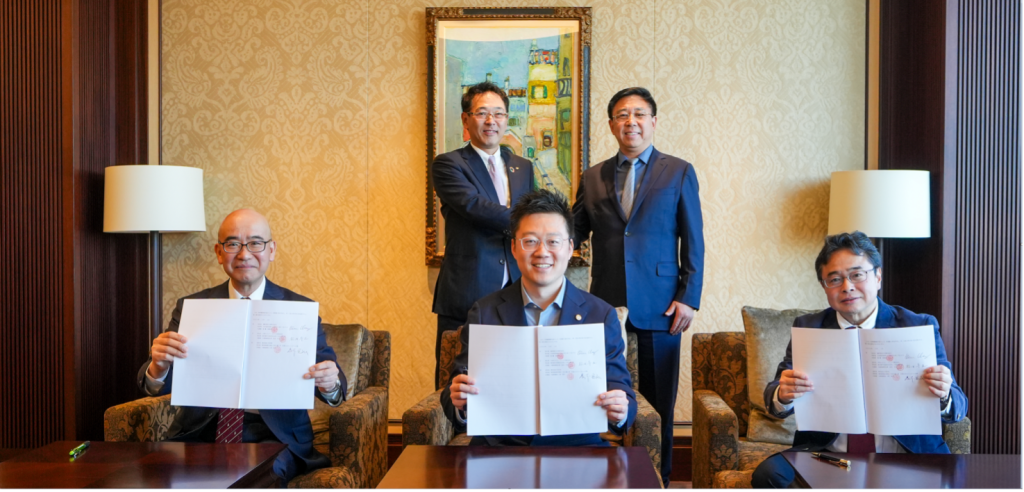

Gotion High Tech has continued its push into Japan’s battery storage market, forming a partnership with investor Daiwa and renewable energy engineering and O&M firm CO2OS.

The new partnership is Chinese battery and energy storage system maker Gotion’s second in Japan, following the company’s entry into the Japanese large-scale BESS market last year via a deal with developer Edison Energy.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Daiwa Energy & Infrastructure said it is targeting the deployment of 1GWh of Gotion battery energy storage system (BESS) solutions within two years.

Daiwa Energy & Infrastructure (DEI) is backed by capital from major Japanese investment bank Daiwa Securities. Since 2018, it has invested more than a billion US dollars into renewables and infrastructure projects, mainly in Japan and Europe. The company also announced a US partnership with developer Solariant for North American solar and energy storage projects in 2022, targeting 2.5GWh of projects.

CO2OS will serve as the engineering, procurement, and construction (EPC) partner, providing technical assistance to Gotion.

DEI and CO2OS have already begun their BESS ventures in Japan: in September, DEI and two other investors, Fuyo Sogo and Astomax announced they would co-fund large-scale projects beginning with a 50MW/100MWh project on the northern island of Hokkaido.

That project is thought to have already begun construction to come online in 2025. In February, DEI and CO2OS brought online a 580kWh battery system at an existing solar PV plant in Kagoshima, which is on the southern island of Kyushu.

Toshiba ESS serves as that project’s aggregator, with the PV plant benefitting from Japan’s new feed-in premium (FiP) subsidy scheme, which DEI said enables some “creativity” in how batteries can be paired with PV to optimise generation and market participation.

Japan’s BESS revenue opportunities evolving gradually

The trio’s new business partnership agreement was signed at the beginning of March and has just been publicly announced.

Vertically integrated manufacturer Gotion is involved in the whole supply chain, from raw materials to recycling. As of 2022, it had 100GWh of total annual production capacity worldwide and is ramping up to 300GWh by 2025, making it one of the world’s biggest lithium-ion (Li-ion) battery manufacturers.

Its Japanese subsidiary was formed in 2017 to serve other segments, including electric vehicles (EVs) and residential energy storage batteries, as well as R&D activities developing next-generation battery tech.

The islands of Hokkaido and Kyushu, at opposite geographical ends of Japan’s biggest populated island, Honshu, are Japanese renewable energy development hotspots and, more recently, have become the place to be for battery storage too.

Yesterday, Energy-Storage.news reported that major Japanese conglomerate Marubeni is building a 103MWh 4-hour duration BESS in Hokkaido.

Japanese BESS market expert Shunsuke Amanai provided some commentary on the market in an interview, noting that the majority of the BESS revenue stack today is coming from ancillary services like frequency regulation, with the capacity market set to play an increasing role.

Wholesale energy trading through the Japanese JEPX power exchange is possible since market regulations to allow BESS participation were introduced, but currently this is a small slice of the total revenues that can be earned by most projects.

Amanai said this is due to JEPX price caps which suppress some of the volatility and fluctuations in price that could be captured by BESS. However, the cap of JPY80 (US$0.53) on imbalance has an implication on spot market prices and spot market prices themselves have a low-end cap of JPY0.1 imposed, which means negative pricing does not occur.

That imbalance price cap is an “artificially low” price, independent expert Amanai said, but it is tentatively planned to be brought up closer to JPY200 and then to JPY600, with price setting set to be further exposed to market forces.

BESS projects are currently being supported by government subsidy schemes to promote their use in integrating renewable energy into the grid and enhancing grid stability.

Shunsuke Amanai said that the market is currently not as lucrative as more mature markets such as the UK, parts of the US and Australia but is likely to present a much bigger opportunity within the next five years, driving major companies like Daiwa and Marubeni to make their play into the market early, particularly in the regions of Hokkaido and Kyushu, where Amanai said increasing competition can be expected.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.