After our trio of exclusive interviews with battery storage system integrators Fluence, Wärtsilä and Powin at RE+ 2022, we speak with Matt Harper and Matt Walz of flow battery company Invinity Energy Systems.

We’re nearing the end of our series of energy storage industry leader conversations from RE+, which took place in California last month and is the US’ largest solar PV and energy storage trade event.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The annual event returned for the first time in three years since the pandemic began and combines Solar Power International and Energy Storage International. Over 27,000 people attended this year.

As you may have seen from our reporting at the show, along with the Inflation Reduction Act (IRA) and lithium supply chain issues, major talking points included long-duration energy storage. On a closely related note, there was also a lot of discussion of how non-lithium technologies could be an alternative route for avoiding those supply chain issues.

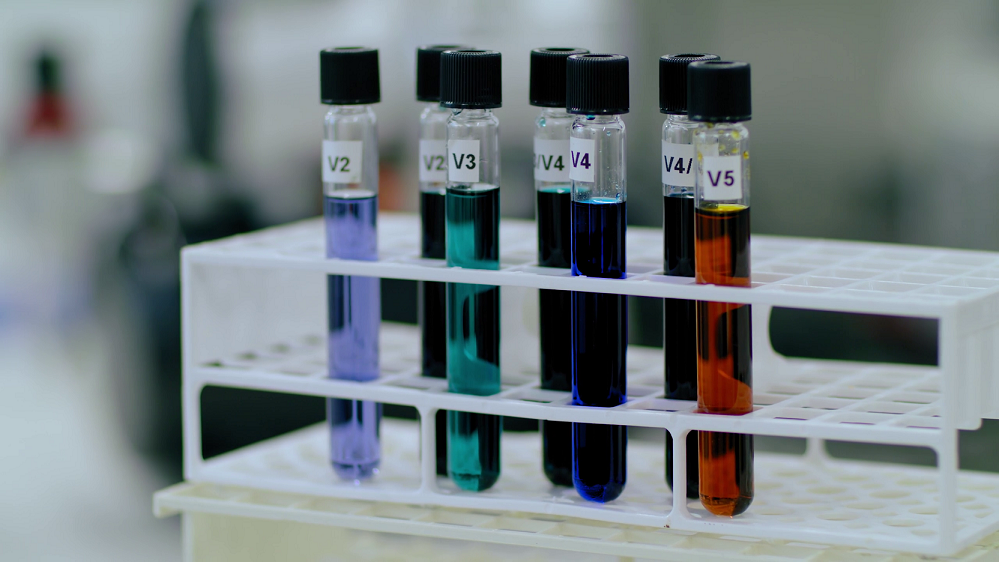

Well, Invinity’s vanadium redox flow battery (VRFB) ticks both of those boxes. So in addition to asking chief commercial officer Matt Harper and VP of business development Matt Walz about the Anglo-American company’s recent UL9540 certification and its microgrid projects for adding resiliency to California communities, we took the opportunity to ask if flow batteries are reaching their inflection point for widespread adoption.

Developers and system integrators appear to be enthusiastic that non-lithium energy storage technologies have a lot of potential. The ones we’ve spoken to aren’t at the stage where they can name a technology or provider they’re going to back, but I get the impression some announcements might come before too long. What sort of traction do you see now and what are some of the bigger picture dynamics in the market?

Matt Harper: Here in California, we’re seeing a tremendous amount of interest in longer duration storage. But the sort of the core of what is currently being built is still what I would call short to medium duration.

We don’t see a lot of kind of market-based mechanisms that are really compensating that longer duration storage as it stands. Now, that’s going to change, the more renewables on the grid, the larger that spread between what energy is worth, on a sunny day at noon, near zero, and what it’s worth eight hours later, when everyone’s getting home and turning the air conditioning on is getting larger.

From that perspective, I think we are going to see more of those kinds of storage rollout, and I hope that we’re going to see some evolution in how energy markets work so that it’s more beneficial to building those sort of longer duration devices that can provide multiple hours.

We’ve heard also that the US Inflation Reduction Act (IRA) and the tax credit incentives that it will unlock has the potential to boost flow battery economics as well as lithium-ion. How does Invinity view that?

Matt Walz: This will be of huge value for us and project owners with our product, because that investment tax credit (ITC) pot with domestic content, it’s part of our roadmap to achieve that. We just announced a partnership with US Vanadium that’s going to help us with that supply chain including electrolyte, which long-term is the highest cost component of our flow battery.

If you move that to US domestic content, plus some other manufacturing on site in the US, we can get to that domestic content threshold for project owners. We’re talking to larger developers, as they think through their 2024, 2025, 2026 pipelines in the large utility-scale.

That is of keen interest to them in terms of an offering that could get them that extra 10% ITC and then back up into the supply chain and the production tax credits (PTC).

I think there’s more work [to be done], you’ve got to get through the rulemaking and understand the details, but vanadium is on the Critical Minerals list, electrolyte qualifies as a separate production tax credit and then there’s a battery module production tax credit as well.

MH: Yesterday, we were talking about the relative value of the IRA, for lithium batteries going into automotive and lithium batteries going into grid storage…

MW: What will be curious on that lithium side is that the lithium battery content domestic manufacturers will compete on standalone storage and EVs. We’re just going to be on the standalone storage side.

The EV tax credit is at US$7,000 a car. Half of it is for Critical Minerals being domestic content. Half of it is for the battery module manufacturing in the United States. Their domestic content thresholds are much higher. It goes to like 80% domestic content.

So, for the lithium and other Critical Minerals in an EV battery, the threshold is higher. A US$7,000 tax credit on that vehicle is going to be a pretty strong incentive in the marketplace. I don’t know where that competition on EVs and standalone battery storage plays out.

If we can deliver enough domestic content into a project to go to 80% US content, that then trips not just us, but the whole project into domestic content. That could be worth substantially more to project developers.

And some of the interest in flow batteries – and other non-lithium tech – is directly coming from the constrained supply chains for lithium, the delays that’s caused, as well as the price volatility. Are you hearing from customers that they see flow batteries as a way to decouple from that risk?

MH: We’re seeing a tremendous amount of near-term interest and traction in our commercial pipeline, based on people who are trying to get storage projects built next year. They’re being told that delivery of lithium-ion is mid-2024. Those 18-to-24-month delivery cycles are starting to become a real thing and that’s pushing a lot of business in our direction.

MW: It’s a lot further out than our immediate pipeline, but [I see] a lot more requests for information (RFIs) coming from large utility-scale developers in the US, about 2025-2027 timeframes where they’ve traditionally used lithium-ion in large 100MW systems and now they want to see what the alternatives are in that timeframe.

When you go through the domestic content checkboxes there, they like the fact that we have systems that are online today that are proof of concept that will build towards that step and then we have a development commercialisation agreement with Siemens Gamesa to prove out a manufacturing capability that’s credible.

If I’m a US developer thinking about a project in 2026, I want domestic content, because it’s going to be worth so much. I’d want a partner that’s going to deliver because the worst thing you have is sign a contract, and it doesn’t hit your timelines and then you want the performance, the demonstration that it’s not just proof of concept at that scale.

In terms of that manufacturing base, how will you serve the US market?

MH: That agreement that we recently announced with US Vanadium a part of it is for the raw vanadium. Part of it is for the vanadium electrolyte which goes into the flow battery, and then there’s a third part of it, which is to look at sort of co-developing a more comprehensive manufacturing capability right here in the US.

Obviously the third of those three is a little further down the road, but it’s the one that, once we get it done, it’s going to put us well over that domestic threshold content, not just the 40% that we have to achieve now but the 55% that’s coming along three years later. That’ll be a big part of it.

If we domestically produce the electrolyte, that’s 35% of the product cost in and of itself and then you do sort of the final integration, assembly tests to get it ready to go to site. Ultimately, you want to do that as close to the point of final use as possible. So, if we do that in the US as well, we’re already well into that 40-plus-percent threshold.

Of course, as well as being a potential alternative to lithium, a lot of industry interest in flow batteries come from it being a complement to lithium-ion. One practical example of this is the recently inaugurated Oxford Energy Superhub in the UK, where there’s a hybrid system combining 2MW/5MWh of flow battery with a 50MW/50MWh lithium-ion battery energy storage system (BESS). What can you tell us about that project, or the concept of hybridisation in general?

MH: I’ve been taken completely by surprise, by how interested people are in the hybrid project, because the genesis of it was [developer] Pivot Power had a 50MW interconnection, there was no way we were going to provide them a 50MW flow battery, it just wasn’t practical, there was going to have to be a split.

Therefore, the hybridised approach arose as a matter of necessity, not necessarily as a matter of sort of operational optimisation.

But what we found is that it is a really good combination because of how the markets for FFR and Dynamic Containment (ancillary services) in the UK work, where you’re constantly sort of nudging power in and out of the system. That’s an application that our battery does really well.

Then as soon as you get beyond a certain threshold, the lithium batteries can step in and provide a huge amount of power, to get the maximum amount of power out of the plant. Only as a unit.

Those two strengths playing together, has worked out better than any of us thought it would when we started the project, three and a half years ago. We’ve been really encouraged by that, and really encouraged by the number of people who are now coming to us, and they’re saying: “We really think this hybrid push makes sense, give us a proposal, how do we make it happen?”

What’s interesting about the hybrid approach is that it is a microcosm of what we all think is going to start happening in the grid in general. People are going to recognise that there’s not just one form of batteries, there are different batteries that are good for different purposes.

You can have lithium cells that are putting a huge amount of power at very high efficiency for a very short period of time and doing it incredibly frequently.

You can have companies like Form Energy, who are those multi-day or ultra-long duration or whatever you want to call them, providing weeks of power at comparatively low efficiency and doing it a few times a year.

You can have us in the middle of doing sort of something that’s a bit of a balance of those two, where we’re taking solar power and delivering it back as baseload overnight, in the mid-range of efficiencies.

I mean, that split of different capabilities is what we’ve been arguing for a long time is going to start to happen. In those hybrid installations, we’re seeing the very first instances of how those different technologies can weave their capabilities together, I think we’re going to start to see more and more at the grid level over the next couple of years as we start to build up more and more of these projects.

MW: The perfect analogy for me is power generation capabilities of different power generation units.

If you take PJM and ERCOT, you have a mix of coal, nuclear, gas, renewables, but even within each of those, like peakers versus combined cycle gas, you have different flexibility and thermal units across a spectrum as a portfolio.

If you look at batteries today, it’s sort of one single technology, one sort of common profile. You’re going to have diversification of capabilities, that together will create more value than a single capability will ever do and that’s how it’s going to evolve.