Harmony Energy Income Trust (Harmony), a battery storage investment fund operated by UK renewables and energy storage developer Harmony Energy, intends to undertake an initial public offering (IPO), to fund the development of 213.5MW of projects using Tesla’s battery storage technology.

It will list on the Specialist Fund Segment of the Main Market of the London Stock Exchange through an institutional placing and an offer for subscription with up to 230 million new ordinary shares that will be available at an initial issue price of 100p per share.

Additionally, Harmony Energy’s management team and their associates will be able to subscribe for 2.5 million shares that will be subject to a five year lock-up period.

It is targeting a dividend yield of 8% per annum, which will be payable quarterly from 2023.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Harmony is planning to use the IPO to fund a diversified portfolio of battery energy storage systems in Great Britain. Shovel ready projects will be targeted, to maximise the value of potential risk-adjusted capital value growth.

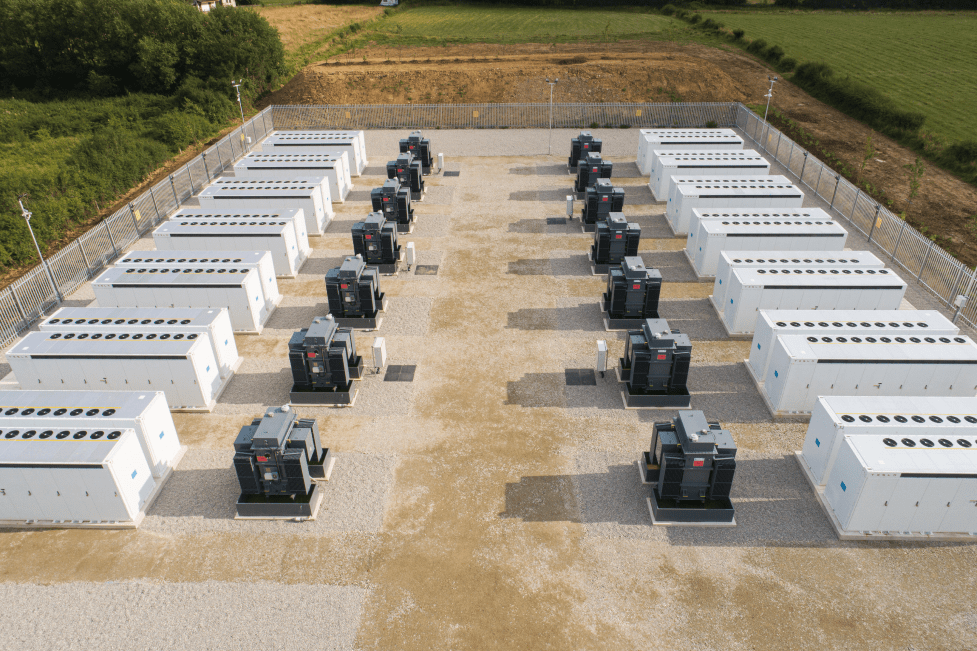

It will initially acquire five projects with a capacity of 213.5MW (427MWh) from Harmony Energy Limited, which have an acquisition value based on a fixed funding requirement of £750,000 per MW on acquisition.

This is expected to further increase to c. £874,000 per MW once constructed, the company noted.

Harmony has contracted with Tesla for this initial portfolio including agreed pricing and timing of delivery. Working with the battery manufacturer will allow it to take advantage of the company’s two-hour duration Megapack systems and Autobidder AI revenue optimisation platform, and see the assets covered by a 15 year warranty.

In additionally to this initial portfolio, there is a 99MW (198MWh) advanced project to be acquired following Admission, bumping up Harmony’s initial portfolio to 312MW (625MWh).

The company will also have exclusive rights to acquire a pipeline of battery storage projects with an aggregate capacity of 687.5MW that is already within Harmony Energy’s control.

Overall this would bring Harmony’s initial target portfolio to 1GW, it will also have preferential rights over Harmony Energy’s future projects.

The company highlighted the growing share of renewables on Britain’s grid for its decision to enter launch an IPO now. With wind and solar capacity meeting around 50% of generation capacity in 2020, and this predicted to reach up to 78% by 2030 (80GW) and 91% by 2050, the need for increased energy storage capacity is clear.

There will be opportunities for batteries through both an increased requirement for system balancing and ancillary services and greater pricing volatility in the wholesale market over the longer term.

To read the full version of this story visit Solar Power Portal.