Energy Vault has got its New York Stock Exchange (NYSE) listing after the gravity-based energy storage company’s merger with special purpose acquisition company (SPAC) Novus Capital Corporation II completed.

The SPAC’s shareholders voted to approve the business combination at a meeting last week. Energy Vault shares list on the NYSE today (14 February) under the ticker ‘NRGV’. Its warrants list as ‘NRGV WS’.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The combination raised around US$235 million in gross proceeds for the company. US$195 million of that is a private investment in public equity (PIPE) commitment from Korea Zinc and Atlas Renewable — strategic partners in Energy Vault — along with a host of funds and accounts including Softbank Investment Advisors.

On those two strategic partners, Korea Zinc had upped its PIPE commitment from US$100 million to US$150 million, Energy-Storage.news reported in January. Korea Zinc saw Energy Vault’s novel technology as a possible means to decarbonise its own extraction and refinery operations, including Sun Metals, a subsidiary in Australia.

Atlas Renewable meanwhile partnered with Energy Vault on commercialising the technology in China, with a 100MWh project claimed to be set to begin construction in the second quarter of 2022 in Jiangsu Province.

Altas Renewable’s main shareholder is China Tianying Inc, a waste processing and recycling group. Atlas counts Jeb Bush, brother of former US president George W Bush, as its chairman. Energy Vault said a US$50 million technology licensing deal had been made between the two, as well as a US$50 million PIPE commitment.

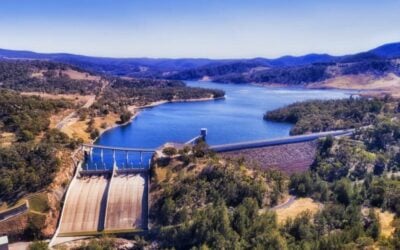

In an interview with IPO Edge a few days before the vote, Energy Vault CEO Robert Piconi said the principles of the gravity storage tech mirror those of pumped hydro energy storage, except that instead of water going downhill, an “energy elevator” is taking large composite block weights up and down to turn motors to discharge energy.

“This is all with fully automated AI and computerised control software,” Piconi said.

In forms filed with the US Securities and Exchange Commission (SEC), Novus Capital Corporation II said it had been seeking an investment opportunity to acquire a target company from early 2021 before its announcement in September 2021 that Energy Vault had been selected.

Novus noted that the gravity storage technology does not have the same geological siting constraints as pumped hydro and is designed to be less at risk of supply chain challenges than other energy storage technologies like batteries.

However in a Form S-4 filed in October last year, Energy Vault outlined that its technology and design of its large-scale energy storage systems had not yet been finalised and that it did face challenges in making those cost-competitive.

The merger gives the combined entity a value of US$1.07 billion based on a price of US$10 per share.

An Energy Vault representative told Energy-Storage.news the proceeds raised, along with a recently closed US$107 million Series C funding round, provided Energy Vault with more capital than it anticipated requiring in its business plan to deploy units and execute a growth strategy.

It’s the latest in a wave of energy storage and related sector companies to go public through SPAC mergers. The last year or so has seen the likes of iron flow battery company ESS Inc, zinc-air battery company Eos, distributed commercial energy storage provider Stem Inc and recycling specialist Li-Cycle all go through the process.

In a March 2021 Guest Blog article for this site, finance expert Charles Lesser at clean energy transaction consultancy Apricum wrote of the high risks and potential pitfalls, as well as rewards, of the SPAC route.