Rho Motion’s head of research Iola Hughes analyses some of the trends shaping the battery storage supply chain as market growth accelerates worldwide.

This is an extract of a feature article that originally appeared in Vol.41 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries. Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the nine-year back catalogue are included as part of a subscription to Energy-Storage.news Premium.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The BESS market has gone through a rapid period of growth. New installations are set to exceed 200GWh in 2024 across the grid and behind-the-meter market. As recently as 2022, this was a level that the market was not forecasted to reach before 2030.

With the market set to more than triple by 2030 (Rho Motion, Q4 2024), the race to the top is still in contention.

The global BESS supply chain is evolving rapidly, marked by intense competition and strategic manoeuvres among leading players in China, Europe and the United States. Each region takes a distinct approach to cell and system manufacturing, with China firmly leading the way. This analysis delves into these contrasting strategies, examining the market dynamics and innovations that position each region within the global landscape.

China’s supply chain dominance and cost advantage

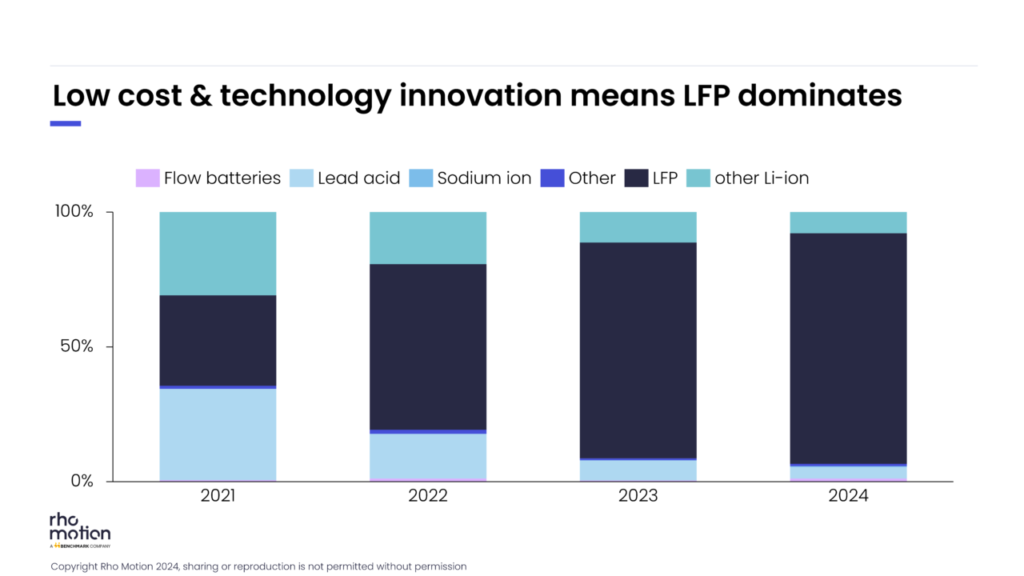

Of the 200GWh of BESS expected to come online globally in 2024, over 85% of this will be lithium iron phosphate (LFP), 8% will be (nickel manganese cobalt) NCM and the remainder a mix of flow batteries, sodium ion and other alternative technologies. The LFP supply chain is almost entirely concentrated in China, from the processing of raw materials, production of anode and cathode and the cell manufacturing itself. China’s market dominance sits between 95 and 100% and will continue to be for the coming years.

The result is that over 85% of BESS installations worldwide, and over 75% of deployment ex-China are therefore reliant on China for the batteries that go into them, a figure that is set to rise over the next few years. The continued decline in raw material prices since the end of 2022, paired with economies of scale and a fierce price war, has caused cell prices to fall to record lows, with reports of LFP cells costing as low as US$45/kWh.

Technological progress, driven in large part by the EV industry, has resulted in improvements in energy density and cycle life and materialised in dedicated cell design for stationary applications.

China has led the way with bigger cells and bigger systems

This low cost and technological prowess led to the current industry standard, Chinese-made 280Ah capacity LFP cells that were first introduced by CATL in 2020 and later by all other players. Innovations in cell design have allowed this capacity to expand, maintaining the same 71173 prismatic cell format (~L173*W71*H205mm), to 314Ah by late 2022.

This upgrade brings notable improvements in energy density, cycle life and cost. By retaining the cell format, production lines can be shared and fast adoption by integrators is possible. To date, Rho Motion has tracked over 15 companies ramping up 314Ah cell production, and over 20GWh of offtake agreements specified for the higher capacity cell. With 314Ah cells estimated to hold a 25% market share by 2024, they are set to dominate by 2025.

Meanwhile, many companies are preparing for mass production of 500Ah+ cells, promising even greater energy density and cycle life improvements. Improvements at the cell level are being passed through to system performance, pushing the typical 3-4MWh 20ft container to 5MWh and higher. Deployments of these larger systems are now starting to take form, with a number of projects identified in the Chinese market from various market players.

Outside of China, we are also seeing more integrators and developers specifically requesting 314Ah cells and 5MWh systems in their offtake agreements and bidding documents.

Chinese manufacturers, leveraging their vertically integrated cell and system production, bring new technologies and products to market with remarkable speed. This integration not only drives down costs—aiding a 40% drop in average BESS system prices within China over the past year—but also enables faster adaptation to evolving demands. When 5MWh systems first emerged around September 2023, they came exclusively from Chinese integrators, and most of these vertically integrated, with the first announcements from outside China following in May 2024, from Powin and Fluence.

The ultra-competitive nature of the Chinese battery market is creating significant challenges for producers outside China who are just now establishing initial production capacities in Europe and the US especially.

New administration could spur or hinder the US storage market

While the Inflation Reduction Act (IRA) has spurred numerous announcements of new US-based cell and system manufacturing facilities for battery storage, it will take several years before these facilities are fully operational. Many of these gigafactories are still in the planning or early construction phases, with expected production start dates extending into the late 2020s.

During this time, China is likely to retain its dominant position in the global battery supply chain, as it already has the infrastructure, scale and technical expertise to produce high-performance systems at competitive prices.

Although the IRA is a substantial step towards reshoring the supply chain and reducing reliance on imports, particularly from China, the transition period means that US manufacturers will still face significant challenges in matching China’s established production capacity and cost efficiencies.

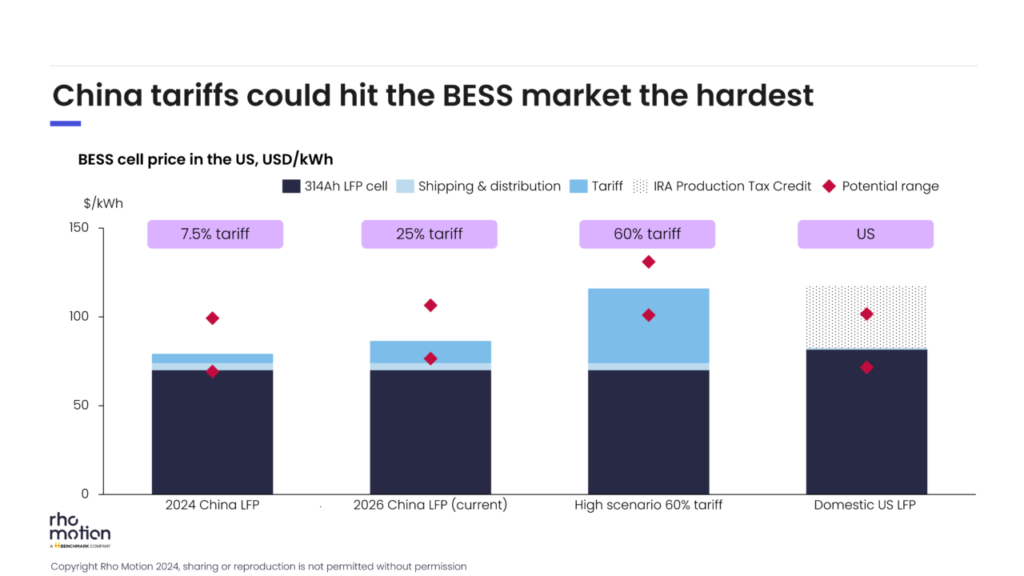

The election of Donald Trump as the 47th President of the United States raises some questions about supply, given the heavy reliance on Chinese cells and the potential for higher tariffs. An increase in tariffs on Chinese batteries for BESS— currently set to take effect in 2026— would strain US integrators and developers, especially in the near term, where few domestic alternatives exist.

However, higher tariffs could also accelerate the development of a domestic supply chain, potentially encouraging Chinese companies to establish production within the US, bringing along investment and jobs.

As for the broader support for battery manufacturing and storage expansion under the IRA, a full repeal seems unlikely due to strong bipartisan backing, particularly from Republican-led states benefiting from related investments. Changes to the details within the IRA are more likely, such as more emphasis on domestic content or FEOC rules extending to the BESS market. Recent Rho Motion analysis considered the impact a “more than 60% tariff on all Chinese imports”, as suggested during Trump’s presidential campaign, would have on the US BESS market.

As discussed previously, the current level of tariff for non-EV batteries will remain at 7.5% until January 2026, at which point it will increase to 25%.

Here we consider the cost dynamics for an LFP cell based on location of cell manufacturing (China versus US), factoring in tariffs, shipping costs and the IRA Production Tax Credit (PTC) that provides USD35/kWh for cell manufacturing and US$10/kWh for pack assembly. With US-based LFP production just beginning in 2026, costs may be significantly higher—particularly for startups producing batteries domestically for the first time. Established players such as AESC, with technical expertise transferred from China, may achieve lower production costs earlier.

Under the high-tariff scenario, US-made LFP cells could become price-competitive with Chinese imports, potentially boosting demand for US supply. However, an across-the-board increase in costs could also lead to lower overall BESS deployment, as developers face higher project expenses.

Europe lagging in BESS deployments and even further in its supply chain

Europe is currently trailing in BESS deployment and even further behind in building a robust battery supply chain, with a notable shortage of domestic cell and system manufacturing.

The top three system manufacturers in Europe in 2023, Tesla, Fluence and Sungrow, all manufacture outside of the region and all rely on cells from China. Unlike the US, which benefits from the IRA’s generous support for cell manufacturing, Europe’s initiatives for the sector are comparatively limited and fragmented across countries. This has slowed the establishment of domestic production, leaving Europe reliant on imports, particularly from China. Unlike the US, which has imposed tariffs to curb dependency, Europe remains open to Chinese players, who are gaining a strong foothold in the market.

This openness could be an advantage for Europe if leveraged strategically. Chinese players can help fill immediate supply gaps, while partnerships and joint ventures with Chinese firms may facilitate faster knowledge transfer and technological progress.

In the longer term, Europe has an opportunity to carve out a competitive position by focusing on sustainable practices, circular economy principles, and end-of-life management regulations, areas where it has regulatory strength. By emphasising quality, environmental standards and recyclability, Europe can develop a distinct value proposition within the BESS landscape, differentiating itself from markets focused primarily on scale and cost.

This is an extract of a feature article that originally appeared in Vol.41 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries. Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the nine-year back catalogue are included as part of a subscription to Energy-Storage.news Premium.

About the Author

Iola Hughes leads and coordinates research at Rho Motion, working on electric vehicle, battery and energy storage market analysis, and has been with the company since its inception. Her work spans the battery demand sectors, from electric vehicle to stationary storage forecasting, managing the team’s view of battery demand and chemistry, and considering the influence of key variables from legislation to OEM strategy and technology roadmaps. Rho Motion, headquartered in London, offers forecasts and analysis for the energy transition.