Stem Inc has reported a year-on-year revenue increase of 334% and its first-ever quarter with positive gross margin (GAAP).

The artificial intelligence-driven energy storage company published its Q3 2021 financial results yesterday. Revenues for the quarter reached US$39.8 million, its highest quarterly revenue figure to date and far above the US$9.2 million reported in Q3 2020.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

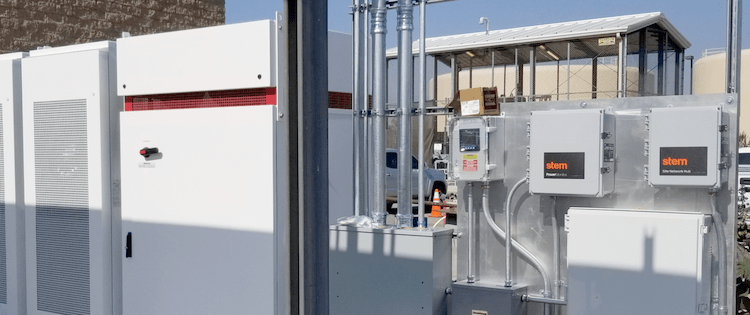

The company is active mainly in the commercial and industrial (C&I) behind-the-meter energy storage space, typically contracting with customers to deploy battery storage at their sites to help them shave their peak use of electricity and lower costs, while also enrolling their systems into grid services programmes.

It has also more recently become involved in the front-of-meter solar-plus-storage space, where it can combine its grid services offerings with applications like smoothing and integrating the output of solar PV systems for utilities and cooperatives.

Stem reaffirmed its full-year 2021 guidance for US$147 million in revenues. The company’s contracted backlog reached US$312 million at the end of the quarter, up 25% from the previous quarter. It has collected year-to-date bookings worth US$200 million, already surpassing the US$138 million bookings taken for the whole of 2020.

CEO John Carrington and other executives pointed out on a conference call to discuss results that the latter half of every year, particularly the fourth quarter, tends to be its busiest period. Q4 2021 is likely to represent between 50% and 60% of the entire year’s takings, the company said.

However, achieving and maintaining long-term profitability remains a big challenge, as pointed out by the company itself when it went public earlier this year, listing on the New York Stock Exchange (NYSE) through a special purpose acquisition company (SPAC) merger which completed in April.

Stem’s earnings showed a reduced loss for the quarter, with EBITDA standing at a loss of US$7.2 million rather than the US$8.5 million loss recorded in Q2 2021. Gross margin (GAAP) was US$3.1 million, up from the US$1.7 million loss recorded in Q3 2020 and from US$0.1 million loss in Q2 2021. EBITDA for the year is guided at a loss of US$25 million.

Ahead of the NYSE listing, Stem Inc had highlighted that it did not expect to achieve long-term profitability until 2023 at the earliest.

Why the company believes it’s on the right track

Despite the obvious difficulties of turning what was a niche technology-based proposition into a more mainstream business opportunity, Stem Inc executives said they were confident on being able to scale up and improve gross margins to meet an expected “significant” growth in demand.

CEO John Carrington noted that the company’s 12-month forward pipeline stands at US$2.4 billion as of the end of September, up 41% from the end of June (US$1.7 billion). Stem Inc also has 1.4GWh of assets under management (AUM).

Customer contracts are long-term at 10 to 20 years and the company believes its growing focus on its software platform, Athena, adding new features to meet the rise of merchant wholesale electricity market opportunities, can be a key differentiator.

Chief financial officer Bill Bush noted that hardware generates gross margins between 10% and 30% for the company, versus 80%+ on its software. Bush also said that Stem Inc does not engage in what it considers to be lower margin activities such as construction or field services and does not intend to own and finance assets on Balance Sheets on a long-term basis.

Keeping strategies intentionally asset-light keeps Stem’s capital expenditures low, Bush said.

Supply chain has become a key issue across many industries in 2021. This has been felt acutely in the solar PV industry and more recently, reports are emerging that battery storage companies are also starting to experience supply chain constraints.

Carrington said that Stem Inc has secured its supply chain “into the third quarter of 2022, we’re starting on [the] fourth quarter as well and I feel very good about where we stand with our suppliers”.

The company sources equipment from three core suppliers and is looking to add a fourth. Carrington said “diversity of supplier is very important and a big part of our success as we look at ensuring delivery for our customers”.

Its suppliers are also diversifying their own upstream supplier base, Carrington said. Relating to solar supply chain issues, the company did not foresee any “material change” to project timing for the first half of 2022 as a result. The CEO did not rule out “potential timing risks” to projects in the second half of next year but Stem would be monitoring the situation closely, he said.

Some delays the company had experienced recently had been directly correlated to COVID and staffing issues, impact interconnection and permitting processes. Stem would be engaging directly with utilities and permitting agencies to mitigate delays, he said.

In response to a question on fourth quarter 2022 supply from Credit Suisse analyst Maheep Mandloi, Carrington said Stem expected to be able to finalise Q4 2022 supplies: “maybe mid-January at the latest,” adding that the company will “probably lock it down this quarter”.

In terms of regions and markets the company has been most active and expects to see more action ahead, Q3 2021 bookings were 80% in the front-of-meter segment and many of those from customers in Texas. The pipeline ahead is about 75% front-of-meter, the CEO noted.

The California-headquartered company is anticipating “accelerated demand across our major markets,” Carrington said, with these including California, Texas, Arizona and broadly the northeast of the US, with Stem making successful inroads into the ISO New England wholesale market. It has also made some partnerships in the electric mobility sector for the first time over the past few months.

Stem recently announced its participation into what is thought to be Chile’s first-ever virtual power plant (VPP) project, and sees South America as a potentially “strong market,” while partnerships with international investors are being sought to tackle markets in Europe, especially the UK. In the coming quarters, the company will also have further activities to discuss in Asia and Australia, Carrington said.