Stem Inc saw a 251% increase in revenues for 2021 compared to the previous year and has offered full-year 2022 revenue guidance of between US$350 million and US$425 million.

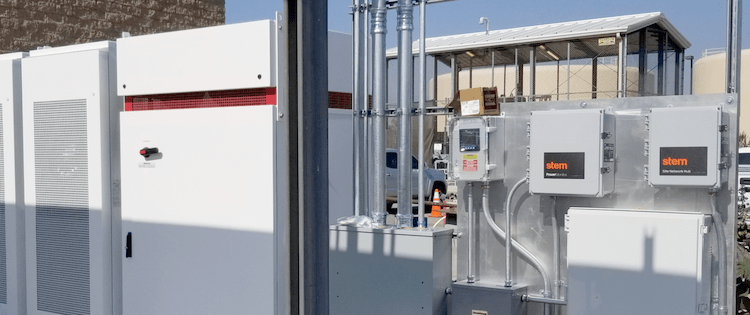

The California-headquartered ‘smart energy storage’ provider which mostly equips commercial and industrial (C&I) customers with lithium-ion battery storage, optimised and controlled by its proprietary software platform, Athena, has just reported its fourth quarter and full-year financial results for 2021.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The company said Q4 2021 was a record quarter, taking in US$216.9 million in bookings, a 400% increase from the same period in 2020 (US$34 million), while revenues for the three month period stood at US$52.8 million, again a record quarterly figure and a 184% increase on US$18.6 million revenues in Q4 2020.

Along with the financial results disclosure yesterday Stem Inc said the Athena software had been selected for onboarding to up to 1GW/2GWh of energy storage in Texas’ ERCOT market by developer Available Power.

The platform will be used to optimise a total of 100 front-of-the-meter (FTM) sites at industrial and commercial microgrid and distributed energy resources (DER) systems over 20-year contracts. The deal could be worth more than US$500 million by the time deployments are completed.

The first 20 sites will be equipped with the Athena artificial intelligence (AI)-driven platform early next year and the software’s bidding platform will control the energy storage systems’ participation in wholesale market and energy trading opportunities. Stem Inc will also provide the developer with revenue modelling, consulting on battery hardware and support with project development.

Causes of delays ‘expected to resolve over time’

Stem Inc publicly listed on the New York Stock Exchange (NYSE) in April 2021 through a special purpose acquisition company (SPAC) merger. At the time, company leadership laid out that the path to profitability was likely to take at least a couple of years to traverse.

Since the listing it has reported consistent increases in revenues, but also losses in each quarter. The company missed its 2021 revenue guidance of US$147 million, instead bringing in US$127.4 million for the full year. It still represented a 251% increase from 2020 full-year revenues of US$36.3 million.

Net loss for 2020 had been US$156.1 million, while in 2021 these were US$101.2 million. However adjusted EBITDA had been -US$30.3 million last year versus -US$25.4 million the year before.

Nonetheless the company has reported a backlog of US$449 million contracted at the end of 2021, which compares very favourably with US$184 million by year-end 2020, it holds 1.6GWh of assets under management and ended 2021 with US$921 million in cash, equivalents and short-term investments.

As with many other companies in the clean energy industries, Stem Inc had seen a negative impact to its fourth quarter revenues from delays in interconnection, permitting and supply chain issues, but company CEO John Carrington said that “demand remains robust and we expect these issues to resolve over time”.

The company said its supply chain is secured into Q4 2022 and expects to be able to secure full year capacity by the end of this quarter. It expects the continuing semiconductor shortage will not impact its supply, while the trend for system manufacturers to diversify their battery cell supplier base

Stem Inc claims it is on course to execute on more than US$1 billion worth of bookings in the 18 months between July 2021 and the end of 2022, and that its pipeline of opportunities stands at US$4 billion of potential orders.

Recent activities by Stem Inc reported on Energy-Storage.news include a deal with developer NineDot to enable market participation of 110MWh of BESS in New York’s Value of Distributed Energy Resources (VDER) programme and Stem’s acquisition of US solar asset management software company AlsoEnergy.

The company also launched an EV charging optimisation solution in August last year and has been bullish on the opportunities ahead in that space, signing a recent deal to collaborate on charging solutions with ENGIE.

Stem’s shares listed at around US$25 per share at the end of April 2021, but had fallen to US$11.24 by close of trading on 24 February after reaching a US$37 high in July.