An investment worth €110 million (US$131.5 million) has been agreed by ‘thermal battery’ manufacturer EnergyNest which would make infrastructure equity investor Infracapital its biggest shareholder.

Infracapital is the infrastructure equity arm of FTSE 100-listed global investment management firm M&G Plc. In November Infracapital committed nearly US$200 million to investing in UK battery storage and electric fleet transport solutions provider Zenobe Energy.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

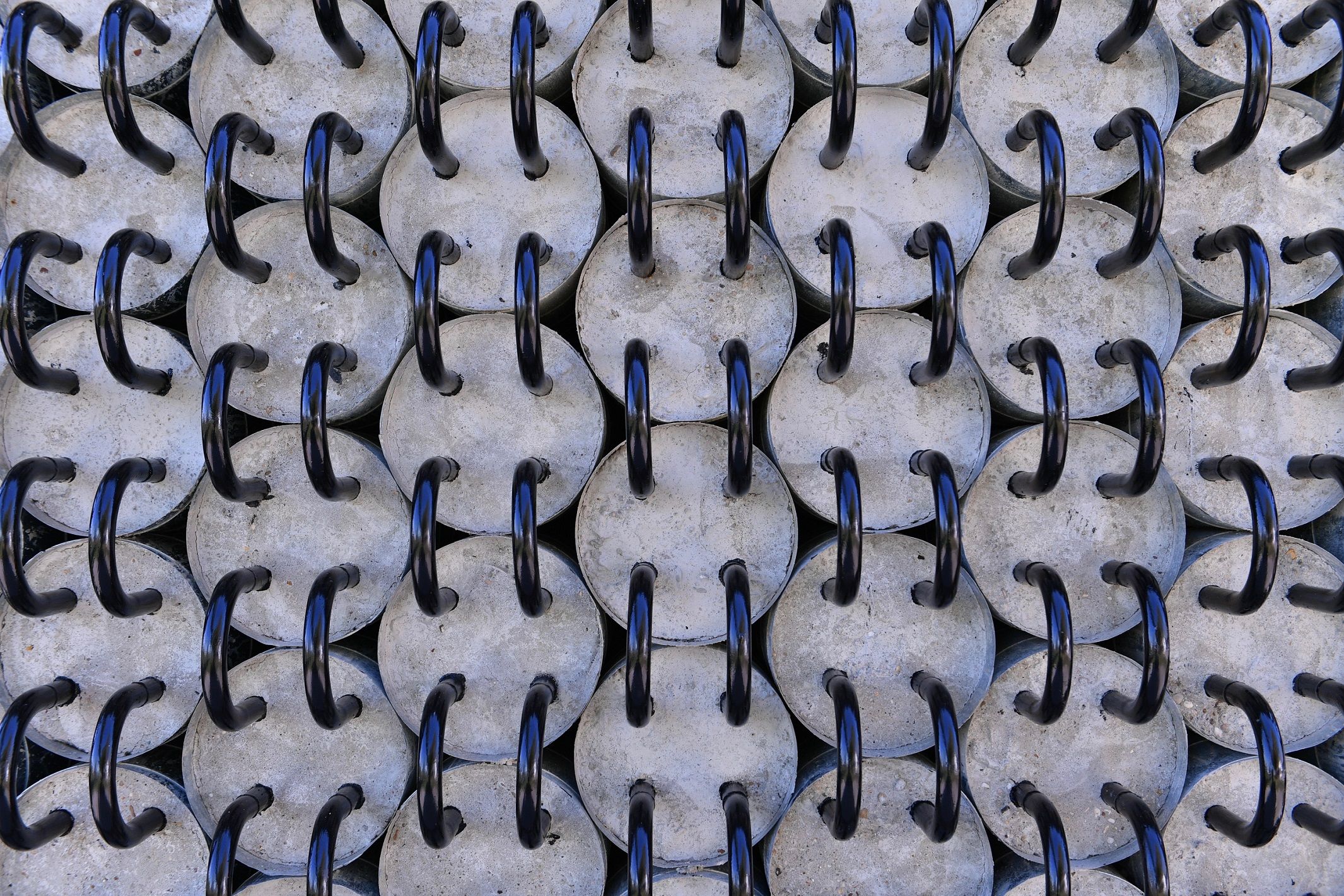

Norway-headquartered EnergyNest makes its own branded ThermalBattery product which essentially stores heat in a patented form of concrete, which it has dubbed Heatcrete. A heat transfer fluid (HTF) at high temperatures passes through steel pipes cast into the ‘battery’, in technology that the company claims enables storage of energy at very low CapEx cost, using low-cost materials in a simple design. EnergyNest has previously said the Heatcrete materials can last 30 to 50 years of use without degradation.

Infracapital’s investment will be used by the thermal energy storage company towards delivering financed turnkey energy storage solutions in a range of international regions, targeting the difficult to abate reduction of carbon emissions in industrial processes that use heat. EnergyNest’s commercial and industrial (C&I) customers can reduce their energy use and carbon emissions — and costs — with long-term, financed solutions.

EnergyNest made its first large-scale deployment in a research and demonstration project in Abu Dhabi with Masdar Institute, a 1MWth system developed between 2013 and late 2015. As with providers of other novel energy storage technologies, the company has been seeking to commercialise its products and offerings over the past few years and claimed that 2020 was its strongest year to date.

In January last year Energy-Storage.news reported that the company was deploying a multi-megawatt solution at a brick making factory in Austria and in June announced a partnership with Siemens Energy to develop commercialised solutions — the pair had already worked together previously at the Abu Dhabi pilot project. A project with Italian energy major Eni at a solar energy plant is also already underway and another with Norwegian chemical company Yara is in development to produce steam for industrial use.

Other companies targeting the low-carbon thermal storage market — an opportunity worth an estimated €300 billion worldwide according to EnergyNest — include Germany’s Lumenion which is conducting a trial of its high temperature steel technology with utility Vattenfall, Swedish company Azelio which stores heat in a special aluminium alloy and US grid-scale electro-thermal energy storage company Malta Inc, which earlier this year closed a Series B funding from investors that included one of Facebook’s co-founders.