Eric Dresselhuys, CEO of iron and saltwater electrolyte flow battery provider ESS Inc speaks to Energy-Storage.news about markets, strategy and profitability for long-duration energy storage (LDES).

At this year’s RE+ show, which took place last month in Las Vegas, Nevada, more than 40,000 industry professionals came through the doors. Buoyed by the one-year anniversary of the Inflation Reduction Act (IRA), which is already revolutionising upstream and downstream activity in the clean energy sector, attendees will have noted more interest in long-duration energy storage (LDES) than ever before.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

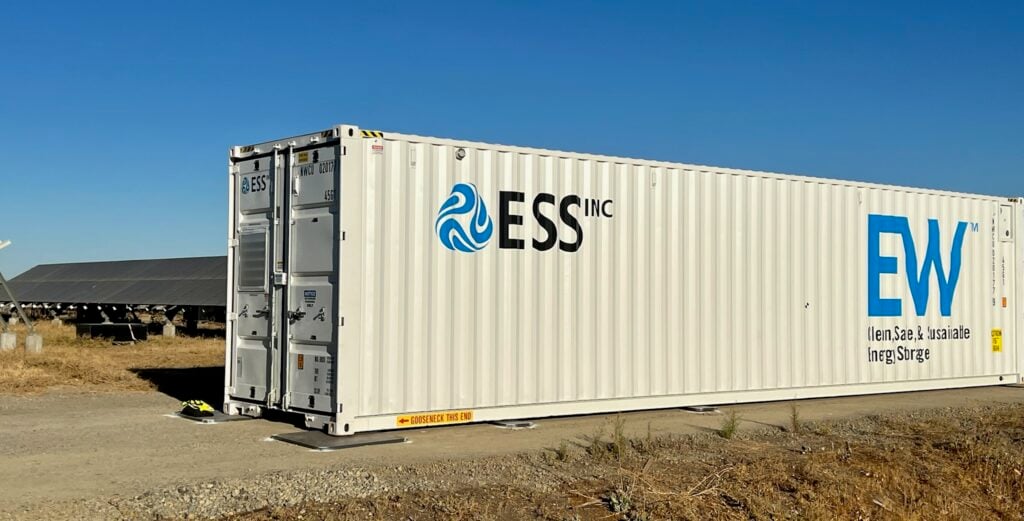

One of the highest-profile companies in that LDES space, ESS Inc has been making flow batteries with its proprietary IP for over ten years. It has 800MWh of annual production capacity at its factory in Wilsonville, Oregon, while its revenues have been steadily increasing since it went public through a special purpose acquisition company (SPAC) merger in 2021.

One key challenge that all players in the emerging LDES space are facing is that although it is widely considered impossible to reach net zero emissions without significant storage capacity, energy markets are largely configured for the pre-energy transition grid.

That means the value of storing energy for later use over several hours or sometimes days is not readily monetisable. That needs to change, says Dresselhuys, as we look discuss the business case for LDES as a key component of a decarbonised energy system.

Since this interview took place just over a month ago, the company and Honeywell have announced a partnership. Honeywell is investing in ESS Inc, and has agreed to purchase up to US$300 million of systems, while the two companies will share IP on their respective flow battery technologies – Honeywell having been working on an iron electrolyte flow battery of its own behind closed doors until an unveiling last year.

According to Dresselhuys, who offered a comment separately, just ahead of publication of this interview, the Honeywell partnership followed “months of extensive due diligence on ESS’ technology and operations by a global leader in advanced materials and energy systems, representing a major validation of our value proposition”.

Anyway, back to our interview, which took place on a busy show floor at RE+ last month:

We caught up with some of your colleagues (Hugh McDermott and Alan Greenshields) at the 2022 edition of RE+, and the big news from ESS Inc then was the deal signed with Sacramento Municipal Utility District (SMUD) for up to 2GWh of systems, which also included some commitments to working with SMUD to decarbonise its fleet and train some of its workforce in clean energy technologies.

Since then, there’s been a fairly large project deal signed with power generation company LEAG in Germany. And on the eve of this event, we heard the first systems have been delivered to SMUD. Shall we start with some comments on those deals, and any other updates you’d like to share?

I think it is great to see the delivery at SMUD. One of the things with all younger, growing companies in this space is that we love announcements, we love new customers, we love fundraising announcements, all of those things, but as an industry, we need more products in the field.

We’ve had a really busy last few months, starting with the announcement that we made at Intersolar Europe with LEAG. For us it’s a very big project. It’s not the biggest agreement that we’ve announced, but it’s the biggest single battery order on a schedule, at 50MW/500MWh.

What’s also cool about it is that it’s really bringing home this idea of ‘green baseload’, which is where long-duration storage shines; how we create a 24/7 system based on renewables. LEAG is the second biggest generator of any kind in Germany, saying the future looks like renewable energy and what they call the green baseload. They’re planning 7GW of solar, plus 2GW to 3GW of storage, plus some green hydrogen production.

[Similarly] what we really loved about SMUD is that they have this ambition to have an entirely decarbonised grid by 2030, and they’re brave enough, bold enough to publish the details of the plan on their website. If you think about that, versus a lot of discussion we have around the energy transition, a lot of it comes across as just an aspiration.

‘Pick a plan and stick to it’

One other recent project for ESS Inc is at Schiphol Airport in Amsterdam, and thinking about that reminds me that the government of the Netherlands’ plan for getting to net zero was interesting in that it modelled a net zero system and then sort of figured out how to work backwards from there.

Decarbonisation without a plan is just an aspiration. That’s a natural way for any sort of a movement like this to start, but as we progress, and as we mature as an industry, it’s time to start showing your work and putting the details down of how you’re going to get there. The more of that that gets done, the more it’s going to highlight the benefits and the value streams for long-duration storage.

The specific plans, the details of what’s going to get done by when, and how are we going to change the market rules to encourage and incentivise people to build storage or [other clean energy technologies], those are not as clearly defined in Europe as they need to be.

To contrast that to the US, what the IRA has done is given clarity to developers, to manufacturers, to governments, to start to say, “Okay, we have a kind of a rulebook now about the different incentives and tax treatments and things that that we’re going to use as incentives to do more renewable energy”. That’s helping to give clarity for people to start putting concrete plans in place.

There seems to be growing recognition that without long-duration storage, decarbonisation of the grid isn’t feasible, certainly not within the timeframes pledged to by governments or modelled by experts on climate. But as we’ve said, that recognition is also not incorporated into market structures. Do you have a view on what the ‘ideal’ market structure might be?

It’s almost unnecessarily provocative to try to pick a policy that is somehow the winner. There are a bunch of different ways you can do it.

You can do it through capacity markets, you can do it through firm bidding. At this point in California, why would anybody pay for solar power at two o’clock in the afternoon? We have a 2.5TWh curtailment problem.

There are a number of different pricing mechanisms and incentive mechanisms that you can put into place. It’s just important that you pick one, and you stick with it, because this market eats uncertainty. You’re building large capital assets that have to operate for 10,15, 20 years and the banking world, the financial world doesn’t like uncertainty.

There’s two elements of the IRA that are exceedingly valuable: the first is that it goes for a really long time. It’s a 10 year plan. Then the second piece is that the majority of the incentives are what I would describe as non-deterministic, meaning I know the rules and if I go and do a project, and I meet the requirements in the rules, I will get the money.

The European Union’s (EU’s) rough challenge is that there is no EU-wide tax policy, because individual states do the taxation, and then they make their payments to the EU. So in the EU’s case, they’re going to have to find a way to either empower the member state governments to do something or find a way to do grants in a different way because they’re not going to be able to create an IRA equivalent.

‘Macro drivers have become substantially better for ESS Inc’

One thing that’s really interesting about the show this year is the amount of interest in long-duration storage. Previously, it would be something you’d have to seek out if you were interested to learn about it, but it’s almost got to the point where it’s unavoidable, so many different conference speakers are talking about it – and not just the LDES technology providers themselves.

I joined as CEO of ESS Inc about two and a half years ago. Since then, all of the macro things around our business have gotten better. We haven’t changed our strategy, our product. We think it has long-term advantages. All of the macro market drivers have become substantially better.

Now that people like SMUD, like LEAG are kind of doing the math and they’re thinking about how this is going to work. I think that’s helped to bring this into the mainstream.

I am old enough to remember when everybody said solar was too expensive, and just never going to work because we were at US$3 a watt, or whatever it was. Every subsequent forecast of solar penetration gets crushed and they have to increase the forecast, because products keep getting better and products keep getting cheaper. That’s the pattern we’re trying to drive out.

Clearly there’s a challenge for all the companies involved in the space to still be there when it becomes, something that is correctly valued by market structures. For ESS Inc, those challenges have become very visible since the company went public. What gives you and your company the belief that you still will be there, and able to thrive in the coming years?

You could be a public company, you can be a private company, you can be selling iron flow batteries, or some other chemistry or technology. I think everybody has the same fundamental challenge. As a publicly traded company, ours just happens to be on view for the public to look at every day.

What gives us confidence is that we’ve built a team of very experienced operators, people who have gone through multiple technology innovations in the energy space, who are optimistic, but not irrationally exuberant.

We believe that we have the best long-term cost entitlement in the space: iron and saltwater [electrolyte] and standard off-the-shelf components, we have a great long-term path and that’s really important in these industries.

What we’ve done is then draw a business plan for our roadmap to improve unit profitability, and then ultimately company profitability, in the most disciplined and structured way. We could ship a lot more product right now which will look good on the one hand, but will cost more money on the other hand. So you’re balancing that growth versus the spend in a market that has become more conservative.

We’re continuing to be extremely bullish about where the business is going, the progress we’re making on scaling.

We’re going to build more [and build it] faster, cheaper, better, for more people to have more impact.