Tesla has announced that by the end of 2026, it expects to have around 4.5GW of grid-forming battery storage operating across Australia.

According to Josef Tadich, regional director of Tesla Energy, APAC, who took to LinkedIn to make the claim, this figure is expected to “double again” in the future as grid-forming battery energy storage systems (BESS) become a staple of the Australian energy system.

It should also be noted that this 4.5GW grid-forming battery storage figure is not specific to the National Electricity Market (NEM), which spans Australia’s eastern and southern states, but also to the South West Interconnected System (SWIS), which spans much of south-west Western Australia, including the state capital Perth.

“It’s an exciting time for the industry, with system operators globally managing the displacement of traditional synchronous generators with inverter-based renewables and storage,” Tadich said on LinkedIn.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“It’s through informed debate and collaboration, engineering design and testing, and a growing base of empirical evidence and experience, that the power system begins to rely on this technology to provide system strength services.”

Tesla confirmed that it has over 4.5GW/12GWh of grid-forming BESS in the pipeline across Australia, with projects in various stages of development.

The company’s Australian portfolio of operating projects includes 17 grid-forming projects, with notable installations such as Hornsdale Power Reserve (Neoen) at 150MW/194MWh in South Australia, Victoria Big Battery (HMC Capital) at 300MW/450MWh in Victoria, Melbourne Renewable Energy Hub (Equis) at 600MW/1,600MWh in Victoria and the Orana BESS (Akaysha Energy) at 415MW/1,660MWh in New South Wales.

This announcement regarding grid-forming inverters comes after remarks made by Shane Bannister, Tesla’s head of business development and sales for Megapack APAC, during the Clean Energy Council’s Australian Clean Energy Summit 2025. Bannister said that he does not believe Tesla will “sell another battery in Australia that’s not grid-forming.”

Tesla on the use of grid-forming BESS

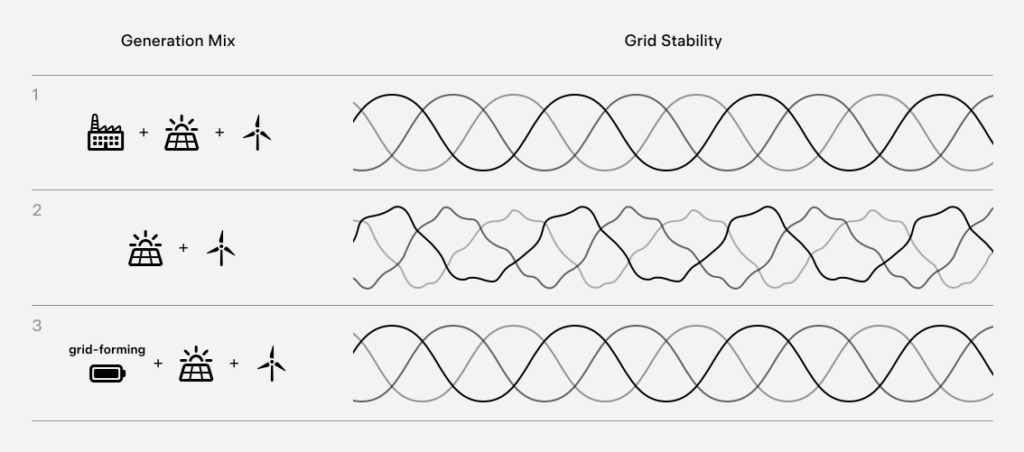

Tesla has released two white papers detailing how grid-forming inverters can provide synthetic inertia to stabilise Australia’s NEM as the grid transitions to higher renewable energy penetration.

The documents, titled Grid-Forming: The Path to a Stable and Sustainable Future and The Role of Grid-Forming Inverters in Providing Inertia, present evidence that grid-forming batteries can deliver reliable inertial responses comparable to traditional synchronous generators while offering greater flexibility and reliability at lower costs.

The white papers directly address several persistent myths about grid-forming technology. One significant misconception is that grid-forming batteries cannot provide inertia, which has traditionally been provided by coal, gas and hydropower plants.

Tesla counters this with evidence that these systems can provide synthetic inertia through advanced control systems that emulate the behaviour of traditional synchronous machines during grid disturbances.

Another myth tackled in the white papers suggests that synthetic inertia is less reliable than traditional mechanical inertia. Tesla argues that grid-forming inverters offer more consistent and controllable responses than conventional synchronous generators, with the ability to provide precisely calibrated frequency support during system events.

Tesla also challenges the notion that synchronous condensers (syncons) are superior to grid-forming batteries.

According to cost comparisons cited from the Australian Energy Market Commission (AEMC), new synchronous condensers for inertia have fixed costs of approximately AU$7,000 (US$4627.49)/MWh/year with variable costs between AU$0.20-AU$0.50/MWh/hour.

In contrast, new grid-forming BESS have significantly lower fixed costs ranging from AU$0-AU$806/MWh/year and variable costs averaging just AU$0.02/MWh/hour.

Grid-forming inverters vs synchronous condensers

Another key aspect of the white papers explains how grid-forming inverters deliver synthetic inertia through sophisticated control algorithms.

Unlike traditional synchronous generators that provide inertia through rotating mass, grid-forming batteries deliver a controllable, instantaneous active power response that helps limit frequency nadir, the lowest point that the grid’s frequency reaches after a disturbance.

The documents highlight the superior reliability of grid-forming systems compared to synchronous condensers.

A case study from AEMO’s Operating Incident Report reveals that the Buronga synchronous condensers experienced 20 trip events between November 2020 and March 2022.

Specifically, Buronga No. 1 SC tripped seven times, No. 2 SC tripped 13 times, and No. 3 SC tripped five times during this period, with root causes related to protection-control system maloperation and failures.

In contrast, Tesla emphasises that grid-forming batteries feature modular architecture allowing continued operation even when individual units fail, remote diagnostics capabilities reducing downtime, and average availability rates exceeding 99%.

This reliability advantage becomes particularly important as Australia and the wider globe transition away from traditional generation sources.

Blackstart capabilities

Another important aspect of grid-forming inverter technology is its ability to facilitate blackstart operations, a critical grid service traditionally provided by conventional generators.

Tesla noted that grid-forming BESS will be capable of progressively restoring power following a blackout through a three-stage process.

First, the battery storage system initiates power flow to establish a stable voltage and frequency reference. Next, renewable energy generation sources like solar and wind are brought online as the battery maintains grid stability.

Finally, the system achieves complete energisation with full power flow established across the network, including industrial facilities and other load centres.

Tesla is also keen to highlight the growing acceptance of grid-forming technology among grid operators worldwide. The Australian Energy Market Operator (AEMO) has recognised that “the inertial response provided by the 150MW/194MWh Hornsdale Power Reserve grid-forming BESS is comparable to a typical inertial response provided by a synchronous machine during a frequency event.”

Similar endorsements come from other major system operators. Tesla cites ERCOT, EirGrid, National Grid ESO and Hawaiian Electric as those that have acknowledged the technology’s capabilities in providing system stability, synthetic inertia and blackstart functionality.

Policy recommendations for Australia

Tesla’s white papers conclude with several detailed policy recommendations to accelerate the adoption of grid-forming technology in Australia.

The company calls for streamlining connection processes for grid-forming batteries under the National Electricity Rules and designing mandatory specifications for inertia provision embedded in the NER.

Tesla specifically recommends reviewing Clause 5.3.4A(b1) of the National Electricity Rules. Currently, proponents are required to aim for the Automatic Access Standard, creating what Tesla describes as “a major barrier” to grid-forming battery storage adoption.

Additional recommendations include accelerating inertia procurement mechanisms through a real-time inertia market, incentivising retrofitting of suitable grid-following batteries, improving transparency on inertia requirements, and fostering education and collaboration among stakeholders.

Modo Energy: the costs to build a grid-forming BESS are ‘virtually the same’ as grid-following

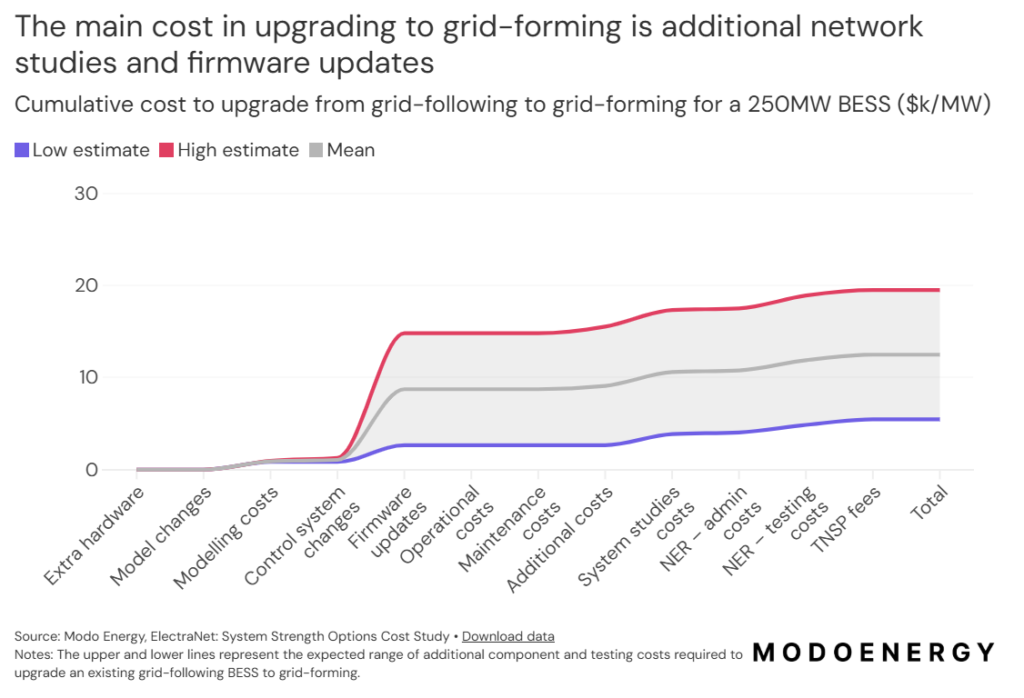

In other news, UK-headquartered energy industry data platform Modo Energy has said that the cost to build a grid-forming BESS is now virtually identical to that of traditional grid-following systems.

While grid-forming systems in the NEM do require additional testing for grid connection, Modo said this only adds marginal expenses to the commissioning process. The negligible premium makes grid-forming an increasingly attractive option for developers planning new projects.

The economics become even more compelling when considering retrofitting scenarios. Converting an existing grid-following battery to grid-forming capability can cost up to 21 times more than implementing grid-forming from the beginning.

Despite this significant multiplier, the absolute cost remains relatively modest at approximately AU$12,000 (US$7,902) per megawatt for a 250MW asset. This creates a strong financial incentive for developers to choose grid-forming technology from the outset.

The market trajectory shows grid-forming batteries transitioning from experimental pilot projects to mainstream adoption across the NEM. Early implementations relied heavily on government funding to offset higher costs, but this support is becoming less necessary as economics improve.

As such, Modo noted that network agreements are now emerging as the next incentive mechanism driving adoption.

With significant cost advantages, greater reliability, and enhanced flexibility, grid-forming batteries appear positioned to become a cornerstone of Australia’s future grid architecture.