Eos Energy Enterprises has progressed to the due diligence stage in its application for a share of US$2.5 billion in US government loans.

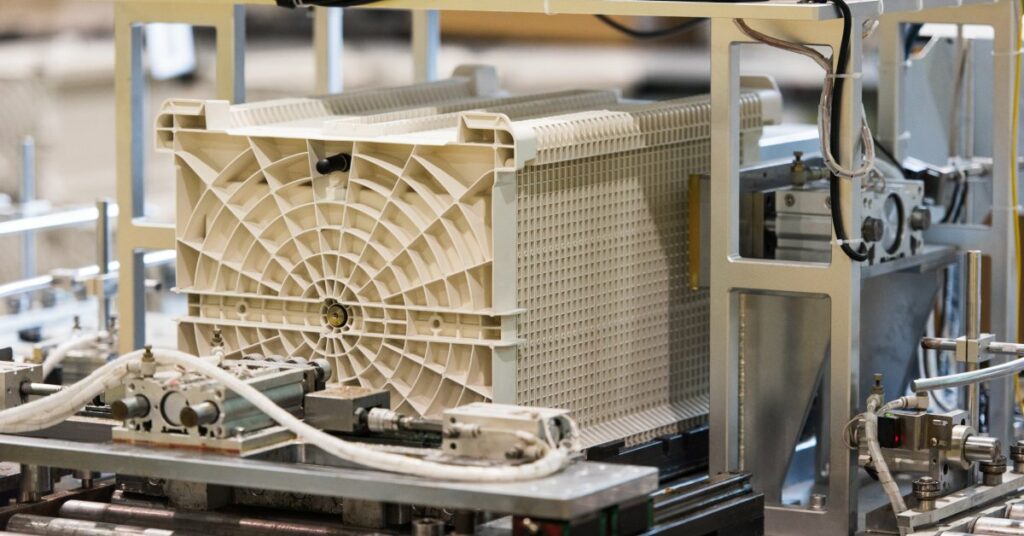

The company manufactures zinc-based battery energy storage systems which offer three hours of storage duration per unit but can be stacked to make longer durations of up to about 12 – 15 hours. Based on an aqueous zinc hybrid cathode that plates and replates zinc as it charges and discharges, Pennsylvania-headquartered Eos claims its products are long life and durable and made using abundant materials.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Eos is in line to reach a targeted annual production capacity of 800MWh by the end of this year, but wants backing for a more ambitious 3GWh target.

Meanwhile, the US Department of Energy’s Loan Programs Office (LPO) returned to active status shortly after President Joe Biden took office in early 2021, with solar industry veteran and clean energy investor Jigar Shah at the helm.

Eos applied for a loan through the office’s Renewable Energy and Efficient Energy solicitation, through which it could access debt capital, a customised financing arrangement, enter a committed partnership with the LPO, or benefit from direct technical experience provided through the office.

The LPO invited the company to the next step in the process, the final part of the second stage in applying, Eos said yesterday. That means that it has gone through vetting for project risk allocation, creditworthiness, legal, environmental and regulatory factors and more.

Eos’ 3GWh production plan will now undergo LPO’s due diligence process. In discussing the loan earlier this year, Eos CEO Joe Mastrangelo said the company sources 80% of its raw materials domestically – within a five-hour drive of its factory – and aims to go to 90% by the end of this year.

That could aid the company in its push for the loan, with increasing the domestic supply chain for energy storage a stated aim of the US government. Another is to reduce the cost of providing long-duration energy storage (LDES) in support of increasing renewable energy adoption.

In June, the LPO made its first lending commitment in its present-day incarnation, confirming a US$504 million loan to the Advanced Clean Energy Storage (ACES) 300GWh green hydrogen storage hub in Utah.

Eos received a US$200 million investment commitment in April from an unnamed investor affiliated with the company’s financing partner Yorkville Advisors, and then secured an US$85 million loan facility with Atlas Credit Partners in August.

The battery storage company went public via a SPAC merger in November 2020 and claimed an order backlog worth US$457 million as of the end of Q2 2022 from 1.9GWh of customer orders, including US$258 million of orders booked during the second quarter alone.