What do Ireland, Germany, Poland and Spain all have in common? Well, like the other members of the European Union they all have a requirement to decarbonise and a desire for sustainable economic growth. Andy Colthorpe speaks with energy storage associations from those four countries to hear about their unique situations as well as the opportunities and challenges they share. This is a short extract of an article which originally appeared in Vol.27 of PV Tech Power, our quarterly journal and can be found in the Storage & Smart Power section contributed to each edition by the team at Energy-Storage.news.

The European Union brings together 27 different member states with shared goals across everything from promoting peace, security and justice to promoting scientific and technological progress and establishing an economic and monetary union.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Where energy markets and policies sit within this loose unification of nations is a complex issue, one that also spans the distance from social issues (climate change and environmental justice) to economic (job creation and security of supply) and more.

The macro trend is the same as it is worldwide: renewable energy is on the rise and energy storage is a key to unlocking the decarbonisation and economic growth potential of the energy transition. Representatives of energy storage associations from Ireland, Germany, Spain and Poland gathered together to discuss the status and role(s) of energy storage in their respective countries, in Europe and in the wider world.

While Energy Storage Europe, the annual conference and trade fair held in Düsseldorf, Germany, could not take place in person due to coronavirus, German trade association BVES’ head of communications and markets Valeska Gottke helped us put together this multi-lateral online gathering from which the responses below were gathered.

Ireland – Paddy Phelan, president, Irish Energy Storage Association

“Energy storage is regarded as relatively new” in Ireland, Phelan says. The first projects to be handed contracts through the DS3 grid services scheme set up by high voltage grid operator EirGrid to help meet Ireland’s 2020 goal of sourcing 40% of its electricity came online earlier in 2021. The transmission system operator (TSO) modelled pathways to achieving net zero by 2050 and as a result a policy target of 70% renewable electricity by 2030 has been set.

Ireland has now surpassed the 40% target. Renewable energy development is gathering pace: the first large-scale solar facilities broke ground in this calendar

year, while “significant” offshore wind development is expected over the next decade, Phelan says. Alongside this, the first national community auctions for renewable contracts were completed in 2020, handing contracts to four solar and three wind projects. The three ‘Ds’ of the energy transition: decentralisation, decarbonisation and digitalisation are now being developed at a system modelling level, but outside of a number of test centres, there is not yet “too much in practise,” Phelan says.

The DS3 market gave the energy storage market a strong start, but the fixed tariff regime for 14 different network ancillary services is due to expire in Q2 2023 and the future is uncertain. IESA has been lobbying and it looks as though DS3 will last at least a year longer. The 12 month extension “wasn’t as much as we’d hoped for,” Paddy Phelan says, but it still “gives investors a good opportunity, or new companies to come into the market from outside”.

To achieve 70% renewable electricity by 2030, non-synchronous generation would have to be at about 90%, leaving only 10% for conventional heavy generators which historically have provided grid stability. At present there is about 65% non-synchronous generation and so the requirement for very fast-acting response that energy storage can provide, is increasing.

The energy potential for Ireland from onshore and offshore wind is “phenomenal,” Phelan says. In order to make Ireland a “smart island,” short-term energy storage will be required. That’s where the market and support, financing and funding is at the moment. However, long-duration energy storage will become “very valuable in the context of interconnection to be able to supply green electricity to our European counterparts from renewable resources,” the IESA president says.

Another clear challenge today is that retrofitting energy storage with existing wind resources is tricky from a standpoint of regulatory treatment. Co-location might be more common among new-build projects, but IESA is still seeking answers to the retrofit question. Phelan says his association seeks cooperation with European stakeholders that could participate in helping to provide some solutions for the regulators.

Germany – Valeska Gottke, senior expert for communications and markets at Bundersvand Energies- peicher (BVES)

In Germany, which was of course a global early adopter of solar PV, it seemed about five years ago that battery storage would similarly also become an integral and fast-growing component of the energy system. Yet while residential energy storage sales to environment and independence-conscious households has accelerated to more than 300,000 such systems now installed and commercial and industrial (C&I) sales continue despite a slowdown during coronavirus, the utility-scale segment’s opportunities largely became saturated after an initial first wave. Regulatory barriers also prevent the unlocking of the full value of energy storage, inhibiting the delivery of multiple applications and “double charging” operators of assets for using the grid (levying fees when drawing power from the grid and again when injecting into it).

“Germany does not consider energy storage as a key element of the Energiewende (Germany’s ‘energy transition’),” relying largely instead on moves to extend grid infrastructure, Valeska Gottke at the German Energy Storage Systems Association (BVES) says.

In contrast, the European Union, particularly its Clean Energy Package for All Europeans, recognises the central role energy storage plays in “new climate-friendly and secure energy systems”. The EU also has a strong geopolitical interest in diversification of its energy supply within and beyond the Union, while the European internal market promotes peaceful ties within Europe, including cross-border energy interconnection. The EU Market Design Directive and the EU Renewable Energy Directive are not applicable directly on member states, but instead member states’ national laws are adapted to meet EU requirements.

However, Gottke says that many people are concerned that Germany’s legal mechanisms for implementing energy policy are somewhat divergent with the EU’s Market Design Directive and Renewable Energy Directive frameworks for promoting renewables and regulating energy networks. For instance, rather than adopting a regulatory definition of energy storage set out by the EU Clean Energy Package, the German government has created its own definition of energy storage.

Since late 2017, BVES surveys of its member organisations have shown consistently that the industry considers regulatory conditions to be the main burden on the energy storage market preventing it from developing “more positively,” Gottke says. There remains a lot of work to be done on this side, urgently so, she says, because deadlines for Market Design Directive implementation passed last December and Renewable Energy Directive deadlines are this June.

Despite the regulatory difficulties, Gottke says the German energy storage industry is still “very strong internationally, especially within Europe, with a strong reputation for system competence and ability to provide customised solutions in very complex conditions”. Within the country however, the front-of-the-meter market, initially accelerated by access to frequency control opportunities is largely saturated. Behind-the-meter storage applications in residential and C&I are “growing very strongly”, but as BVES has previously argued, energy storage needs to be recognised as an integral part of the Energiwende, along with grid infrastructure build-out and other options.

“The overall main trend, the most important one, is that the Energiewende is still important and very popular in Germany. It enjoys a lot of support from society and installing an energy storage-plus-renewable system, at home, or at your office, is a way of doing your own Energiewende. It’s still developing well, but there could be more force [at the top level] in my opinion and I think a lot of Germans see that, so they just do their own Energiwende.”

Spain – Luis Marquina, president, AEPIBAL

By contrast, at the moment, “Spain is the place to be,” says Luis Marquina of Spanish energy storage association AEPIBAL. While only three years old, 20 of its 60 member organisations from across the whole value chain have joined the group within the four months leading up to this interview, he says.

Spain’s renewable energy industry has enjoyed a huge renaissance in the past couple of years and now from a policy standpoint targets more than 50GW of renewable energy capacity by 2030 including 30GW of solar PV and 20GW of wind. Nuclear and coal plants will shut down and Marquina describes energy storage as the “unique solution” to mitigate the risks to security, quality and quantity of electricity supply.

Marquina says the renewable strategy and target is “absolutely achievable,” with about 4GW of solar capacity deployed annually in the last two years. The challenge comes with the way that electricity prices and revenues will likely change with the addition of massive solar capacity in the middle of the day. This of course opens the door to energy storage if there’s a big discrepancy between peak and off-peak pricing, while the system will also require grid services that batteries and other storage can deliver to provide stability to the grid.

With this in mind, the country has set a 20GW target for energy storage deployment by 2030, 9GW of which should be coming from electrochemical batteries. There was also a recent renewable energy auction which included an energy storage option so that developers could provide “manageable” electricity capacity to the grid. While the incentives proposed by the government were not enough to provoke an “explosion” of energy storage through the auction, the hosting of the auction in itself caught the attention of the wider energy sector and served to raise the profile of energy storage, the AEPIBAL president says.

But while Spain may be enjoying — if you’ll pardon the expression — this moment of sunshine on its industry, Marquinos says, the challenges it faces are shared across many countries and the energy transition is an effort that should be undertaken collectively.

“We have to be more coordinated in Europe, because we are living all the same experiences. Ireland is at the same point we are. The difference between Ireland and where we are is very small. We have a lot in common and a lot of information to share, we can serve business opportunities.”

Poland – Barbara Adamska, president, PSME

When people think of Poland’s energy sector, they usually think of coal. However although around 70% of electricity production still comes from the fossil fuel, renewables now provide around 18% of electricity production and Poland was Europe’s fourth largest solar PV market in 2020. Coal plants are also scheduled for phase out by 2049.

With policy in the country adapting to climate risk, partly driven by its European Union commitments, the “dynamic deployment of renewable energy sources” is the main driver for energy storage, Barbara Adamska, president of the Polish energy storage association PSME, confirms. The country is targeting at least 32% of domestic net electricity consumption to come from renewables by 2030.

“The photovoltaics sector in Poland is growing rapidly. The development of the photovoltaics market in Poland is actually a matter of the last few years. At the end of 2015, the installed capacity in PV was only about 70MW. At the end of 2020, it amounted to around 4GW — an increase of some 5000%. In the same period, the number of prosumers went up from 4,000 at the end of 2015 to over 450,000 at the end of 2020. An increase of 11,000% over 5 years,” Adamska says.

At the same time, Poland’s energy supply security is “jeopardised by the deteriorating technical conditions” of its power infrastructure, with the majority of transformers and transmission lines built in the 1970s and 1980s, making the development of energy storage a necessity, according to Adamska and PSME.

After several years of discussion, the first few “experimental investments” into energy storage have begun in Poland, but as with other territories, the lack of regulatory framework has been a burden for the industry. However, this year looks set to be transformative for the Polish energy storage sector: the Polish parliament adopted an amendment to its Energy Law in April which Adamska believes will “enable the dynamic development of the energy storage market”.

These changes include the elimination of the “double charging” of fees for import and export to the grid, the removal of licensing requirements for systems under 10MW rated power, exemption from the obligation for a specific energy storage tariff and allowing distribution and transmission networks to invest in energy storage as eligible costs for recovery through rate structures.

Poland has moved faster than the UK or Germany to adopt a set of regulatory definitions of “grid energy storage” and “grid energy storage facilities”. The PSME president says this will solve “interpretation problems stemming from inconsistencies in these definitions across different legal acts”.

Allowing network organisations to classify investment in energy storage assets as eligible costs for running their transmission and distribution grids more efficiently and as a substitute for grid expansion has led the transmission operator PGE to announce that it will deploy at least 800MW of energy storage by 2030.

As with all of the other trade association representatives spoken to for this article, Poland’s energy storage association president believes international cooperation and communication is vital for the future.

“For the development of the energy storage market in Poland, it is extremely important to exchange experiences with industry representatives from other countries and to stay in contact with foreign universities and research institutes,” Adamska says.

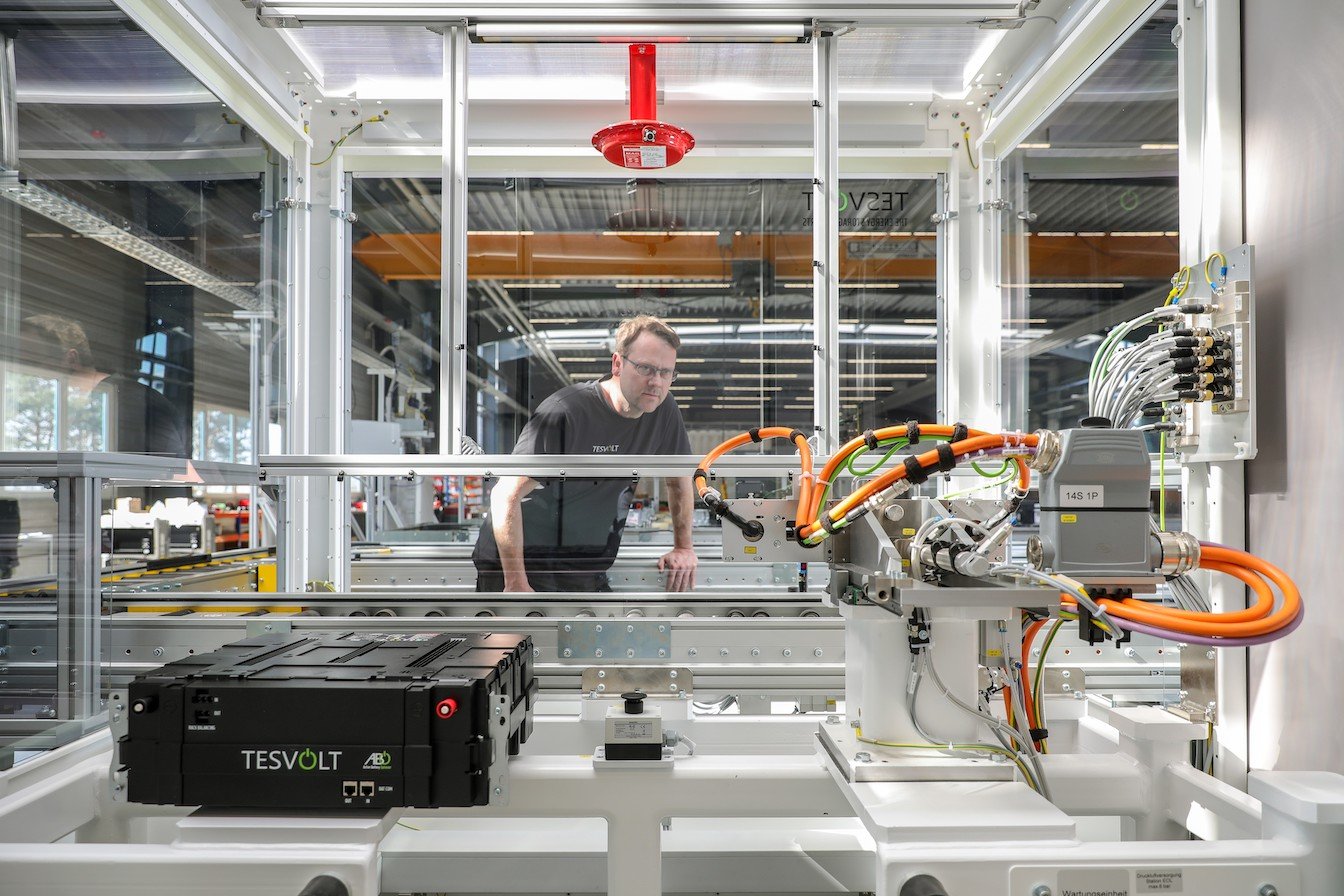

Cover Image: Ireland’s first grid-scale battery storage project, supplying grid services under the DS3 regime, was inaugurated at the beginning of this year. Image: Statkraft.

This is an extract of an article which appeared in Volume 27 of PV Tech Power, the quarterly technical journal dedicated to the downstream solar PV industry, including ‘Storage & Smart Power’, a section contributed by Energy-Storage.news. Subscribe to the journal or buy individual volumes, here.