Competition from Chinese manufacturers put Powin on a tricky footing, even before industry headwinds dealt the company what appears to have been a lethal blow.

That was the take of Drew Lebowitz, managing director of energy storage consulting firm Powerswitch, who spoke with ESN Premium about the US system integrator’s recent financial challenges.

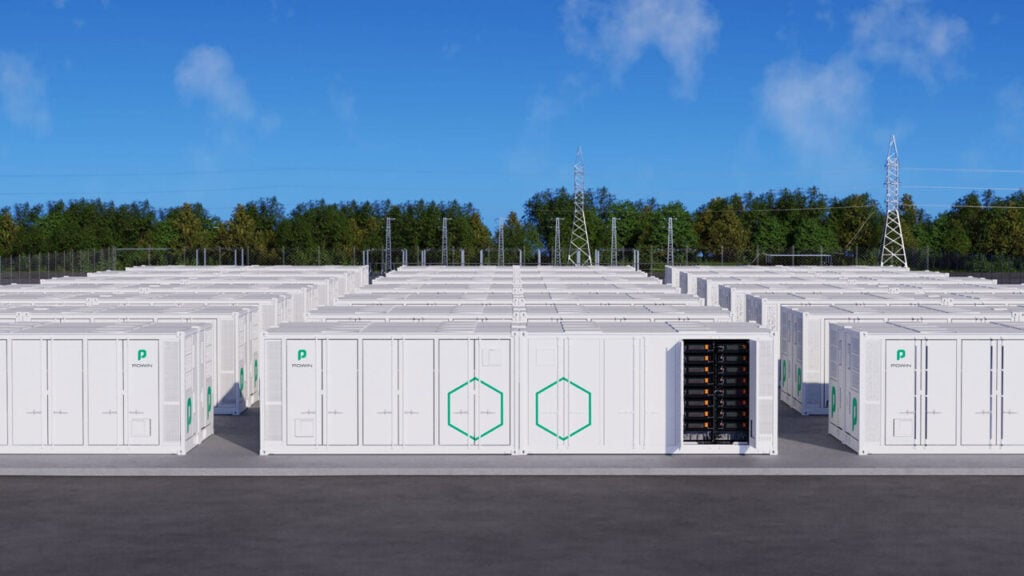

Powin, one of the early leaders in the US battery energy storage system (BESS) space, said 29 May that it was at risk of going out of business and ceasing operations within two months.

In a statement, the company said that the “significant financial challenge” it was currently navigating was “reflective of ongoing headwinds in the broader energy storage industry.” An independent manager from financial advisory Uzzi & Lall was appointed to work with company management to figure out the next steps.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Headwinds cited in the statement included the ongoing saga of US-China import tariffs and the uncertainty about the future of tax credit incentives in the US. Since that initial statement, Powin has filed for Chapter 11 bankruptcy protection, and while there appears to be an outside hope that a solution can be found, many employees have already left the company.

Powin: From early leader to small fish

According to Drew Lebowitz, a former DNV principal consultant who now leads Powerswitch’s advisory for energy storage developers, financiers and project owners, industry headwinds likely accelerated a downward spiral of economic challenges that Powin was already mired in.

Powin actually got its start as both a developer and provider of technologies for battery storage projects before pivoting in 2017 to become a system integrator.

Its early projects in the mid-2010s included landmark BESS installations in California that followed the Aliso Canyon gas leak and went some way to proving how batteries could quickly fill the reliability gap on the grid.

“The broader story of Powin is that they were really early [into the market]. Back in 2015, 2016 they were getting off the ground, getting their first projects deployed, one in California and one in Ontario, Canada,” Lebowitz said.

Powin entered the market during its initial growth phase, characterised by a lot of experimentation. The company was “ahead of the curve and did really well,” becoming instrumental in the industry’s growth story, Lebowitz said.

The consultant, who himself lives in Oregon not far from Powin’s HQ, said the company was among one of the few that really had the knowhow to deliver projects in those days, based on a business model of importing lithium-ion (Li-ion) battery cells from China and integrating them into complete BESS systems.

“They prided themselves on cells, as opposed to a lot of the firms that brought in racks and bigger components, and they prided themselves on their battery management system (BMS) being one of the key aspects.”

The competition heated up, however, when battery cell manufacturers from China, started making and selling their own integrated BESS products, beginning with CATL—one of Powin’s suppliers—in 2019.

As Iola Hughes, head of research at market intelligence firm Rho Motion, wrote in an article for our quarterly journal PV Tech Power (Vol.41) at the beginning of this year, Chinese manufacturers were able to leverage vertically integrated cell and system production to “bring new technologies and products to market with remarkable speed.”

While competition led to a 40% drop in Chinese BESS prices over 2024, Hughes wrote that the advantage extended to the trend towards higher energy density BESS enclosures. Systems packing 5MWh of capacity within the industry standard 20-foot container form factor first emerged in late 2023, exclusively from Chinese players, most of which were vertically integrated manufacturers.

Hughes noted that Powin, along with Fluence, was one of the first non-Chinese companies to launch a 5MWh BESS, but this was not until May 2024, around nine months later. Now that the industry is already seemingly diversifying away from 5MWh containers and back to modular, sometimes even bigger solutions, Chinese players again lead the way, often by leveraging larger-size cells that they themselves make.

“The ultra-competitive nature of the Chinese battery market is creating significant challenges for producers outside China who are just now establishing initial production capacities in Europe and the US especially,” Hughes wrote in the article.

“The story has been these cell manufacturers, predominantly in China, and some in South Korea, moving up the value chain, so that you can buy the energy storage container from REPT, EVE, Hithium, CATL, BYD, they’re all coming,” Lebowitz said.

“It really squeezed Powin to say: ‘What’s your differentiator? Why would we buy from Powin?’”

Chinese cell suppliers moved up BESS value chain

According to the Powerswitch managing director, whose role encompasses owners’ engineering services for developers and procurement decisions on projects, Powin is likely far from alone in feeling the pinch.

US or European integrators such as Fluence, Wärtsilä and Tesla in the past were seen as “taking the cell tech and then turning it into this magical box that was the fully functional system,” including in Tesla’s case, taking a lead in creating an AC block with power electronics inside.

“As the Chinese cell suppliers moved up the value chain, I was there in the room making decisions with developers. Who do we buy a gigawatt-hour of batteries from? And looking at eight bids, and asking, what is it you’re getting from someone like Powin that differentiates it from buying from even the higher end of those containers coming out of China?”

Indeed, China dominates the US market to the extent that BloombergNEF (BNEF) only uses data on Chinese BESS imports to calculate the cost of grid-scale battery storage in the US market in its survey of battery storage pricing.

Lebowitz said BYD was a good example: the electric vehicle (EV) market-leading battery manufacturer had been integrating BESS since 2016, and now has “a great DC block product,” he said.

Meanwhile, although it had brought onboard investors like KKR and Samsung, Powin was a relatively small fish even within the non-Chinese BESS integration space, up against companies like Tesla, Wärtsilä and Fluence, which have bigger balance sheets or the backing of multinational corporate owners or shareholders.

Powin also received a setback that may later prove telling of its race to compete in a rapidly expanding industry, when one of the first field deployments of its Centipede modular BESS solution caught fire at a site in New York in 2023.

“Just keep in mind, you’re buying a product that has a 20-year warranty. So, any whiff that that company is having any financial trouble, or difficulty surviving, is going to be very difficult from the sales perspective,” Lebowitz said.

‘Red flag’ financial situation for Powin

Certainly now, in hindsight, some of those financial troubles for Powin appear to have been foreshadowed. At the beginning of this year, CATL filed a US court complaint against its customer, seeking arbitration over claims that invoices for batteries supplied in 2022 and 2023, worth around US$44 million, had gone unpaid.

Since the bankruptcy announcement, credit score database provider Creditsafe contacted Energy-Storage.news with comments that “Powin struggled to pay its suppliers on time in the months before filing for bankruptcy.”

Ragini Bhalla, Creditsafe spokesperson and head of brand, said that the situation regarding Days Beyond Terms (DBT) i.e., how late a company pays its bills, worsened for Powin over the last five months.

As of December 2024, the company’s DBT over the past 12 months stood at 14 and rose to 37 by May 2025. In some months its DBT score was three times higher than the industry average.

“This consistent climb reflects deepening cash flow problems and a clear inability to meet payment obligations on time,” Bhalla said.

The number of suppliers that had to wait more than three months for payment for Powin went from around 4.5% in February to 41% in May.

“This type of ageing profile is a critical red flag in credit analysis and one of the strongest indicators that Powin’s cash flow challenges were not temporary, but structural and deepening throughout the year,” Ragini Bhalla said.

According to Creditsafe, the increase in trade barriers and customs delays, as well as rising component prices as a result of China and Southeast Asia tariffs levied by the US, “will likely have played a part in Powin’s financial distress and decision to file for bankruptcy.”

‘Higher-end’ integrators could survive industry shakeout

Balance sheet aside, Lebowitz thinks that Powin’s fellow non-Chinese competitors may still have a better shot at riding out the headwinds. Of course, the headwinds will still buffet the industry; Fluence has recently been seen presenting its argument for support of domestic content BESS manufacturing with John Curtis, the Republican Senator for Utah, where one of Fluence’s manufacturing bases is located.

“To set aside domestic content for a second, I think the storage industry is still growing very rapidly, despite everything, in the US market,” Lebowitz said.

With that growth in demand, the consolidation through what Iola Hughes described as “cut-throat competition” will not just be financial. Lebowitz said he believes there will be a further industry shakeout defined by product and service quality.

“The argument that say, the Teslas, or the Fluences of the world are making, [is that] they are saying, ‘We’re not going to be the cheapest, we are not going to be able to be absolutely the lowest cost option,’ but they’re going to say ‘We have the stability, we have the networks, we have the documentation, and the product support, product design, engineering, all these things, that there’s a certain seriousness, and a track record that they bring to the table.”

Those companies are “certainly feeling similar pressures to Powin,” Lebowitz said, but will have to make quality and track record central to their argument for differentiation.

“Anyone who makes a really solid product with a solid warranty that they honour, and it does great, there will always be a place in the market for that, people are willing to pay a premium for it.”

Lebowitz predicts that market dynamics will swing like a pendulum: a rush into the market by new, low-cost entrants might well be followed by the sorts of lawsuits, litigations and warranty claims Powerswitch already sees a lot of in the industry.

“There’s going to be a lot of projects going after integrators, integrators going after cell suppliers, and then they’re going to scratch their heads and say, ‘You know what, maybe we shouldn’t have saved 8% by not going for this integrated option,’” he said.

“I think there’ll be a kind of broad shaking out in the industry, but it’s a growing industry, and if the suppliers that are intent on having that higher end offering and stay the course, there’s a way that they will survive. The car industry is a good proxy for it. BMW is still selling cars for US$80-US$90,000, and people are buying them, and they love the quality. There will be different segments of the market as it evolves.”