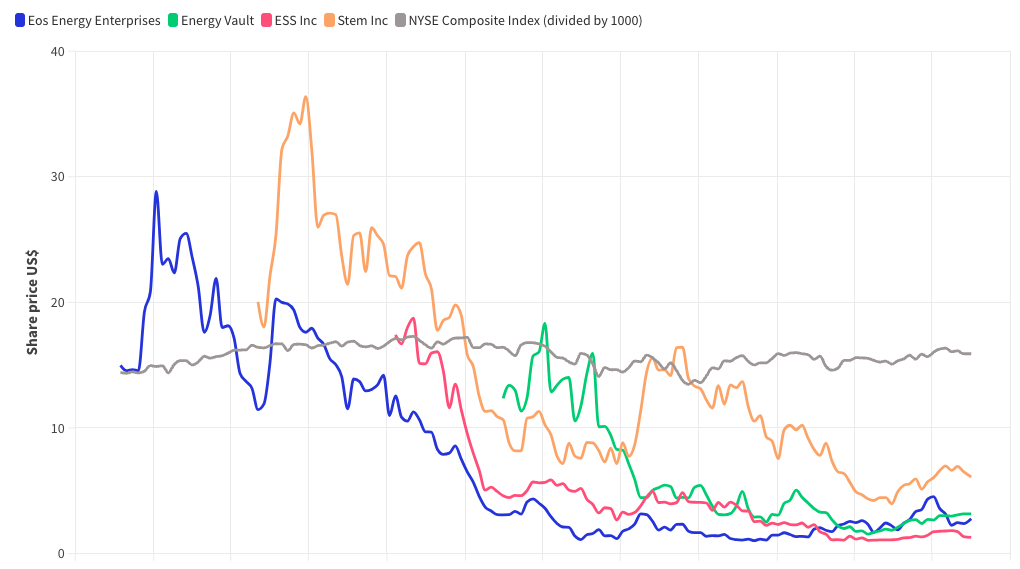

The four most high-profile energy storage system (ESS) companies that listed via SPAC mergers – Eos, Energy Vault, ESS Inc and Stem – have seen their share prices fall by an average of 80% since going public.

Special purpose acquisition company listings, or SPACs, are a faster alternative to initial public offerings (IPOs) and have grown in popularity in recent years.

Numerous ESS companies have used them as a route to going public but the most high-profile have been gravity-based energy storage firm Energy Vault, zinc-hybrid battery firm Eos Energy Enterprises, iron-flow battery firm ESS Inc and lithium-ion ESS system integrator Stem Inc.

However, as Energy-Storage.news shows in the infographics above and below, the four have severely underperformed since going becoming publicly listed via a SPAC merger, with their share prices down by an average of c.80% at the time of writing.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

This led one source we spoke to to call them an “unmitigated disaster for investors.”

Below are the companies’ weekly closing share prices starting on the Monday after the mergers were completed through to the time of writing (15 August). Eos is on the NASDAQ while Energy Vault, ESS Inc and Stem Inc are on the NYSE, so we’ve included the latter’s index as a reference (itself divided by 1000 in order to be able to compare it).

Hover over a line to track the company or NYSE index over time.

The four companies’ long-term outlook is bright, with proprietary technology and software offerings positioning themselves well to take advantage of market tailwinds only furthered boosted by the US Inflation Reduction Act.

However, their financial performance has lagged behind forecasts given during analyst presentations around the time of their SPAC listings. Energy-Storage.news looked at this in some detail earlier this year and their latest revenue figures compared to their previous forecasts are summarised in the table below.

This underperformance ultimately has much more to do with the companies’ suitability or timing for SPAC listings rather than their underlying business case and model, which is fundamentally strong.

Ultimately, the demand for long-duration energy storage has not come as soon as some had hoped. Energy Vault CEO Rob Piconi has told us this was why it had pivoted into short-duration battery energy storage system (BESS) technology in a recent interview.

Energy-Storage.news was not able to find forward forecasts from Stem Inc while ESS Inc has not released updated revenue guidance for 2023. The figures are all in US$ millions and the earlier forecasts can be found in company presentations or stock market filings from ESS Inc, Energy Vault and Eos.

| Company | 2022 forecast revenue | 2022 actual revenue | 2023 forecast revenue | 2023 latest guidance | H1 2023 actual revenue |

| Eos Energy Enterprises | 268.6 | 17.9 | 735.5 | 30-50 | 9.1 |

| Energy Vault | 148 | 146 | 535 | 325-425 | 50 |

| ESS Inc | 37 | 0.9 | 300 | / | 2.9 |

It remains to be seen how fast the companies can scale up and achieve the forecasts they made around the time of their listing.

The SPAC trend is not yet over either, with energy storage and energy management solutions provider Electriq Power and battery technology company Dragonfly Energy Corp recently going public via SPAC deals.

Vanadium redox flow battery (VRFB) firm CellCube is also now partially owned by a SPAC, along with mining firm Bushveld Minerals, after a series of complicated transactions covered by Energy-Storage.news.