LG Energy Solution will use proceeds from its initial public offering (IPO) this month to feed into growing the company’s manufacturing capacity significantly in Europe, the Americas and Asia.

The energy storage and battery division of LG Chem held a press conference on Monday online to discuss the IPO, through which it will list shares worth more than US$10 billion on the Korea Composite Stock Price Index (KOSPI).

In addition to opening new facilities and expanding existing production bases, the company is also making its lines lower cost and more efficient, with higher levels of automation. Big data and artificial intelligence (AI) technologies will be key to this, LG Energy Solution said.

It emphasised the significance of a recently announced collaboration with German engineering company Siemens to create “manufacturing intelligence” for smart factories.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Company CEO and vice chairman Kwon Young-Soo said the IPO was the culmination of 30 years of business activities for LG Energy Solution, which serves sectors including electric vehicles (EVs) and stationary energy storage systems and was rebranded and spun out of LG Chem a couple of years ago.

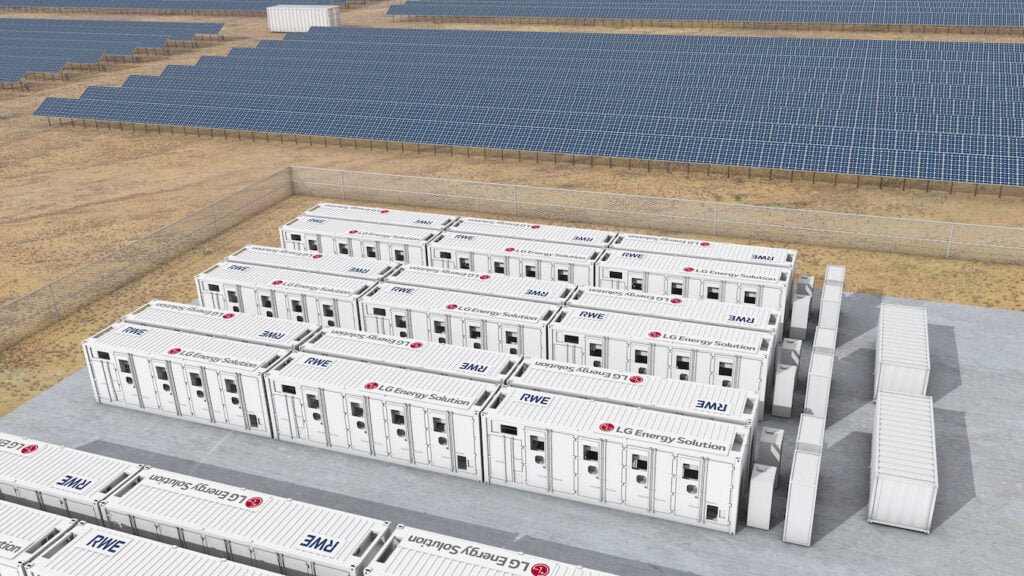

It has participated in some of the world’s biggest battery storage projects, including the Moss Landing 400MW / 1,600MWh battery energy storage system (BESS) in California. That project went online during 2021. Also announced last year by LG Energy Solution was a deal to supply 200MW / 800MWh of BESS equipment to RWE Renewables, subsidiary of European utility group RWE, for two solar-plus-storage projects in the US.

In September LG Energy Solution acquired what was left of NEC Energy Solutions (NEC ES), the NEC Corporation subsidiary focused on energy storage. NEC ES had delivered around 1GW of battery storage worldwide before its parent company decided to exit the sector in 2020.

LG Energy Solution also has its own line of residential and small commercial battery storage units. US leading residential solar installer Sunrun offers the company’s RESU home storage units as part of its solar-plus-storage package, Brightbox.

The public offering of 42.5 million shares could raise up to ₩12.75 trillion (US$10.67 billion) at a price of between ₩257,000 to ₩300,000 per share.

The expansion of production bases in Korea, North America, Europe and China would be invested in, while some of the funding will also go towards next-generation battery R&D and new businesses. The company will also invest in battery and system quality, safety and the securing of “differentiated profitability,” it said.

It will add around 110GWh or more of production capacity in China, 100GWh or more in Europe, 160GWh in North America, including through Ultium, a joint venture with GM and at least 22GWh production expansion at its Ochang site, Korea.

In terms of next-generation batteries, LG Energy Solution said it is focused on two types: all solid-state batteries — including polymer-based and sulfide-based batteries — and lithium-sulfur.

In safety and quality, the company is seeking to implement robust design features to minimise the possibility of structural cell fires, while some of its smart factory technologies will be capable of monitoring and assessing quality control on production lines.

Safety remains a key topic for the battery industry: LG Energy Solution itself has made voluntary product recalls of some of its residential units produced between 2017 and 2019 in the US and Australia markets due to potential fire risks, while part of the Moss Landing project was taken offline in September last year after overheating affected some of the battery modules.

It will continue to seek ways to reduce material costs, while emphasising the growing importance of ESG in manufacturing as well as securing supply chains. Energy-Storage.news has reported on recent deals for the company with lithium-ion battery recycling specialist Li-Cycle as well as with ‘sustainable lithium’ supplier Sigma Lithium.

Final IPO offering price is expected to be confirmed on 14 January, ahead of subscription for shares opening for general investors on 18 and 19 January.