At RE+ 2022 last month, Energy-Storage.news met with leading figures from the energy storage industry for a series of exclusive interviews. This time out, we speak with Andy Tang, VP of optimisation and energy storage at Wärtsilä Energy.

The show is the US’ biggest trade event for solar PV and energy storage, combining the Solar Power International and Energy Storage International exhibitions and conferences. Returning for the first time in three years since the COVID pandemic, more than 27,000 people attended.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The mood at the California show was undoubtedly positive, with the industry’s already strong forward momentum buoyed by discussion of the Inflation Reduction Act (IRA) and other signposts for rapid and continuing growth ahead.

But there are also challenges to that success that cannot be ignored. The show presented an opportunity to talk frankly about both the positives and negatives, which, if you’ll excuse the pun, seems apt for a site like ours that focuses largely on batteries.

Looking at the big picture, the industry, both in the US and internationally, continues to grow, but if we look deeper, from Wärtsilä Energy’s perspective, what are some of the things you’ve seen in recent times and how do you view the industry’s status today?

In 2021, we booked something along the lines of 3.5+GWh of storage and so now we have a fleet of 4.5+GWh of storage. We did more in one year than in our entire 10-year cumulative history combined in 2021.

And then 2022 started off brightly, but then this supply chain shock to the system really, really hit us and obviously it hit everyone across the board in the industry. We could not supply our systems at the contracted price that we were at, because we all of a sudden found ourselves in a position where we had no battery supply.

Lithium carbonate prices went up 500% in 12 months, so battery companies were really in a place where the marginal return on each incremental battery was losing money.

In addition to that, you still had what was going on in the background with supply chain and with transportation, and the bottlenecks and challenges we had there.

As an industry, I think we did a really good job with it on the whole, and really addressed the problems head-on.

I mean, there were some projects that we were far enough along in the in the PO process that we could honour. There were some projects that we had not signed yet and we had to renegotiate, and it actually caused a cascading renegotiation; with our customers and then our customers would have to renegotiate with off-takers.

It took us probably as an industry, a good six-plus months to sort through that and I’m pretty happy to say that we’re somewhat through it, albeit at a higher price level.

There are some projects that had been delayed because the higher price level created a situation where the economics weren’t as compelling.

As you describe it, it came as a shock to an industry used to seeing year-in-year cost declines in batteries for at least the past decade.

What was interesting too is that historically we have seen some price shocks in the industry, but it was mostly with nickel manganese cobalt (NMC) batteries. [The] reason being that nickel is volatile, and cobalt is extremely volatile in terms of pricing.

Lithium iron phosphate (LFP) was kind of always viewed as the safer choice and it continued its downward decline and when NMC went up, LFP continued its [downward] trend.

But, of course, the main shortage that we see now is the lithium itself. It’s really because of the explosive growth in electric vehicles, but it’s that lithium shortage that impacts every battery chemistry across the board.

People are talking about alternative technologies to lithium-ion, particularly for long-duration applications.

You may even actually have me on the record from one of our past meetings saying that lithium-ion has kind of won the war. And I am now here to recant that!

It was hard to see how a new technology could break in as the curves kept going like this, but the reset that we’ve seen with the new price level, and I think it’s more the awareness that people now have in the industry about the supply chain risks.

Do you think that’s a consideration that’s quite specific to the US market, or is it something you see everywhere?

It’s not just the US, but there’s certainly some good movement in the US.

Ok, let’s take that as a starting point to talk about the US market. Wärtsilä has some big projects in California and Hawaii, for example, and another notable project is the solar-plus-storage project for RWE in Georgia, with utility Georgia Power as the plant’s off-taker.

If I look at our portfolio, we’re about 65% to 70% in the US, 23% in the Middle East and Asia and about 7% in Europe.

So, the US is clearly a very, very important market for us. The most recent [US] announcement we had was the Clearway project in Hawaii, Mililani Solar, 35MW solar PV attached to 35MW by four hours (140MWh) of battery energy storage.

What’s really interesting is that that project has the solar power perfectly matched with the energy storage power. What that means is you can take all the solar and transfer it to the batteries. Usually the solar-to-energy storage ratio is about 30%.

This is 100%, and it’s a function of the fact that Hawaii already has a high penetration of solar. As they put on more and more, they fully filled the daytime of their Duck Curve. Now they’re building solar for the ‘shoulder hours’, so they have to be able to store it and then reissue that power in the shoulder hours.

We’ve got another Hawaii project of equivalent size, also on the island of Oahu coming online this fall, then we have three other projects with Clearway, five projects totalling over 2GWh.

The RWE project in Georgia (Hickory Park) was our first DC to DC-coupled project. DC-DC is a lot more challenging than people realise, there’s a lot of technical challenges.

That project [also] has a really unique feature with our software. RWE, our customer, negotiated a very complicated power purchase agreement (PPA).

They’re paid different rates at different times of day, but then they’re also required to create a forecast the day before and meet that forecast. If they don’t, they get penalised.

With our software, we’re doing the day ahead weather forecasting, taking the forecast and creating a dispatch schedule. We understand when the solar power is going to be generating, we understand where the battery is on state of charge, we have a 15-minute interval look at that.

Then as the day goes, we’re sharpening those forecasts, every 15 minutes gets sharpened down to every minute. And we’re able to basically determine: when do I take solar power into the battery? When do I take battery power to the grid? When do I take solar power directly to the grid?

All those optimisations are automated, and the goal is that RWE can maximise the money on the PPA. It’s not like a simple solar PPA, you generate electricity, you get paid four cents, three cents, whatever the prevailing number is.

But if you have a PPA where day ahead they say, “I need exactly 75MW at this time, for this 15-minute block”. The only way you have to serve that is some combination of whatever the solar might be generating based on the weather forecast and then to backfill it with the batteries.

What were the reasons for designing the PPA that way? And is that something you expect to be doing for other Wärtsilä customers, since it appears to be quite specific to this project’s needs?

RWE was very clever in that one, in the sense that you could engage in a competitive, commodity-oriented race to the bottom and just offer the plain vanilla PPA, or you could try to work with the customers to try to offer them something that gives them more value.

The challenge, or the question, for them was, could they structure something that gave the off-taker Georgia Power more value and therefore have a PPA price that’s higher than what the standard winning bid would have been?

Do I see more of these? I hope so. They’re hard to negotiate, but they’re really all about how you make the most of the assets that you’re putting in the ground.

At the conference we heard a lot of conversations about raw materials and hardware, but software is in many ways equally important.

Hardware is stealing the thunder, because it has dislocated pricing, and people are worried about whether or not they can get their projects done. But prior to this hardware dislocation, there really was a lot of talk about software and the value add that you could do, and how you actually generate more revenue as opposed to reducing costs.

‘Carrot vs stick’

We’ve reported already on the excitement that you and many others feel about the Inflation Reduction Act (IRA) and how it will accelerate deployment of energy storage. The flip side of the IRA – and other US policy like the Bipartisan Infrastructure Law – is that it seeks to encourage domestic manufacturing and supply chains. Do you think the Biden-Harris administration can be successful in that aim?

It is creating a lot of good motivation for the supply chain. You have to look at the IRA in a dual context. The IRA is one component, and the other component is the so-called Section 301 tariffs.

These are the tariffs lobbied against specific Chinese goods. List 4A is the current list for batteries right now and the Section 301 tariffs were put in place against Chinese goods in 2018 under the previous administration.

It had and continues to enjoy bipartisan support, one of the few things where there is bipartisan support in the US and 2023 is when they are up for renewal. There was some speculation when Biden first came into power in 2021, about whether or not he would eliminate List 4A, which he did not.

I think consensus is that they will be renewed, that the tariffs may remain in place at the current level, 7.5% for 2023-2024, but that they will step up and become increasingly painful.

That piece is the stick, and the IRA is the carrot. What we have here is a really coordinated policy approach on how we build domestic manufacturing.

One commentator we spoke to a while ago said the IRA itself is “all carrot and no stick”.

It is all carrot. But there is a stick, and that’s the Section 301 tariffs.

You need to incentivise people to come onshore and do manufacturing, you need to give them some period of years to do that because factories take two three years to build.

Then the incentive alone may not be enough, so you need to kind of have the threat of that stick that basically says your projects won’t be economically viable by a certain point in time.

Do you realistically see Wärtsilä sourcing, for example, battery cells from an American manufacturer within the next three to five years?

Yes. But let’s define that. It’s going to be an Asian company that opens up a facility in the US and manufactures it, most likely. But the important part is, it’s US labour.

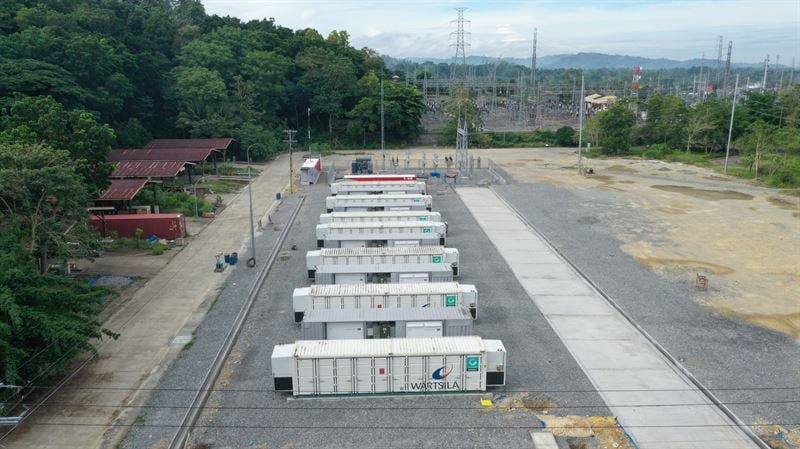

Finally, let’s talk about international markets and which you see coming up next. We covered Wärtsilä battery energy storage system (BESS) projects in some new territories recently, such as Taiwan and the Philippines. It seems like there’s growing interest in Southeast Asia, but what can you tell us about those and other emerging markets?

[Expansion] is a real hard balance to manage. We’re now at the point where we have scale emerging in certain markets and scale is important, because to properly support these systems, you need to have people on the services side in these locations.

If we have systems that are in faraway places, that service is going to be really hard. So, we are in this kind of internal debate right now: what are our target markets for the next 18 months, 24 months?

The UK, Western Europe, United States, Taiwan, Australia, for sure. We are now at the point where [in a lot of those markets] the average sized system for us is 100MW/200MWh.

As Wärtsilä, we also have a lot of strength in kind of ‘random’ markets: I’d like to say that Taiwan was a concerted effort from my team saying, “Hey, this is going to be a big market, let’s go in there”.

But the reality is that Taiwan was a market where Wärtsilä has sold engines for many, many years and we had engine salespeople that knew the local community, the companies, knew the executives. It started with a small 5MW/5MWh battery storage deal, now our portfolio there is over 500MWh, in less than a year.

We started with one 5MW/5MWh system and we had the real hemming and hawing of: “We can’t support this system, it’s going to be really hard, how do we do this?”

The account team assured us, “There’s more coming” and we had another small system… then the big ones came.

You can read our RE+ 2022 interview with the Kiran Kumaraswamy, VP of growth and head of commercial of Fluence, another major battery energy storage system integrator alongside Wärtsilä, which was published last week, here.