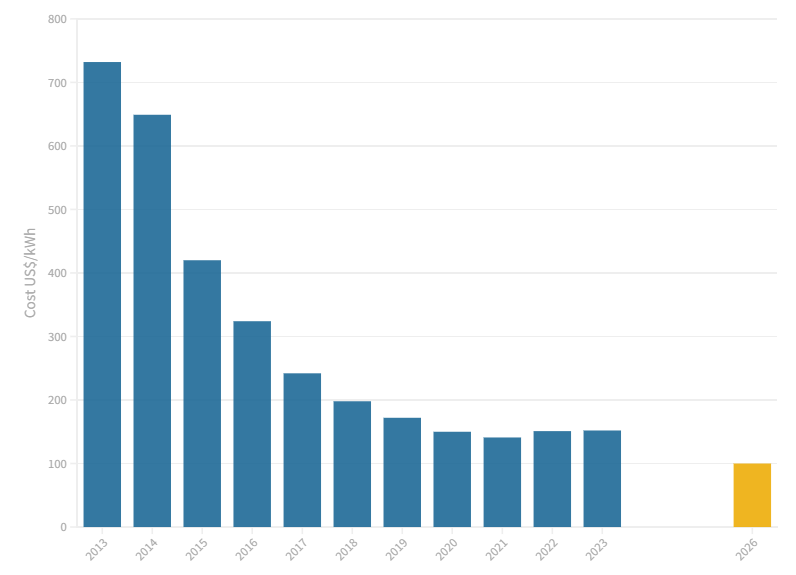

Lithium-ion battery pack prices have gone up 7% in 2022, marking the first time that prices have risen since BloombergNEF began its surveys in 2010.

The finding that average pack prices for electric vehicles (EVs) and battery energy storage systems (BESS) have increased globally in real terms to US$151/kWh confirms the consequences of what the industry has been confronted with in recent months. It follows years of consistent declines of close to 10% every 12 months.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Widely reported challenges have come from global battery supply chain constraints causing material and component cost rises, logistics issues caused by COVID-19 and soaring inflation.

It comes just two years after the research group reported finding pack prices at sub-US$100/kWh benchmarks and made a prediction that averaged costs would fall to US$101/kWh by 2023.

In fact, from 2010 to 2021, average costs fell by 89%, to US$137/kWh across the EV and stationary battery storage markets worldwide. Last year, the drop was just 6%, to US$131/kWh.

BloombergNEF (BNEF) pushed back its prediction made in 2020, forecasting instead that pack prices would fall below the US$100/kWh threshold in 2024.

The firm again revised that prediction, and said it now expected cost declines to start to be observed again from 2024, reaching that sub-hundred-dollar mark by 2026.

BNEF noted today that, in EVs at least, cells now comprise a much higher portion of total cost than before. Traditionally, a 70:30 split has been observed between cell and pack costs but the dynamic has been shifting gradually and in 2021 was about 74:26. Cells now represent close to 83% of the average EV battery pack cost, with cell costs particularly sensitive to material and component cost volatility.

“Raw material and component price increases have been the biggest contributors to the higher cell prices observed in 2022,” Evelina Stoikou, the lead author of the report and an energy storage associate at BNEF, said.

As with last year’s edition, the cheapest packs were found in China, at just US$127/kWh, unsurprising given BloombergNEF’s consistent ranking of China first among all countries involved in the lithium battery supply chain. Meanwhile packs in the US cost about 24% more and in Europe about 33% more on average.

Prices to remain ‘slightly elevated’ in 2023

Over the past few years, lithium iron phosphate (LFP) has emerged as a popular alternative to nickel manganese cobalt (NMC), for shorter range EVs and for BESS applications. Reasons include a higher tolerance of physical abuse and rises in temperature, but also key to its selection is its historically lower cost than NMC, as well as its decoupling from supply chains that can be problematic such as for cobalt.

However, as noted in recent months, LFP has a higher portion of lithium carbonate as a raw material input than NMC, and costs of lithium carbonate have risen significantly, impacting the cost of LFP cells disproportionately highly.

That said, wider adoption of the lower cost cathode chemistry helped arrest slightly the increase in weighted average prices, according to BNEF. At the same time, LFP, which continued to cost less than NMC, on average about 20% less, still saw its cell costs go up 27% from 2021 figures.

For next year, average pack prices will remain “slightly elevated” at US$152/kWh. The good news is that the rising demand for lithium batteries has signalled to investors that it’s worth taking a bet on supporting raw materials extraction and processing facilities, as well as factories to produce finished products. The only problem is that it will take some time for those new upstream resources to come online.

“Amidst these price increases for battery metals, large battery manufacturers and automakers have turned to more aggressive strategies to hedge against volatility, including direct investments in mining and refining projects,” Evelina Stoikou said.

Additional lithium supply coming online in 2024 could ease supply chain constraints, BloombergNEF head of metals and mining Kwasi Ampofo said, but the biggest short-term source of uncertainty for battery metals prices is “geo-politics and trade tension”.

Other factors that could bring prices down are improvements in manufacturing processes and production capacity expansions, as well as the adoption of next generation technologies which could include batteries with silicon anodes or solid-state electrolytes.

At the RE+ 2022 trade event in California in September, BNEF analyst Helen Kou offered a short preview of the reports’ findings and noted that while high prices could dampen US enthusiasm for battery storage in the short-term, the long-term demand for BESS was clear to see.

The company’s latest forecasting of the global BESS market, published a couple of months ago, highlighted that rising demand is being seen outside the US too. BNEF revised its 2030 global deployment forecast upwards from 358GW/1,028GWh to 411GW/1,194GWh.

BNEF’s head of energy storage, Yayoi Sekine reinforced that message in a statement on the latest report, noting that “battery demand is still reaching new records each year,” despite the cost increase “setback”.

“Demand will reach 603GWh in 2022, which is almost double that in 2021. Scaling up supply at that rate of growth is a real challenge for the industry, but investment in the sector is also rising rapidly and technology innovation is not slowing down,” Sekine said.

Energy-Storage.news’ publisher Solar Media will host the 8th annual Energy Storage Summit EU in London, 22-23 February 2023. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.