LG Energy Solution has seen a drop in its profitability during the second quarter of this year, which according to the company’s CFO was largely caused by industry headwinds.

Nonetheless, while profits fell 24.4% from the previous quarter, sales remained strong, and revenues rose 16.8%. Year-on-year however that equates to a drop in profitability from Q2 2021 of 73% and drop in revenues of 1.2%, although the company did note that Q2 2021 saw it receive a couple of one-off payments that accounted for higher than usual profitability.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Revenues were KRW5.071 trillion (US$3.86 billion) for Q2 2022, while operating profits were KRW195.6 billion (US$149 million) in the reported period.

Despite some challenges, LG Energy Solution (LG ES) has revised its annual revenue forecast for the year upwards and has offered some updates to its near and long-term strategies.

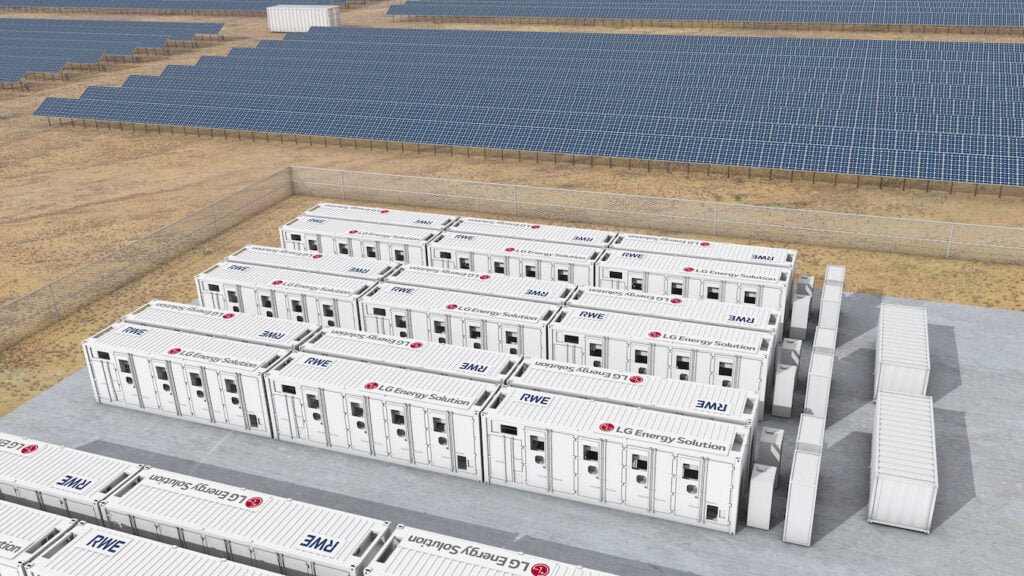

The company, which is active in automotive, IT and energy storage system (ESS) battery market segments, has not issued a breakout of figures by industry segment, although Energy-Storage.news has asked LG ES for ESS figures.

“This quarter’s profitability has shown moderate drop, mainly due the impacts from lockdown measures in China, global supply chain disruptions, and the time gap between the actual increase in material costs and applying them to selling prices,” CFO Chang Sil Lee said in a conference call to discuss financial results.

“Nevertheless, steady growth in revenue was possible thanks to the strong sales of cylindrical cells for EV, as well as successfully passing through major metal price hikes to the battery prices.”

The previously set KRW19.2 trillion revenue target for the 2022 full year has now been upped to KRW22 trillion, versus 2021 annual consolidated revenues of KRW17.9 trillion.

While it earned KRW9.4 trillion during the first half of this year, LG Energy Solution expects revenues in the second half to reach KRW12.6 trillion.

H2 2022 revenue growth is largely expected to come from an increase in OEM contracts, the ramp-up of a battery production plant in Ohio, US, by LG Energy Solution’s joint venture (JV) with General Motors, Ultium Cells, as well as the cost pass-through mentioned by CFO Chang Sil Lee.

The downstream battery arm of LG Group, LG ES went public through an IPO in January this year, listing shares worth more than US$10 billion on the Korea Composite Stock Price Index (KOSPI).

In its first results announcement since that listing, the company said in April that a 2.2% downturn in revenues for Q1 2022 had been caused largely by ongoing supply chain challenges as well as the war caused by Russia’s Ukraine invasion.

North American production shift

The company is going to focus more on the North American market, which is growing at a faster rate than the European or Asian regions where it also has a manufacturing presence.

It is targeting for North America to host the biggest share of its production by 2025 in fact. By that time LG Energy Solution wants to have 45% of its footprint there, with 35% in Asia and 25% in Europe.

This would be a big turnaround from today, where 59% is in Asia, 34% in Europe and just 7% in North America, according to the company.

It intends to continue developing and making both pouch and cylindrical form factor cells.

In its premium segment, pouch cells will largely be single crystal NCMA cathode and silicon anode-based, while in mainstream production, LG ES will focus on lithium iron phosphate (LFP) and manganese-rich battery chemistries.

As well as attempting mass production of 4680 cylindrical cells, the company will also look to develop next-gen batteries with technologies like polymer or sulfide-based solid state.

It is also targeting new business lines such as battery-as-a-service and energy-as-a-service, while it aims to have smarter automation and production defect detection in its factories and better fault detection and analytics capabilities for its battery management systems (BMS).

Earlier this year LG ES acquired NEC Energy Solutions, the energy storage system division of Japan’s NEC Corporation, through which LG ES said it sought more involvement in the downstream end of the ESS market, although since the acquisition there have been no public announcements of projects or the strategic direction the business will take.

The company will continue to establish long-term materials supply partnerships to stabilise its supply chain, while developing capabilities in recycling and reuse of batteries.

In all, it targets a tripling of revenues and achieving a double-digit profit margin over five years.