Energy-Storage.news takes another look at the fortunes of Eos, ESS Inc and Energy Vault, a trio of long-duration energy storage (LDES) providers with non-lithium technologies, which have all just released their Q3 2023 financial results.

Iron electrolyte flow battery company ESS Inc, zinc hybrid battery maker Eos Energy Enterprises, and gravity energy storage specialist Energy Vault were all profiled back in May by this site as their Q1 results came out.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Each had gone public through mergers with blank cheque special purpose acquisition company (SPAC) entities between late 2020 (Eos) and early 2022 (Energy Vault), with ESS Inc getting its listing in October 2021.

To summarise that analysis from May, all had yet to recognise significant revenues from their core businesses and said that markets for their technologies were yet to take off. When they did, however, each claimed to be in the right place and the right shape to capitalise on opportunities from a global energy storage market seeking diversification from reliance on lithium-ion and looking for answers to solve the problem of providing cost-effective long-duration storage over periods of several hours.

Additionally, they were all also included in this look at the fates so far of energy storage companies that went through SPAC mergers, finding that a group of four (the other two being Stem Inc) had seen their average share price fall by 80% since going public.

Eos’ Q3 revenues just US$0.7 million, with US$399 million DOE loan incoming

Zinc battery storage provider Eos will not be profitable until its production lines are fully automated, company leadership has said, after just US$700,000 revenue was reported for Q3 2023.

Eos Energy Enterprises, to give the long-duration energy storage company’s full monicker, released its third quarter financial results earlier this week (6 November).

Attention will likely be focused on the conspicuous plunge in revenue, down from US$6.1 million in the equivalent quarter of 2022. However, there were highlights alluded to, such as the beginning of deliveries for the company’s third-generation aqueous zinc hybrid cathode battery-based storage systems.

CFO Nathan Kroeker said in an earnings call to explain results that the Gen 3 product was designed “at half the cost of where we started” with its previous Gen 2.3 iteration on a kilowatt-hour basis.

Elsewhere, the company claimed that a shift in value proposition towards longer-duration storage favours its technology, while it had an order backlog of around 2GWh for a value of US$538.8 million as of the end of September, including just under US$93 million in orders booked in the year to date.

Perhaps most importantly, Kroeker said that gross margin profits will be recognised once Eos has fully automated production lines up and running.

Eos has a plan which it calls Project AMAZE, or ‘American Made Zinc Manufacturing’, which would see the company establish 8GWh of annual production capacity by 2026. The plan would require an investment of about half a billion dollars, and the pathway to get there looks like it might be made possible by a US government loan for around 80% of that sum, via the Department of Energy’s Loan Programs Office (LPO).

Eos could be further assisted by availing of US government incentives for manufacturing clean energy technologies domestically. CEO Joe Mastrangelo said in the call that tax credits could be worth up to US$45/kWh. However, the long-duration firm’s CEO claimed that while the tax credit “will help to accelerate our path to breakeven, we do not believe it is essential to achieve profitability”.

“We believe this business makes economic sense even without the tax credit, but it certainly acts as an added benefit to us over time.”

ESS Inc says profitability on flow battery product to come in H2 2024

ESS Inc’s CEO Eric Dresselhuys was a recent interviewee for Energy-Storage.news Premium, discussing how the “macro drivers for long-duration” are improving all the time, but that it and other companies in the space will at the same time need to achieve continuous improvements in cost reduction.

The company also needs to grow its revenues sooner or later, with Dresselhuys this week offering guidance that ESS Inc’s full-year revenues will be US$9 million for 2023, with year-to-date revenues standing at US$4.7 million as of the end of September.

That said, the year-to-date figure is an almost 700% increase from 2022, which strongly implies that ESS Inc – and perhaps others in the space – are really only just getting started. The company has also been helped by recent investment from Honeywell, which has also become a strategic partner and collaborator on flow battery technology as well as aiming to purchase around US$300 million-worth of the startup’s systems.

An agreement is also being finalised for ESS Inc’s biggest project to date, which is a 10-hour, 50MW (500MWh) project in Germany with power producer LEAG, while the iron flow battery technology has been licensed to a partner in Australia, Energy Storage Industries Asia-Pacific (ESI) for distribution, local production and sales to the Australian and wider APAC markets.

Like Eos, ESS Inc also said automated production and other process improvements would be key to achieving its target of non-GAAP gross margin profitability on sales of its Energy Warehouse product by the second half of next year.

ESS Inc’s Q3 revenue stood at US$1.5 million, and although adjusted EBITDA for the quarter was a loss of US$14.2 million, this was a sequential improvement of US$6.3 million, while the long-duration flow battery player’s cash and short-term investments position improved US$25 million sequentially to US$124.5 million.

Energy Vault revenues driven by US BESS business

As regular readers of Energy-Storage.news will likely know, Energy Vault’s recent earnings calls have painted a very different picture to long-duration rivals ESS Inc and Eos’, for the simple fact that instead of focusing solely on its proprietary gravity-based storage tech, the Swiss-American startup has pivoted to also work in the lithium-ion battery energy storage system (BESS) space.

That meant it was able to recognise US$172.2 million revenue during the third quarter, which came from “multiple customer sets in the US market,” according to CEO and chairman Robert Piconi. The biggest share of that came from the on-time delivery of a 275MWh BESS project in Southern California for customers Wellhead and W Power, with investor-owned utility (IOU) Southern California Edison as the project’s off-taker. What is also interesting is that the project, Stanton BESS, used the company’s proprietary system design and its own energy management system (EMS).

Energy Vault achieved a third quarter GAAP gross margin of US$7.1 million (4.1%), and nine month gross margin up to the end of September of 6.1%. While it continues to run at a loss, its net loss improved 28% sequentially, to -US$18.9 million and adjusted EBITDA improved 43% to -US$10.2 million.

Holding total cash and cash equivalents of US$132.2 million and without debt at the end of the quarter, Energy Vault reaffirmed previously offered guidance that full-year revenue will be between US$325 million and US$425 million, with a gross margin of 10% to 15%. Adjusted EBITDA for the year will be between -US$50 million and -US$70 million.

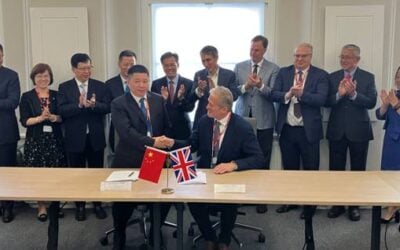

However, Energy Vault has far from abandoned its gravity storage business. The firm’s first large-scale project using that technology, a 100MWh system in China, nears completion and Piconi claimed there is “strong regional demand for our gravity energy storage systems in China, India, South Africa and the US market”.