Shanghai-based WeView has raised US$56.5 million in several rounds of financing to commercialise the zinc-iron flow battery energy storage systems technology originally developed by ViZn Energy Systems.

WeView announced yesterday (21 September) that it had completed the fundraising rounds in the last six months with a total amount raised exceeding RMB400 million (US$56.5 million). Investors include Gaorong Capital, Songhe Capital, Ultrasound Juneng, Dashu Evergreen, ZhenFund and other venture capital firms.

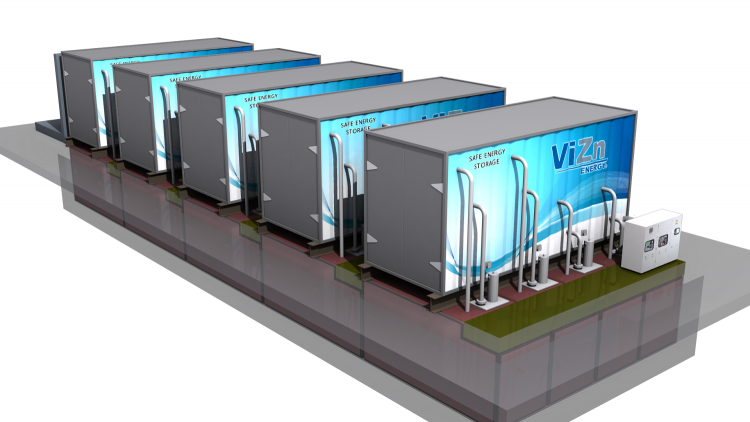

The money will go towards the development of its zinc-iron liquid flow batteries and the construction of gigafactories, with an aim to exceed a gigawatt of production capacity by the end of 2023. The company appears to be directly continuing the work of the original developer of the technology, US group ViZn Energy Systems.

In 2019, WeView partnered with ViZn, which had developed the zinc-iron flow battery technology, as reported by Energy-Storage.news at the time. The companies said then that WeView was preparing a GW-scale manufacturing facility in China for ViZn’s energy storage technology, in a deal which also involved WeView taking a minority stake in ViZn as well as a technology licensing agreement for the China market.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The deal came shortly after ViZn had to furlough a majority of staff in 2018 because of a lack of funding after a major investor was unable to lead a further fundraising round, as CEO at the time Steve Bonner told Energy-Storage.news.

Bonner was succeeded shortly after that by John Lowell, who secured the deal with WeView. His LinkedIn profile says he stayed at the company until August this year, and appears to reveal that a Chinese company, presumably WeView, acquired a majority stake in ViZn in 2020.

“Controlling interest in ViZn was successfully sold to Chinese strategic partner in Q1 of 2020,” it reads.

ViZn still has a website but it has not been updated since 2016.

WeView, founded in 2018, describes itself as a company focusing on grid-level energy storage technology targeting system integrators, new power plants, power grids and commercial and industrial (C&I) users with the ‘world’s leading zinc-iron flow battery technology’.

It was founded as a joint venture company formed by companies including Hasen Electric and Shanghai Lingxin (controlled by Jingyi Electrical), both power conversion and switchgear equipment makers.

WeView plans to invest around RMB10 billion (US$1.4 billion) in its technology over the next five years, building a 5GW factory, research & development base and electrolyte production centre.