The residential segment accelerated its dominance of the German battery storage market in 2021 but new opportunities for grid-scale systems are opening up, according to a new report.

Home storage systems (HSS) accounted for 93% of the 1,357MWh of new energy capacity installed last year, according to ‘The development of battery storage systems in Germany – A market review (status 2022)‘.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The paper was co-authored by a group of RWTH Aachen University-based or spinout organisations, led by the Institute for Power Electronics and Electrical Drives (ISEA) and its findings largely continue the trends noted in its report from two years ago.

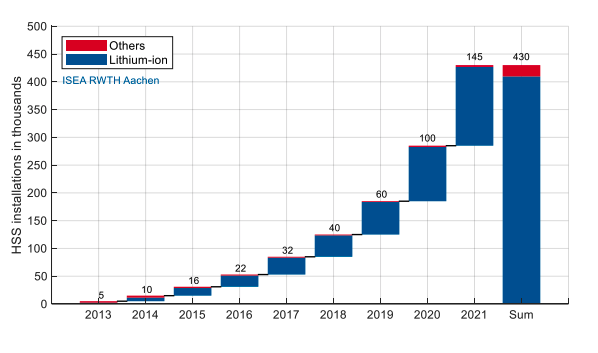

The authors define HSS as those under 30kWh, and Germany now has 430,000 total installations after 145,000 totalling 739MW/1,268MWh were installed last year. Its figures roughly match up with research by Energie Consulting commissioned by the Germany energy storage association (BVES), which pegged the 2020-year end figure at over 300,000.

In contrast, only 27MW/57MWh of 30kWh-1MWh industrial storage systems (ISS) were installed while 1MWh-plus large-scale storage (LSS) was even smaller at 36MW/32MWh of new installations. ISS and LSS can be both grid-connected or behind-the-meter commercial and industrial-sited (C&I).

Home installation numbers have been growing since 2013, as have ISS, although at a less rapid rate.

LSS on the other hand has dropped off sharply since a record year of 288MWh installations in 2018 when it nearly matched HSS’ 323MWh. New LSS installations have fallen since to just over a tenth of that high watermark in 2021, and the average installation size also fell by three quarters over the period, from 11.5MWh to just 2.9MWh.

The writers attribute this trend of fewer LSS installations to a saturation of the frequency containment reserve market (FCR) for which utility-scale storage systems were mainly built from 2016 to 2019. Other issues in the German market include double-charging for energy storage assets (for drawing and dispatching power from and to the grid).

Regulatory issues are in fact the number one burden for storage asset operators in Germany when asked, according to a survey by BVES, whose spokesperson told Energy-storage.news last year that “Germany does not consider energy storage as a key element” of its energy transition.

The result of these barriers inhibiting growth is that, by 2021, the residential/HSS sector accounts for 79% of 4,406MWh total installed battery storage capacity in Germany. LSS is 17% and ISS is the remaining 4%. The German battery storage market is, however, evolving to allow more participation for grid-scale storage paired with renewables, explained next.

The vast majority of installations in HSS and ISS last year were lithium-ion while LSS’s 11 installations were exclusively so, though after a fairly diverse deployment of technology in 2017-2019 LSS is the most diverse of the three cumulatively with nearly one-fifth of energy capacity provided by other technologies (mainly lead-acid, redox flow and thermal storage solutions).

New revenue sources in the German battery storage market

Because of FCR’s saturation (notwithstanding a temporary price spike in 2021), last year was the first year when most LSS installations were at large commercial & industrial sites rather than for the FCR market.

But larger BESS are starting to play in other grid services launched by the Federal Network Agency (FNA). One of those is ‘innovation auctions’ which are open to projects that combine two or more clean energy technologies, for example large solar and wind parks that can bid in combination with a BESS, usually above 1MWh.

In the first three innovation auction rounds from September 2020 to August 2021, 62 BESS totalling 250MWh took part. However, the partaking BESS must only be charged from the directly connected renewable energy sources which prevents them from stacking revenues by also participating in the FCR, aFRR or merchant markets.

Massive BESS projects called ‘GridBoosters’ (‘NetzBooster’ in German) are also being launched by grid operators to temporarily relieve grid bottlenecks and save preventive redispatch.

Pilot projects from Dutch-German grid operator TenneT (100MWh) and Baden-Württemberg grid operator TransnetBW (250MWh) are expected to come online in 2023 and 2025, respectively.

Electric vehicle market in Germany doubles in size

The research also found that 340,000 battery electric vehicles (BEV, i.e. pure electric) and 341,000 plug-in hybrid electric vehicles (PHEV) were registered in Germany last year, bringing the total across groups to 1.27 million to-date, roughly evenly split.

The total energy of their combined batteries should be total 40GWh, the report adds, with four-fifths from BEVs. It points to the potential this holds for things like vehicle-to-grid and vehicle-to-home charging solutions:

“The cumulative battery energy of 44 GWh is therefore larger than the 39 GWh of nationally

installed pumped hydro storage symbolizing the enormous flexibility potential of battery storage for the future energy system.”

Later adding: “…integrating vehicles to serve the grid would be highly desirable from an economic perspective.”

However, it points out that public charging infrastructure could not follow the growth and only grew ‘linearly’ with 11,700 new installations to 50,000 charging points. EVs per charging point grew from 10 in 2018 to 25 in 2021.