Australian large-scale renewables investor Lyon Group has confirmed it is selling three projects under development, totalling 800MWh of energy storage and 545MW of PV generation capacity, in Queensland, Victoria and South Australia.

The group said on Friday in a statement sent to Energy-Storage.News that the Cape York, Nowingi and Riverland projects are expected to be sold by the end of this year. Lyon already has a shortlist of bidders, but refused to reveal names at this stage.

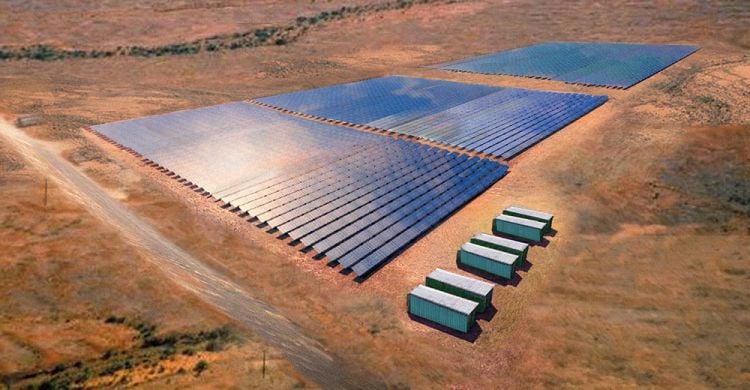

The sales will help support Lyon Group’s ongoing strategy to develop more than 2,000MW of solar PV and over 1,000MW of battery energy storage within the next three years. The company was behind the development of Australia’s first utility-scale solar-plus-storage facility, Lakeland in Queensland, which pairs 22MW of solar with 1.4MW of energy storage.

Lyon Group launched a ‘Battery storage market services tender’ for 640MWh of energy storage across the three projects in June, open to electricity retailers and generators, heavy electricity users, and other sector participants.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The Riverland project in South Australia features what is thought will be the world’s largest lithium battery installation to date when completed, pairing 240MW of solar PV with 100MW / 400MWh of energy storage, although the solar portion could be scaled up to 330MW in future. It will take the ‘world’s largest’ crown from Tesla’s just-completed 129MWh project, also in South Australia.

Nowingi is in Victoria, and combines 250MW of PV with 80MW / 320MWh of energy storage – the battery was increased in size from an original planned 160MWh.

Finally, the Cape York project in Queensland will utilise 55MW of solar co-located with 20MW / 80MWh of battery energy storage.

Australia’s ‘only imminent dispatchable new renewables projects’

Everything is in place for the projects to go ahead, including agreements with the Australian Electricity Market Operator (AEMO), although they each still require final government Notice to Proceed rubber-stamping, which Lyon expects to obtain by February 2018.

“Development approvals and offers to connect are either granted or imminent,” Lyon Group’s statement said, adding that preferred equipment suppliers and engineering, procurement and construction (EPC) partners have already been chosen.

“Major global players are keen to purchase Australia’s only imminent dispatchable new renewables projects because they will deliver commercial returns, with no government funding. These are the world’s biggest integrated solar and storage projects. The purchaser will be a major new player bringing competition to the Australian market,” Lyon Group partner David Green said.

“These projects will undercut gas generation, which has commonly set the wholesale electricity price in recent times. The shift from 30 to 5-minute settlement will enhance their value.”

In April this year, regulator the Australian Energy Market Commission (AEMC) revealed it has been deliberating for some time on whether or not to introduce five minute settlement periods for electricity spot prices in the wholesale market. Traditionally, settlement has been at 30 minute intervals, with a shorter period thought to favour flexible and fast-responding resources like battery energy storage.

David Green said the three projects would help exert downward pressure on wholesale electricity prices, introduce competition into the electricity market and stabilise the grid cost-effectively.

A report in the Australian Financial Review last week claimed Mitsubishi Corp, which has a partnership agreement in place with Lyon on battery storage, was among the prospective buyers, along with two unnamed Japanese utility and grid companies.