A recent report by UK Electricity Networks Commissioner Nick Winser laid out how to halve the time needed to build up the grid infrastructure for net zero.

Despite the positive legislations and changes Winser presented to the energy community, there was still a distinct lack of key parameters in delivering the required grid infrastructure to attain net zero. This however does not take away from the importance of the recommendations and these should be explored in due course to support decarbonisation efforts.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

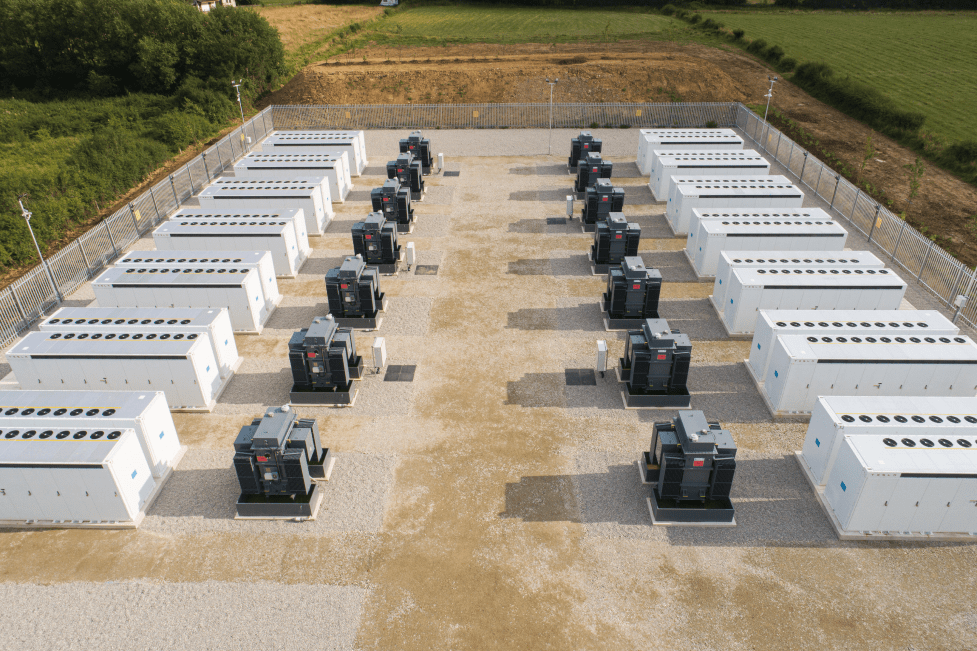

Perhaps the most fundamental absentee from Winser’s report however was energy storage. Battery energy storage in particular is expected to be a crucial aspect of the energy transition by capturing intermittent renewable energy generation from wind and solar, for example, to be distributed at times of high demands or when generation is low.

To learn more on the topic and battery energy storage’s omission from the Winser report, our sister site Current± spoke with Damian Jackman, technical commercial lead at Field and Phil Thompson, CEO of Balance Power, both developers in the UK battery storage market.

A step in the right direction

It is important to first highlight the significance of the report and some of the key takeaways. One which Jackman is keen to highlight, is to showcase to the energy industry just how much renewable energy is being wasted due to the inefficiencies of the UK national grid.

“At the moment we are throwing away valuable renewable energy at a large cost to consumers and businesses because of under investment in grid infrastructure. Nick Winser has suggested a lot of good remedies here, and it’s right that communities who welcome this infrastructure should receive some benefits as a result,” Jackman says.

“Nick Winser’s report is a positive step forwards, with a number of interesting proposals which, if realised, could accelerate progress towards net zero. To get to that point though, the right infrastructure must be in place to connect the vast quantities of renewable energy that we need to decarbonise the electricity system, plus all the other energy uses that are currently met by fossil fuels (mainly heating and transport). To do this we need lots of new connections and in particular, big transmission wires as our lowest cost energy source is wind, which is either out at sea or mainly in Scotland.”

Jackman also draws attention to the need for investment, a message that is ever-present throughout the Nick Winser report.

“Investment in these connections is needed, but Winser’s Single Spatial Energy Plan (SSEP) should also result in a better siting of new renewable energy sources, which in turn means less new network needs building,” he says.

These sentiments are also backed by Thompson who argues that the current issues we now face in the GB energy sector are a result of “historic lack of investment”.

“The primary takeaway for me is that it further acknowledges the problem we’re now facing is due to a historic lack of investment and planning for a net zero energy system. We should all hope that Winser’s recommendations are acted on by the Secretary of State, it will certainly have no detriment to investment in the short term. The key for us as developers will be reducing red tape, and educating voters about the importance net zero and what we need for the transition,” Thompson says.

A lack of energy storage support

As discussed previously in this article, there is a distinct lack of support for energy storage. The use of battery energy storage in particular can be a method to provide flexible support to the grid thus mitigating the need to invest vast sums of capital into grid infrastructure, which can be very costly.

On this topic, Jackman says: “In short, to get the full value from renewable energy sources – whether that be in terms of climate benefits or cost savings – we need energy storage. This technology isn’t a silver bullet for all our problems, but it can and will help a lot.

“Grid scale batteries can be particularly effective where long and expensive new transmission lines are required to connect Scottish renewables to English demand. More storage in these places equals less fresh investment needed in transmission lines. In certain locations, batteries are likely to be enough to defer or even avoid a significant chunk of new transmission within a region, giving at the very least some breathing room while we get the line installed to enable the connection of new energy sources.”

See the full version of this article on our sister site Current.