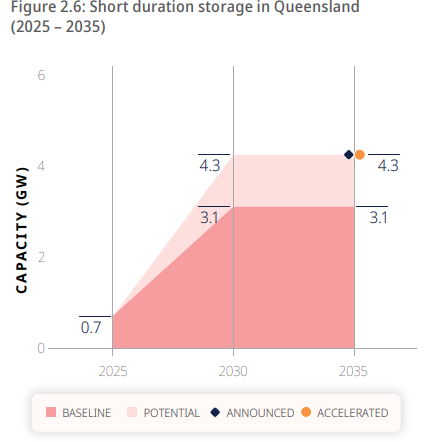

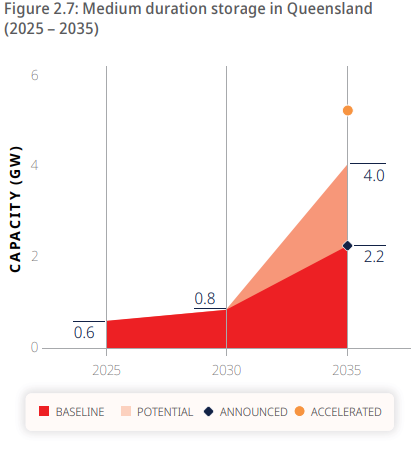

Queensland could have up to 4.3GW of short-duration energy storage operational by 2030 and an additional 4GW of medium-duration storage by 2035, according to the Australian state’s newly released Energy Roadmap 2025.

In the Australian state, short-duration energy storage is defined as up to 4-hours, whereas medium-duration energy storage can be between 4-12-hours.

Long-duration energy storage (LDES) is not defined by a single number of hours in the state but often refers to projects that are 8-hour duration or longer.

The new Energy Roadmap publication outlines how the state will balance renewable energy integration with grid stability while extending the operational life of coal-fired power plants to maintain system reliability.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The roadmap paints a transformation ahead for Queensland’s electricity grid, where energy storage technologies will become the system’s backbone. By 2030, the state expects to host at least 3.1GW of short-duration batteries, representing a 2.4GW increase from 2025 levels.

This expansion comes as Queensland recorded a minimum demand level of 2,790MW in August 2025 and a maximum demand level of 11,144MW in January 2025.

Renewables set for growth despite stricter planning regulations

Alongside energy storage, renewables, such as solar and wind, are expected to see a dramatic level of change despite both having been wrestling with stricter regulations in the state.

Currently, the state has 1GW of wind power and 3.2GW of large-scale solar generation, along with nearly 7GW of rooftop solar PV systems. By 2030, the government forecasts that this will rapidly climb, with an additional 6.8GW of wind and solar capacity expected to become operational, with another 4.4GW projected to be added by 2035.

This renewable energy surge has created a new reality for operators. When system demand reaches low levels, coal generation drops to technical minimum levels, and the Australian Energy Market Operator (AEMO) often curtails generation from grid renewables to balance the system.

The government also said that intraday wholesale price volatility has increased with excess supply and negative prices becoming common during midday hours due to growth in large-scale solar and rooftop photovoltaic installations.

Solar generation now mitigates the requirement for other generation during the middle of the day, reducing daytime prices and forcing coal plants to adjust their operating profiles.

Energy storage capacity continues to be touted as the critical solution for firming variable renewable energy and managing minimum system load challenges.

Indeed, the roadmap identifies a stark trade-off between energy storage and dispatchable supply sources such as gas-fired generation required for firming renewables.

Without sufficient energy storage, renewable energy output that would charge storage systems may spill, requiring more frequent gas dispatch to fill supply gaps. This dynamic makes every megawatt of storage capacity a strategic asset in Queensland’s energy transition.

The Roadmap outlines that government-owned corporations, such as Stanwell, which is developing the 1,200MWh Stanwell battery energy storage system (BESS), are responding with investments into the sector, committing AU$379 million (US$284 million) in new large-scale BESS at existing power station sites and AU$135 million for network-scale batteries across the distribution network during 2025-26.

The report also states considerable market interest and private sector investment in short—to medium-duration batteries, with multiple 2-hour batteries currently operating, 4-hour batteries under construction or proposed, and the potential for 8-hour battery deployments.

Pumped hydro ambitions scale back

Queensland’s pumped hydro energy storage (PHES) strategy has also undergone a dramatic recalibration, which may not come as too much of a surprise to readers of Energy-Storage.news.

Since being elected in October 2024, the government decided against progressing the previously proposed 5GW/120GWh Pioneer Burdekin Pumped Hydro Project, once touted as the world’s largest, citing higher risks around deliverability, cost and community impacts.

However, the project, which was more than twice the scale of the AU$12 billion Snowy 2.0 project, represents a retreat from mega-project ambitions toward more manageable developments.

Instead, Queensland is pursuing multiple smaller pumped hydro projects through coordinated assessment.

The Queensland Investment Corporation (QIC) Investor Gateway will lead future investigations and investment partnerships with the private sector on prospective projects for the government and government-owned corporations.

The government said four major projects remain under active consideration, each representing a different approach to long-duration storage.

Mt Rawdon, a proposed 2GW/20GWh facility located near Mt Perry, involves CleanCo working with private sector proponents Evolution Mining and ICA Partners. The 2025-26 budget allocates AU$50 million for CleanCo toward project acquisition.

Big T, a proposed 400MW/4GWh facility at Lake Cressbrook near Toowoomba, will see Stanwell investing AU$29.4 million in 2025-26 to acquire the project through a joint venture with an established global pumped hydro operator.

Capricornia, a proposed 750MW/12GW facility located 80km west of Mackay, remains under consideration by CS Energy for potential participation.

The 250MW Kidston project in Far North Queensland continues construction under Genex, while BE Power investigates the proposed 9.6GWh Big G facility for Central Queensland.

These projects represent a more distributed approach to pumped hydro development, spreading risk while maintaining substantial storage capacity additions.

Capital cost escalation reshapes investment landscape

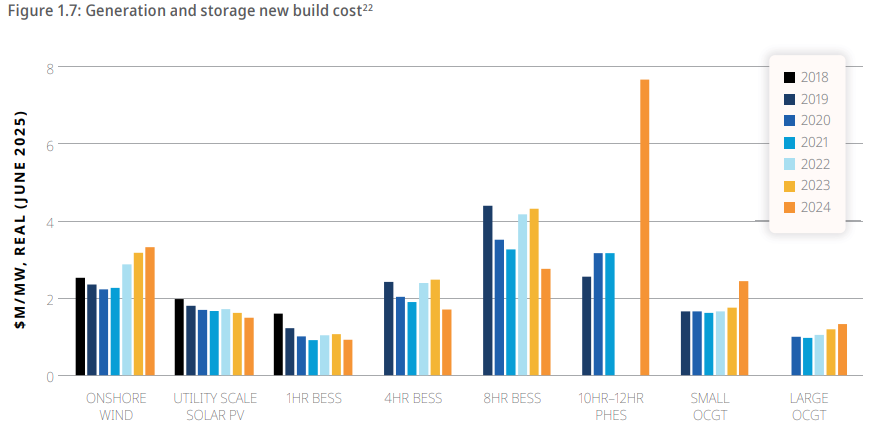

Widespread capital cost escalation across the supply chain has fundamentally altered the economics of Queensland’s energy transition.

The Energy Roadmap details that most technologies have experienced real cost increases in recent years, driven by supply chain constraints in capital equipment and labour, environmental assessment processes at the national level, social licence considerations and grid connection timeframes.

Onshore wind costs have increased by almost 50% in the last three years, with small open-cycle gas turbines increasing by a similar percentage and large gas turbines increasing by around one-third over the same period.

The CSIRO attributes these changes to supply chain constraints following COVID-19, which increased freight and raw material costs. While large-scale solar and battery storage costs have declined by more than 20% since 2020, cost increases have occurred across other major generation technologies and transmission infrastructure.

Pumped hydro energy storage build cost estimates have risen dramatically, driven by higher construction, land and other development costs. Estimates of early-stage build costs and development timeframes have proven optimistic, with geotechnical risk impacting costs and schedule.

These cost pressures have reshaped the investment outlook for Queensland’s energy system.

The cumulative capital investment over time depends on new build requirements based on technology, locational factors, and investment timing. In recent years, the industry-wide capital investment of the old Queensland Energy and Jobs Plan to 2035 is now estimated at around AU$104 billion in 2022 dollars, up from an announced AU$62 billion at the time of its publication.

Queensland government to scale support for community batteries

The Queensland government has also confirmed that it will commit AU$10 million to catalyse further investment in community batteries across the distribution network.

Energy Queensland and the private sector will collaborate to help manage minimum system load during the day when rooftop solar generation is high and grid demand is low.

These community-level batteries allow local charging of rooftop solar PV exports in strategic parts of the distribution network, creating value for local communities and households while reducing network investment requirements.

Over the next five years, installation of small-scale solar PV systems under 30MW across Queensland may reach 11GW, representing an increase of more than 4GW from 2025 levels.

This distributed generation growth has influenced how the National Electricity Market (NEM) balances real-time grid demand and supply. Rooftop solar growth now affects wholesale electricity price dynamics and the complex distribution network management, with the country’s total installed figure having surpassed 27GW.

Energy Queensland will connect community-level batteries in neighbourhoods across the state, including partnerships with Origin Energy and support from the Australian Renewable Energy Agency (ARENA).

Coal-fired power gets a new lease of life

Queensland’s approach to coal-fired generation represents perhaps the most controversial aspect of the roadmap. Operating timeframes for state-owned coal assets are reset to at least their technical lives, with options for further extension.

The state currently operates around 8GW of coal-fired generation capacity owned by government-owned corporations and private sector entities, supplying more than 60% of total output. This decision contrasts sharply with accelerated closure schedules pursued in other jurisdictions, such as New South Wales, which expects to close its last coal plant in 2038.

The energy market outlook confirms that state-owned coal assets will continue playing an important role in balancing supply and demand and stabilising the system. The government has committed to a clear framework for decisions on operating timeframes for state-owned coal assets through a decision matrix that triangulates system need, asset integrity and economic viability of state-owned coal units.

This approach contrasts with an accelerated closure pathway that would have withdrawn all state-owned coal by 2035 and all remaining coal before 2038.

Running state-owned coal assets to technical life compared to an accelerated closure schedule reduces system investment costs by around AU$26 billion to 2035, translating to an annual avoided cost of AU$1,035 per household, the government claims.

The Queensland government also said it is delivering an AU$1.6 billion investment into state-owned coal, hydro and gas assets through the Electricity Maintenance Guarantee over the next five years.

Gas-fired generation capacity will also expand to support system reliability as the generation mix changes over time. Queensland currently hosts around 3.5GW of combined and open-cycle gas turbine capacity, with the system expected to support up to 4.1GW of gas-fired generation by 2030 and between 6.1-8.3GW by 2035.

The QIC will undertake market sounding to partner with the private sector to deliver an additional 400MW of gas-fired generation capacity in Central Queensland as critical insurance for long-term system security and reliability.