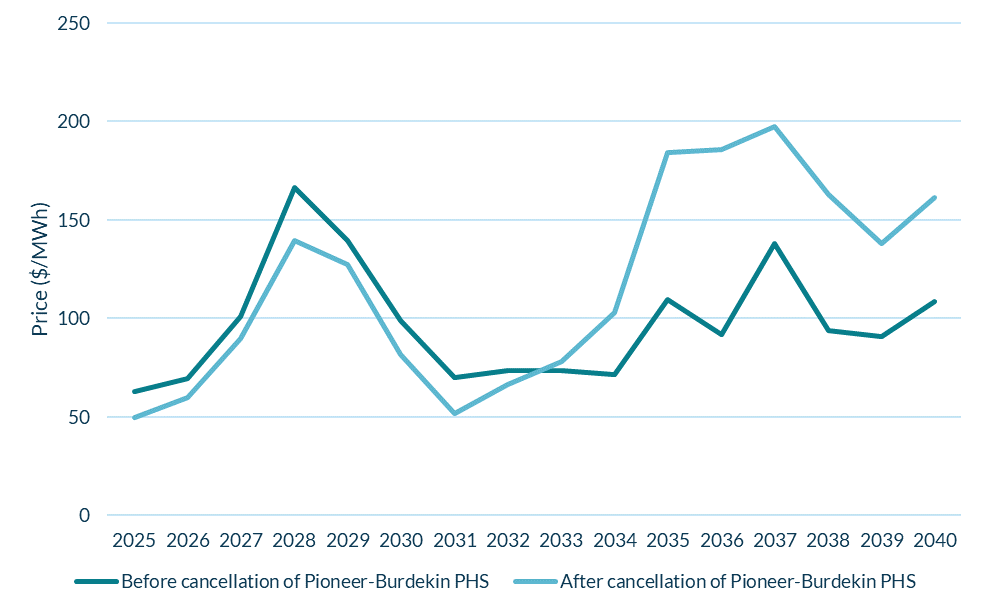

The cancellation of the 5GW/120GWh Pioneer-Burdekin Pumped Hydro Project in Queensland, Australia, has seen power price forecasts jump by over 60% for 2035.

This is according to the UK-based research firm Cornwall Insight, which detailed that the proposed PHES project’s first phase, seeking to bring 2.5GW online by 2035, has led to a huge void in energy storage capacity that must be filled by other means.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In November 2024, the new right-wing Liberal National Party (LNP) of the Queensland government, led by Premier David Crisafulli, cancelled the Pioneer-Burdekin PHES site.

Once touted as the world’s largest PHES project, the government quickly pulled the plug on the development, citing that it was “not financially viable, not environmentally appropriate, and the community was never consulted.”

Indeed, a report commissioned by the government outlined that the AU$36 billion (US$22.43 billion) project would have led to unnecessary additional costs for Queensland residents, with each household spending AU$15,653.

According to Cornwall Insight, the site’s cancellation now means prices will remain at least 40% higher annually through 2040, which will affect consumer energy bills.

Thomas Fitzsimons, senior modeller at Cornwall Insight, said the need for long-duration energy storage capacity like pumped hydro will only increase in the future.

“Without alternatives to the 120GWh of storage the project promised, we face a future of elevated power prices, which could impact households and businesses alike,” Fitzsimons said.

“The market now has a crucial role to play in addressing this storage shortfall and will need to deliver large-scale storage systems in order to bridge the gap left by this project. We would expect such a clear pricing signal to drive fresh interest in storage development in Queensland, and indeed, we are already seeing alternatives beginning to take shape.”

Fitzsimons added that the development of cost-effective energy storage solutions will be a crucial component in Queensland’s energy transition and help the state reduce its citizens’ energy bills.

A shift in energy policy by the Queensland government

Since being elected, the government has taken a hard stance on pumped hydro. Queensland’s treasurer and energy minister, David Janetzki, stated that the government was committed to delivering “an energy policy guided by engineering and economics, not ideology.”

Despite the rollback on the Pioneer-Burdekin pumped hydro project, the government has said it remains committed to supporting the rollout of smaller-scale PHES, which it deems more economically viable.

One such project is the 2GW/48GWh Borumba PHES project, a site that Premier Crisafulli said the government had a “laser-like focus” on finding an affordable development method for.

Energy-Storage.news reported in December that the project’s cost had increased to AU$18 billion and had been delayed by three years, prompting talks between the government and Queensland Hydro to save the development.

Despite this, Queensland’s PHES market has had some positive developments. For instance, earlier this month, renewable energy infrastructure developer BE Power Group submitted its 9.6GWh ‘Big-G’ pumped hydro project to the federal government seeking approval under the Environment Protection and Biodiversity Conservation Act.

Earlier this week, engineering group Gamuda and infrastructure developer Ferrovial were signed up in an early contractor involvement deal for the 12GWh Capricornia PHES site being pursued by Capricornia Energy Hub, owned by investor Copenhagen Infrastructure Partners.

Battery energy storage could fill the Pioneer-Burdekin void

According to Cornwall Insight’s research, the void left by the cancelled Pioneer-Burdekin PHES project could grant an opportunity for BESS in the state.

Although 120GWh is a rather large figure for the BESS to match, there are still major PHES projects in development, and more could be constructed or announced in the future. Plus, with the rapidly declining costs associated with BESS, along with innovation in the technology, scalability could become less of an issue in the future.

A report released by the Australian government’s Department of Industry, Science and Resources indicated that lithium-ion batteries are poised to “dominate” stationary storage for durations under 4-hours. Still, alternative technologies could surpass them for long-duration energy storage (LDES).

Sodium-ion batteries could be one of the emerging technologies that could compete with lithium-ion for durations under 8-hours. These batteries use technologies and processes similar to lithium-ion, but crucially, they do not require any critical minerals; instead, they use sodium, which is naturally abundant.

For sodium-ion batteries to be cost-competitive in short-duration (less than 4 hours) stationary storage, they will need to outcompete the current lithium-ion batteries. Longer life cycles and safer scalability could make sodium-ion batteries a strong candidate for medium-duration stationary storage.

The report reads that flow batteries are expected to become more popular for medium (4-8 hours) and long-term (8-24 hours) energy storage. Unlike lithium-ion batteries, the cost of producing flow batteries does not significantly increase at larger scales. Flow batteries have longer life cycles than lithium-ion batteries, making them a more attractive investment choice.