Funding into battery storage companies fell dramatically in the first half of 2020 compared to last year’s equivalent period, according to the latest reporting from Mercom Capital.

Consultancy Mercom compiles reports on funding and mergers & acquisitions in a number of relevant sectors, with battery storage, smart grid and energy efficiency transactions wrapped up into its regular quarterly reports.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The three sectors taken as a whole saw total corporate funding – including venture capital (VC), private equity and corporate VC – down to US$1.5 billion for H1 2020, a 38% drop from the US$2.4 billion raised across the board in the first half of 2019. VC funding did however increase in the second quarter from the first, up to US$605 million from 26 deals in total for Q2, from US$252 million raised from 16 deals in the first quarter. Also of interest is likely to be the fact that VC funding dropped for the H1 period in battery storage and in energy efficiency year-on-year, but rose significantly in the smart grid space.

Advanced energy storage technology companies were among the leading recipients of VC funding during the half-year period: solid-state battery companies QuantumScape and ProLogium raised US$200 million and US$100 million to lead the Top 10 list for collected battery, smart grid and efficiency deals. Carmaker Volkswagen put that US$200 million into QuantumScape, building on existing investment it made in the company, with which it established a joint venture on enabling “industrial-level production of solid-state batteries” in 2018, Volkswagen has said. The next highest-placed battery storage company was UPS provider Demand Power, which netted US$71 million to come third.

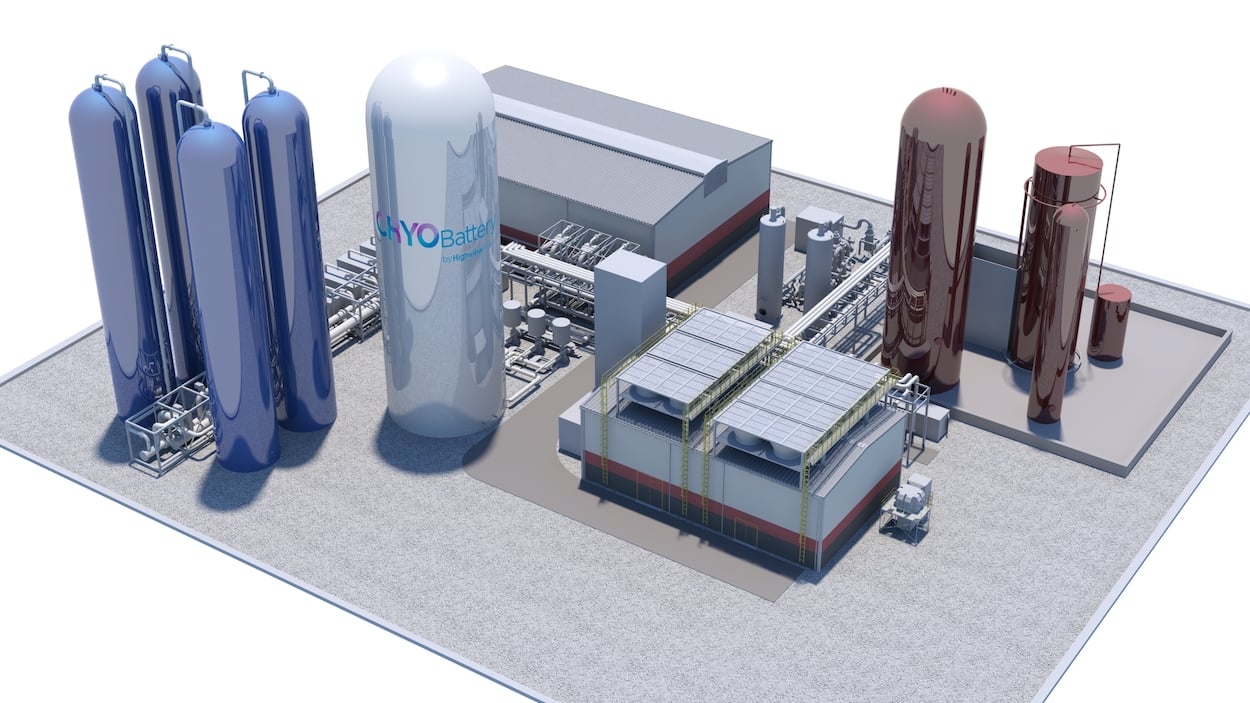

Also in the Top 10, in fifth place, was Highview Power, the UK-headquartered designer, manufacturer and integrator of liquid air energy storage – currently deploying its first large-scale commercial projects in territories including the US, reporting in June that a 250MWh project in England is set to begin construction this year. Highview raised US$46 million in VC funding in the first six months of 2020.

Graphene-based energy storage device maker Nanotech Energy also placed in the Top 10 chart, with US$28 million of VC funding, while nickel zinc and zinc air battery systems manufacturer ZAF Energy Systems raised US$22 million, putting it ninth across the three industry segments and implying that appetite from investors in the energy storage technology space still compares favourably against the other segments.

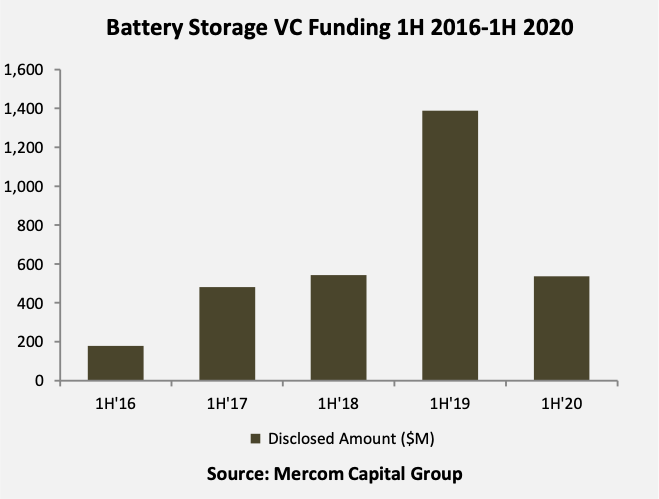

VC funding dropped 61% from H1 2019

However, VC funding for battery storage companies reached just over half a billion dollars (US$536 million) in H1 2020, across 14 deals. This was a significant drop of 61% from H1 2019’s 17 deals which added up to US$1.4 billion. The chart below shows that this places it just over 2018 and 2017’s equivalent periods, although it is much higher than was raised back in 2016. Mercom’s previous quarterly report had shown VC funding had been fairly buoyant in the first quarter of the year – before the COVID-19 pandemic began to bite.

The first half of 2019 saw battery and storage system manufacturing startup Northvolt raising US$1 billion, Mercom Capital pointed out, with no such equivalent big single deals done this year during the reported period. Northvolt’s investors also included Volkswagen, along with others such as Goldman Sachs.

Announced debt and public market financing in battery storage also fell considerably (67%) from H1 2019, when US$547 million was raised across five deals, falling to US$180 million in H1 2020. Project funding deals were perhaps the biggest casualty of what is likely to be a confluence of factors including the coronavirus pandemic: Mercom Capital reported five announced battery storage project funding deals in H1 2020, worth a combined US$26 million, while the first half of 2019 saw US$499 million split across just four deals.

There was continued M&A activity, with eight transactions closed in the first half of the year, compared to six deals in H1 2019, although financial details were not disclosed in any of the deals brokered in this year so far.