Tesla deployed more than a gigawatt-hour of battery energy storage systems (BESS) during the second quarter of this year, but the company has been impacted by component supply issues.

The global semiconductor shortage was the main factor in a decline in year-on-year energy storage deployments, the company said as it announced its quarterly financial results yesterday.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

CFO Zachary Kirkhorn said in a conference call to discuss results that production of both Tesla’s residential Powerwall battery units and Megapack 3MWh utility-scale systems “remains component-constrained”. The company hopes the situation will ease in the second half of the year, Kirkhorn said.

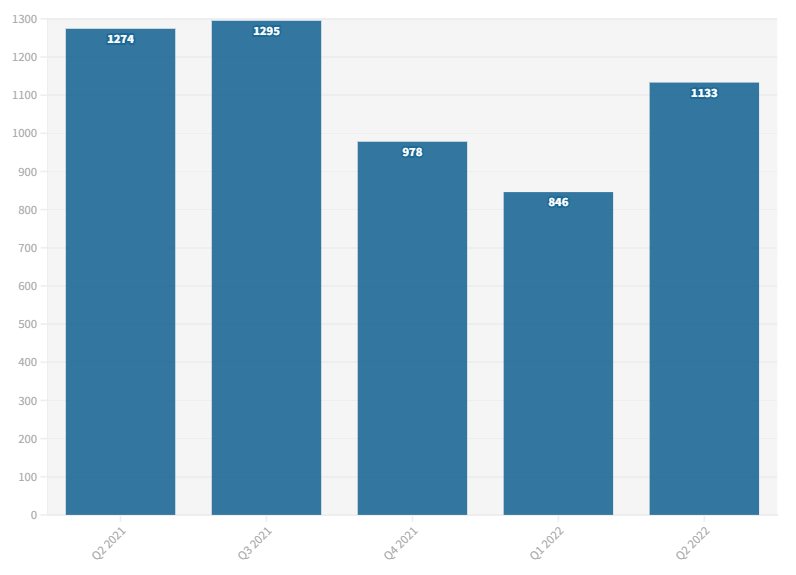

In Q2 2022, Tesla deployed 1,133MWh of storage, versus 1,274MWh in the same period of 2021 and 1,295MWh in Q3 2021. It was however an increase on figures from Q4 2021 (978MWh) and Q1 2022 (846MWh).

Semiconductor shortages are having a greater impact on the company’s energy business than its automotive core business division, although the good news appears to be that customer demand was reported by the company to be strong. With demand continuing to outstrip supply, Tesla is ramping up Megapack production.

Combined with a stronger performance in solar PV deployments (106MW) than at any time since Q3 2017, Tesla said its energy business achieved higher volumes of sales with stronger unit economics, resulting in an overall gross profit.

Tesla’s unaudited revenue figures provided for the quarter do not break out between solar PV and energy storage and are reported together as ‘Energy generation and storage’.

In Q2 2022, revenues from energy generation and storage were US$866 million, against unaudited cost of revenues of US$769 million. Year-on-year, the margin has improved, after US$801 million revenues versus cost of revenues of US$781 million were reported for Q2 2021.

After Q1 2022 results came out in April, the company had said something similar about demand far outstripping production, but that quarter’s reported activity was also constrained to a degree by shipping and other logistical delays owing to the COVID19 pandemic.

This time out, the pandemic’s direct effects were most felt in automotive production at Tesla’s Shanghai gigafactory, with the Chinese city subjected to sporadic lockdowns to limit the spread of infections.

While semiconductors might be the biggest block to energy storage production this time out, CEO Elon Musk noted in the conference call yesterday that the pricing of other commodities has been volatile, describing lithium pricing in particular as “insane”.

Musk noted that mining of lithium is “relatively easy” and that the metal itself is abundant as a natural resource. The refining of lithium into high purity lithium carbonate and lithium hydroxide is “much harder,” the CEO said, but the margins refiners can make are comparable to those for software businesses.

Musk reiterated a previously made call for entrepreneurs to get involved in lithium refining, advising that they would be granting themselves a license to print money, such would be the profitability in a world with accelerating demand for batteries.

Energy storage remains one of the three pillars of a sustainable energy future, Musk said, along with wind and solar for generation and electric vehicles (EVs) for transport.

Indeed, back in October last year, the company noted that it had achieved 96% compound annual growth rate (CAGR) in battery deployments over four years, as its Q3 2021 performance was reported.

In terms of battery technology, Tesla continues to develop its own 4680 format lithium cells with dry electrode technology discussed in its Battery Day in 2020. However, the main source of cells will remain its supplier partners including Panasonic and LG, with Tesla not seeking to displace its outside suppliers but instead add capacity with in-house production.

The speed at which battery production output can grow is, Musk said, “the fundamental limiter” for the global transition to sustainability given batteries’ key role in the transport and storage “pillars” of sustainability he referred to.

The world does not need any further breakthroughs in sustainability technologies, according to the CEO, but instead it needs breakthroughs in the speed and volume of getting lithium from raw material state into finished battery products.

Musk and tech VP Drew Baglino noted, as they have previously done, that they foresee the majority of stationary battery storage systems being made equipped with lithium iron phosphate (LFP) cells, with nickel chemistry batteries to be used for longer range vehicles and perhaps aviation.

Baglino said Tesla is also looking to build up lithium refining capabilities of its own.

“If our suppliers don’t solve these problems, then we will,” Musk added.

Earnings call transcript by Seeking Alpha.