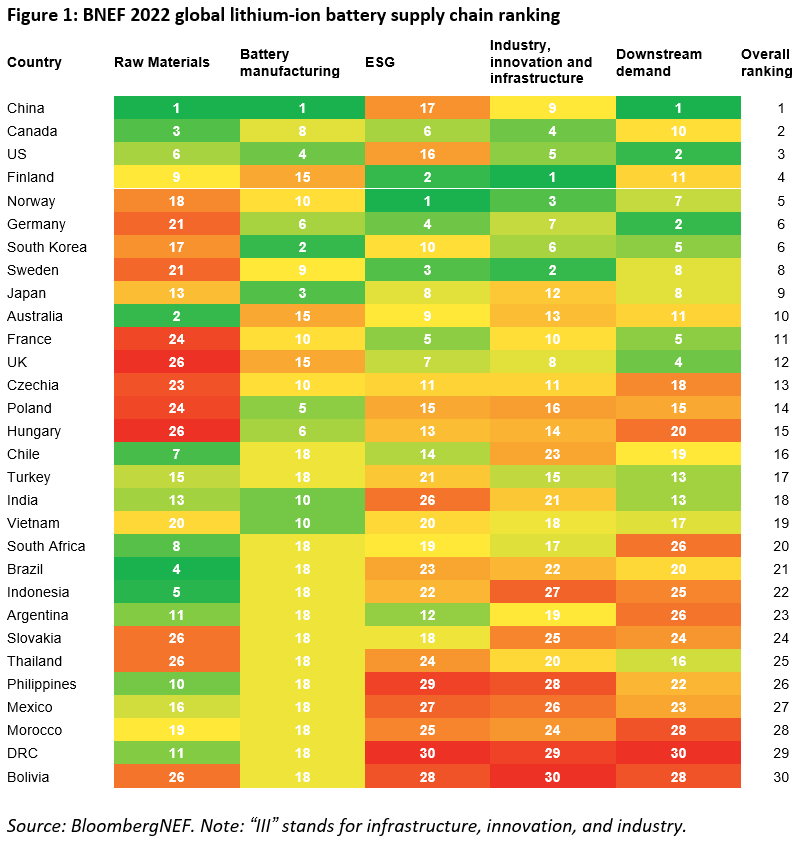

China continues to lead rankings for involvement in the global battery supply chain, but the chasing pack of other countries is in flux, according to BloombergNEF.

The research firm’s annual rankings of countries by involvement in the global battery supply chain found that unsurprisingly, for the third year in a row since it began, China dominates in manufacturing capacity as well as raw materials extraction, refining and processing.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Of the world’s battery cell manufacturing capacity, 75% is in China, and 90% of anode and electrolyte production. Meanwhile the Chinese market has rapidly responded to elevated lithium prices and invested in lithium carbonate and lithium hydroxide refining facilities.

When BloombergNEF (BNEF) first ran the rankings table in 2020, China was top, followed by Japan and then South Korea second and third respectively. Last year, China remained top, but the US had moved from sixth into second place and Germany came in third.

This time out, the US placed third, and Canada, due to heavy investment to capitalise on its abundant resources of raw materials, in second place. However, BNEF noted that Canada’s capacity for manufacturing battery cells and other components remains limited, although some recent factory announcements have been made.

The rankings include an assessment of 2022 supply chain involvement, but also project out five years, to forecasted rankings for 2027. Due to its continued investments into raw materials and support for electric vehicles (EVs), China will retain its leading position by that time, BNEF said.

Overall, 30 leading countries with supply chain involvement were assessed across five criteria: raw materials, battery manufacturing, ESG, industry, innovation and infrastructure, and downstream demand.

From last year to this year, the biggest changes in the rankings were driven by countries that gained greater access to raw materials and manufacturing capacities, BNEF metals and mining analyst Allan Ray Restauro, the report’s lead author, said.

“Countries that are not necessarily the largest producers or manufacturers but have significant presence across several areas in battery metals and minerals extraction, as well as manufacturing, fared better than countries that excel mostly in a single commodity or component. Success in the battery supply chain is increasingly determined by more than one category or metric,” Restauro said.

“A solid foundation on domestically realised resource wealth, bolstered by responsible and ethical production, is the main theme of the rankings this year as countries and the industry strive for a sustainable supply chain.”

In other words, as has been highlighted with previous editions, being rich in natural resources like lithium doesn’t necessarily equate to a high ranking. In fact, many resource-rich countries like Chile, South Africa, and the Democratic Republic of Congo rank lowly due to their lack of battery manufacturing capabilities and low end-user demand for electric vehicles.

Conversely, South Korea and Japan remain among the top ranked countries in terms of battery cell manufacturing, whether from domestically sited factories or those invested in abroad, but lower scores in other areas, most notably raw materials supply chain involvement, dropped them down to sixth and ninth in the overall table respectively.

Meanwhile European countries experienced a drop in their overall rank this year, again largely due to a lack of raw materials involvement, even though manufacturing capacity is set to grow rapidly in key territories including Germany and Sweden.

Finland, for its investment in raw materials supply chains, high quality infrastructure and large percentage of renewable energy available to power production processes, was one of the only European countries to climb the table to fourth place, after a sixth placed finish last year.

“Many European countries are successfully capitalising on their supply chain potential but the trend of decline in the region this year indicates that growth in Europe is starting to be outpaced by North American and Asian countries,” Ellie Gomes-Callus, another metals and mining analyst at BNEF, said.

Gomes-Callus added that certain European countries like Czechia, Poland and Hungary, able to provide “cleaner and more sustainable supply chains” than other countries, are becoming “preferred destinations for investments in batteries manufacturing”.

While Europe has dozens of battery gigafactories planned, according to various reports some may struggle in the near-term with the high and volatile cost of electricity and other factors including inflation and fluctuating currency rates.

Finally, as has been highlighted by BNEF previously the US’ supportive policy landscape, particularly the Inflation Reduction Act (IRA), is likely to drive that country to greater levels of deployment of batteries for transport as well as for the grid.

“The Inflation Reduction Act is a major upside for battery demand in the US but, more importantly, it will change the supply landscape in the coming years. The law is the closest thing to industrial policy for batteries that the US has ever had and makes this the most exciting decade yet for the American battery industry,” BloombergNEF head of energy storage Yayoi Sekine said.

“Companies are looking to maximise battery cell, module and material production incentives and comply with electric-vehicle credit requirements, which will bring more capacity to the country and its allies.”