seeing mostly one, three and four-hour duration for battery storage systems, but it’ll be interesting to see how quickly the industry pivots to longer-duration as the technology advances through incentives and investments. We’re also seeing large ramp ups in manufacturing of longer duration non-lithium-ion with (iron flow battery provider) ESS Inc, vanadium redox flow batteries (VRFBs), (iron-air battery startup) Form Energy and (aqueous zinc cathode battery company) EOS Energy Enterprises.

Jason Barman’s, energy storage technical and strategic partnerships manager

Demand for flow batteries and other long-duration energy storage technologies is growing, even if their current cost does not yet make them competitive in the commercial markets. As the power industry closes coal-fired power plants, brings more renewable energy resources online and seeks ways to manage the resulting imbalances between energy production and demand we think interest in longer-duration, more sustainable solutions will increase.

Electrification programs will also create further demand for stored energy. As more electric vehicles take to the streets, long-duration solutions can be used to help power charging stations.

Elsewhere, companies like Microsoft and Google expect long-duration technologies to play an important role in their pledges to shift data centres from net zero carbon initiatives — where carbon offsets counterbalance emissions — to zero carbon initiatives that depend on 100% carbon-free energy.

Still, multiple barriers — most notably, high production costs and few financial incentives — have limited the application of the emerging longer-duration battery storage technologies now entering the market.

New federal funding for demonstration flow battery projects may do for flow batteries what electric vehicle research and development did for lithium-ion.

Tisha Scroggin-Wicker, process technology director

Have there been any major challenges the industry has faced this year and faces going forwards, and how do you think they can be solved?

Issues with supply chain will likely continue in 2022 and into 2023. We’re also starting to see challenges with sourcing of lithium carbonate and other raw battery materials.

It will also be interesting to see the percentage of batteries that OEMs allocate to the energy storage market versus the EV market. It’s an evolving issue as energy storage projects are becoming larger and competing with the EV industry for cell manufacturing allocations.

Chris Ruckman, director of energy storage

With 80% of ESS batteries coming from Asia, shipping and bottlenecks at ports will continue to be a challenge. Between containers being packaged overseas, ports and trucking, we’re seeing a big increase in costs.

Workforce and labour were particularly challenging in 2020 and 2021 and will likely continue in 2022. We saw first-hand on a project out in California the local labour shortages which make it difficult to staff projects and ramp up as needed, forcing us to get creative about how we execute projects. By having an integrated EPC with all parties involved from concept to completion and greater transparency, we’re able to manage schedule and sequence of design and execution packages better.

Planning and execution are essential. I don’t think we could’ve gotten the Moss 100 project (Moss Landing Energy Storage Facility, at 400MW / 1,600MWh it is the world’s biggest BESS project to date) online three months ahead of schedule without the creativity and integration between all disciplines of the project, from implementing real-time data on the ships carrying the modules, to building the battery enclosure and installing the utilities before the roof was enclosed.

Matt Domeier, director of energy storage EPC

Workforce challenges extended beyond just craft labour. Battery energy storage is still a relatively new and evolving market that requires different skillsets than traditional generation projects that have been executed for centuries. Our focus on developing and integrating engineers on storage projects requires a unique insight into current and future technology, and the ability to think beyond typical engineering practices.

Bailey Semeniuk, energy storage engineering and development director

What will 2022 bring for your company and for the wider energy storage industry?

Supply constraints will continue to be an issue.

If direct-pay and standalone storage credits are included in the Build Back Better bill, we expect to see many more traditional utilities enter the solar and storage market.

We’re excited for more project opportunities in 2022, especially as more of our traditional utility clients enter the market. As we continue to execute some of the largest energy storage projects in the world, we look forward to applying real-world lessons learned to drive project safety, efficiency, and on-time delivery.

Chris Ruckman, director of energy storage

We’ll likely start to see more pilot projects and continued interest in longer-duration storage like the Form Energy 100+ hour storage system.

Utilities at the forefront of the energy transition will continue exploring hydrogen—whether as a blended fuel, storage mechanism or fuel cell for fleet vehicles. It’s definitely exciting to consult and work with our customers on integrating renewable/ clean energy to their portfolio to help them achieve their decarbonisation goals and provide reliable service to their customers.

Tisha Scroggin-Wicker, process technology director

Which regional markets or market opportunities are the most promising for your energy storage business today and why?

Obviously there are a lot of opportunities in California, Texas and the Northeast— primarily NYSO and PJM— but we’re also starting to see planning pick up in the Midwest and states like Illinois with the Clean Energy Jobs Act.

The energy world is starting to get very flat. We’re seeing solar and storage spanning outside of our traditional power customers into other industries we work in like oil, gas, chemicals, manufacturing and data centres.

Outsourcing, offshoring, supply chaining and insourcing are big trends we’re seeing with integrators in the solar and storage industry.

Adam Bernardi, renewables business development lead

Recurrent Energy

Mike Arndt, president and general manager

What did the energy storage business in 2021 mean for your company and how did it compare with previous years?

This was the year that energy storage became an equal part of our business.

Recurrent has been developing storage projects for many years, but 2021 was a step-change for storage activity. With multiple storage projects being sold, under construction and reaching commercial operations, as well as new projects being originated in new markets, Recurrent’s energy storage business is on equal footing with our long-running solar development business.

How are the business models for energy storage evolving?

We see business models from project origination through financing and operations adapting to these risks and setting expectations for risk management. Rather than simply following the templates of solar development we see standalone storage as its own asset class with its own risks, challenges and opportunities.

Developing trust and processes to capture value in these new opportunities, such as merchant operations, while managing risk is where the business model is developing.

What are some of the technology or industry trends you have observed: which of those are the most exciting and conversely are any of them fads that you think will be gone within the longer term?

We are encouraged by the focus on long-duration applications. While many of these technologies need to be proven in large-scale, what we need first is an established demand. It’s encouraging to see utilities and regulators figuring out how to utilise energy storage not just to replace gas peakers, but also combined cycle gas plants.

Have there been any major challenges the industry has faced this year and faces going forwards, and how do you think they can be solved?

The industry will continue to deal with the massive increase in demand for Li-ion batteries and being second in line after EV manufacturers. We would like to see strong federal policy to incentivise demand for energy storage and domestic manufacturing to help create greater certainty and security for energy storage projects.

What will 2022 bring for your company and for the wider energy storage industry?

Next year will see immense continued growth in gigawatt-hours of energy storage being brought online. Recurrent will bring one of the largest, and our first, standalone storage projects online and own and operate a battery in California for the first time. We will also see a continuation of the diversity of players in the markets and a huge amount of investment continue throughout the industry.

Which regional markets or market opportunities are the most promising for your energy storage business today and why?

California will continue to dominate the energy storage market in the US and globally. Recurrent began in California and it is still one of our most important markets due to the size and progressive adoption of new energy technologies.

Texas is also significant and is rapidly deploying storage and adopting new market rules. We expect to see a lot of energy market dynamics change in Texas and to see a lot of value in storage in this market going forward.

COP26 brought climate change into mainstream headlines and the international policy agenda: how best can the energy transition happen more quickly to meet climate goals?

The US is poised to become a leader in the adoption and manufacture of new energy technologies. Significant and long-term federal policy-making will help accelerate the energy transition for all while creating an even larger US job market and fuel resilient growth in the US energy economy.

Read ‘Year in review 2021: ESS technology providers Fluence and Powin Energy,’ here.