Supply chain shocks are causing short-term rises in the price of lithium-ion battery packs, but overall the price trend is downward and by 2024 average prices could dip below US$100/kWh.

That’s according to the latest edition of BloombergNEF’s annual survey of battery pricing across multiple sectors including battery-powered electric vehicles (BEVs) and stationary battery energy storage systems (BESS).

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

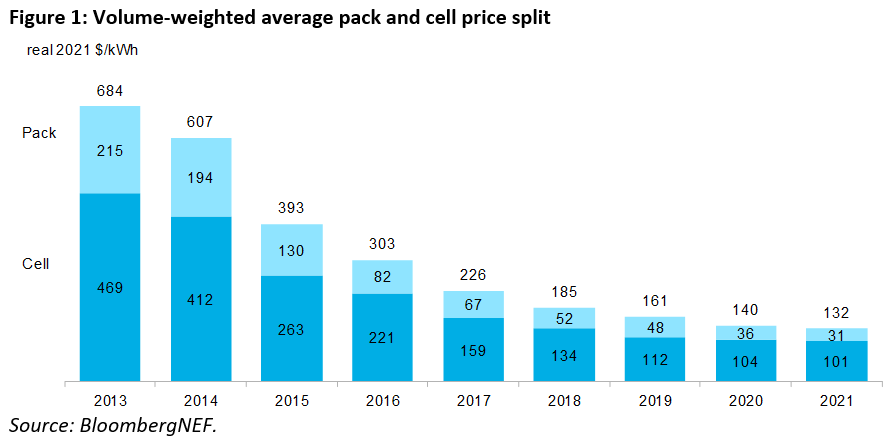

After last year’s survey found some battery packs were offered at under US$100/kWh, the average in both BEV and BESS markets worldwide was US$137/kWh during 2020, a fall of 89% from 2010.

For 2021, BloombergNEF said the average has fallen to US$132/kWh, a 6% drop from last year’s figures — which the firm’s analysts have since revised to about US$140/kWh — with packs cheapest in China. Packs in the US were about 40% more expensive and 60% more expensive in Europe.

Looking at BEVs specifically, volume-weighted average pack prices were found to be US$118/kWh, and battery cells were US$97/kWh, which indicated that cells account for a higher proportion of overall cost (82%) than around the 70% mark seen in the past couple of years.

Although cost reductions indicate a healthy future for electrified mobility and stationary battery applications, the second half of this year has been characterised in many industries as one of rising commodity prices.

Batteries have by no means been immune to this: the cost of electrolytes and other key materials is going up. Raw material price rises mean that in 2022, the average pack price could go back up, to US$135/kWh according to BloombergNEF’s forecasting. The business case for BEVs and BESS alike could be impacted by this.

BloombergNEF head of energy storage research James Frith said that the second half of the year’s price rise wasn’t enough to stop an overall price decrease being recorded for the year.

However, Frith, who was lead author of the new report, noted that the average price of a nickel manganese cobalt (NMC) cell with 8:1:1 proportion chemistry is estimated to be US$10/kWh higher in Q4 2021 than in the first quarter of the year, nearing prices of about US$110/kWh.

BloombergNEF head of metals and mining Kwasi Ampofo said that prices for lithium in 2021 “have risen substantially,” as a result of factors that include constraints within global supply chains, rising demand in China and Europe and China’s recent production curbs due to energy and environment issues.

“Although we expect demand to keep growing in 2022, other factors such as global supply-chain constraints and China’s production curbs should have been resolved by 1Q 2022. This will help to ease lithium prices ,” Ampofo said.

It is to be hoped the supply chain challenges will be proven to be short-term. A month ago, BloombergNEF’s analysts also produced another report predicting a global boom in BESS installations, calling the 2020s “the energy storage decade”.

BloombergNEF forecast global cumulative deployments to reach 358GW / 1,028GWh by 2030, with more than US$260 billion to be invested to get there, from 17GW / 34GWh online as of the end of 2020.

Even low-cost LFP not immune to commodity pricing waves

One interesting trend in lithium-ion batteries discussed over the past couple of years has been the growth of demand for lithium iron phosphate (LFP) cathode chemistry cells.

Lower energy density than NMC, but also lower cost, LFP cells were for a while shunned by automakers due to their perceived lack of suitability for BEVs. They were however started to be more widely adopted for BESS, in part due to their higher tolerance for higher temperatures than NMC, which some argue makes them safer and less likely to go into thermal runaway.

However, as experts from McKinsey pointed out in an Energy-Storage.news webinar earlier this year, LFP cells are starting to be considered by BEV manufacturers for shorter-range and entry-level market vehicles.

BloombergNEF noted that while LFP cells were nearly 30% cheaper than NMC cells in 2021, LFP is very exposed to lithium carbonate prices, which have been rising. Since September, producers in China have raised the prices of their LFP cells by 10% to 20%.

The analysis firm said that while historical trends imply that an average pack price across the board of lithium-ion battery types are likely to fall below US$100/kWh by 2024, if higher raw material prices persist, this could be put back by two years.

Incidentally, US$100/kWh is about the threshold at which BEVs become cost-competitive — and produce similar margins — as internal combustion engine (ICE) vehicles. It is a question of when, not if, pack prices will fall below that threshold, but this year’s market dynamics have introduced a level of uncertainty, BloombergNEF said.

Battery cost reductions and tech improvements can continue to be achieved through investment in R&D, as well as scale driven by capacity expansion, BloombergNEF said. There will also be next-generation technologies coming to market which could change the game, from silicon and lithium metal anodes to solid-state electrodes as well as new manufacturing processes for cathode materials and cells.

In October, the research group produced the second annual edition of its global lithium-ion battery supply chain rankings, which found that although China continued to lead the world in terms of its involvement in the industry, others, including the US and Europe, are at the start of making inroads into a market which could be of strategic as well as economic importance.