‘Multi-day storage’ technology company Form Energy and US utility Georgia Power have sealed a “definitive agreement” for a grid-scale project.

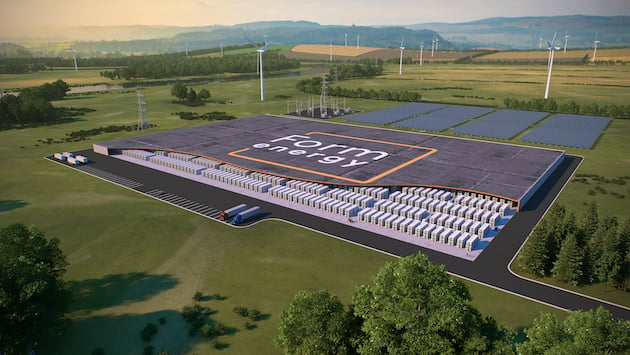

Startup Form Energy has a proprietary electrochemical energy storage tech based on oxidisation (rusting) of iron, which it has claimed creates a battery capable of storage durations of around 100 hours.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The iron-air battery is designed to be made with abundant and recyclable raw materials. While it is lower round trip efficiency (RTE) than technologies like lithium-ion, it can also be made much more cheaply, according to the company. Form Energy recently just broke ground on its first factory, in West Virginia.

The deal with Georgia Power, announced yesterday, puts the proverbial seal on a 15MW output, 1,500MWh energy storage capacity iron-air battery storage project that the two are known to have been in discussions over since February last year.

As reported by Energy-Storage.news at the time, Form Energy and Georgia Power, a subsidiary of utility holding group Southern Company, were in negotiations to find an optimal application for the iron-air battery technology in Georgia Power’s service area.

The utility’s chair, president and CEO noted that more and more of its customers are asking about long-duration energy storage (LDES), specifically multi-day technologies.

“As we continue to build Georgia’s clean energy future, battery storage systems play a vital role in how we will continue to serve our customers with clean, reliable energy for decades to come. That’s why partnerships with innovators like Form Energy are so important to our long-term strategy,” Kim Greene said.

“Our customers, including many business and commercial accounts, are increasingly interested in the use of new technologies such as multi-day energy storage to help grow renewable energy and enhance reliability, especially as they relocate or grow their operations in Georgia.”

Renewables as baseload energy

Form CEO Mateo Jaramillo has told this site previously that the company’s rechargeable battery technology could be what takes high capacity factor thermal assets, such as open cycle gas turbines (OCGTs) and coal, off the grid.

A combination of renewable energy and iron-air batteries, plus other complementary storage tech like lithium-ion, could see renewables becoming considered as reliable, dispatchable sources of baseload energy, Jaramillo said in a an interview with Energy-Storage.news in 2021.

While further details of the project with Georgia Power were not yet disclosed, Form Energy said it could come online “as early as 2026”, and that the two parties are continuing to work together on evaluating and demonstrating the value of the 100-hour battery technology in strengthening the grid during daily, weekly and seasonal weather variations, as well as offering backup to electricity supply in the event of extreme weather-caused disruptions.

It’s one of three known deals or advanced discussions with US utility companies Form Energy has entered into in the three years or so since exiting stealth mode.

The first announced was with Minnesota utility Great River Energy, revealed in 2020 even before Form had disclosed the chemistry of its battery. That pilot will be a 1MW/150MWh system, scheduled to get underway later this year.

Also in the works are two potential projects with Xcel Energy, also headquartered in Minnesota. Bill Gates-founded VC firm Breakthrough Energy recently pledged a US$20 million grant for the Form-Xcel projects. Each of those would be 10MW/1,000MWh systems.

Those two are expected to come online in 2025 and Xcel Energy has said it expects to be able to leverage Inflation Reduction Act (IRA) tax credit incentives to lower the projects’ costs further. Form Energy has said that one of the advantages of its low bill of materials costs is that production can be fairly easily sited locally to demand.

With the IRA boosting financial support for clean energy projects with domestic, US-made components and equipment, this looks like another selling point for the iron-air battery company.

What the utilities Georgia Power, Xcel and Great River Energy have in common are a dependency on thermal generation today that they need to move away from.

Georgia Power plans to retire and decertify all of its coal power plants but one by 2028. Although the utility has approved around 2,000MW of contracts for natural gas as part of the answer, it is also pursuing the buildout of energy storage and renewable energy.

In its 2022 integrated resource plan (IRP), Georgia Power said it wanted the right to own and operate 1,000MW of energy storage by 2030. This follows its previous IRP in 2019, through which it got 80MW of own and operate battery energy storage system (BESS) projects approved by regulators.