There has been US$150 billion of announced investments into the US’ upstream and downstream clean energy industry since the Inflation Reduction Act was passed, according to American Clean Power (ACP).

The investment announced in the last eight months since the Act passed represents more than the previous five years’ (2017-2021) investment in commissioned projects combined, the trade body said in its ‘Clean Energy Investing in America’ report. The period it covers goes up to 31 March, 2023.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

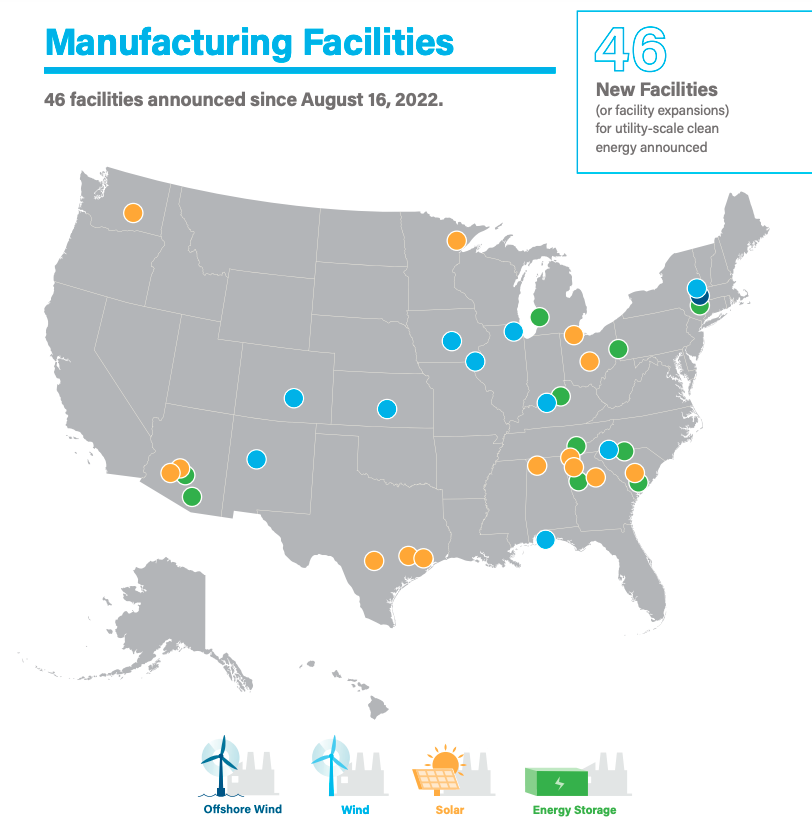

The figure includes 46 new or expanded clean energy manufacturing facilities as well as 96GW of downstream clean energy capacity, including wind, solar and storage, announced since August.

The 46 facilities breaks down as 26 solar, 10 utility-scale battery storage, eight wind power and two offshore wind power facilities, illustrated in the map from the report further down. They are expected to bring a total of 18,000 new jobs with them.

Major utility-scale battery storage manufacturing facilities announced in the period include gigafactories from metal-hydrogen battery firm EnerVenue, iron rust battery firm Form Energy and expansions by lithium-ion battery firms Freyr and Pomega, from Norway and Turkey respectively. Read all our coverage of battery manufacturing internationally here.

However, the ACP urged “the Administration and Congress to continue improving trade policies, supporting next-generation technologies, finalising effective tax implementation and working to enact commonsense permitting reform”.

The third point may allude to the upcoming guidance expected by the Internal Revenue Service (IRS) on the investment tax credit (ITC) and its transferability for standalone energy storage brought in by the Inflation Reduction Act.

The report also highlighted that utilities in the US have announced a total of US$4.4 billion of savings for customers since the Act passed.

On the upstream side, something of an arms race is now brewing between the US, Europe the UK and elsewhere to attract investment into each region’s battery supply chain. Europe responded with its Green Deal Industrial Plan while the UK government is mulling its own equivalent too.

Energy-Storage.news reported that the US’ planned lithium-ion gigfactory capacity has been growing twice as fast as Europe’s since the Act, according to Benchmark Mineral Intelligence.

More recently, a trade body for Europe’s transportation sector said two-thirds of Europe’s gigafactory projects are at risk of cancellation, reduction or delay, confirming anecdotal reports from Energy-Storage.news of a pivot in interest to the US.