Corporate funding into battery storage companies rebounded in Q2 after a slow start to the year, but remains considerably lower than in 2022 or 2021 so far.

That’s a key takeaway from the latest ‘Funding and M&A report for Storage and Grid’ published by analysis and market research firm Mercom Capital.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The group produces quarterly reports on activities in the energy storage and smart grid sectors, with the latest edition rounding up trends and activities observed during the first half of 2023 as well as the most recent quarter just gone.

In Q1 2023, Mercom found a considerable drop both quarter-on-quarter and year-on-year, with just US$2.2 billion raised from 27 deals, versus US$12.9 billion from the same number of deals in the same period of 2022 – an 83% decrease.

The good news is, that sum was more than doubled in Q2 2023, with Mercom reporting that US$4.9 billion of corporate funding was raised during the three month period across 32 deals, marking a 126% quarter-on-quarter increase.

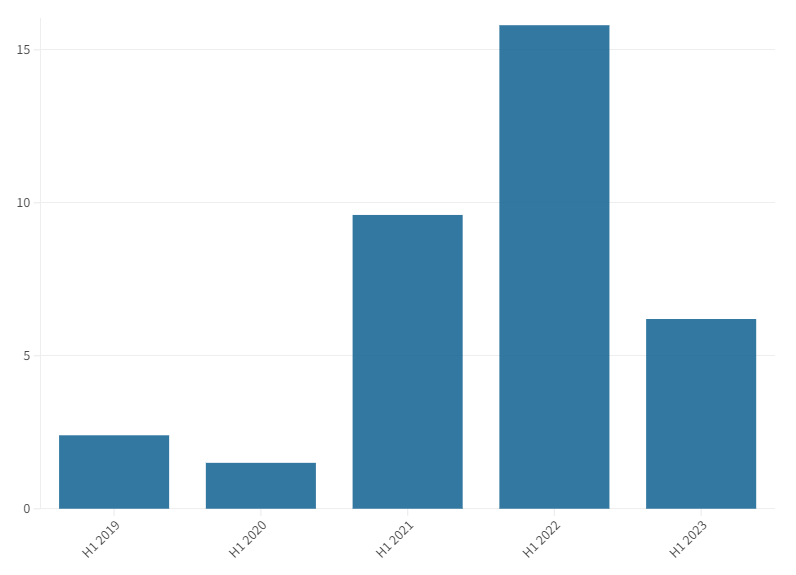

Comparing the first six months of 2023 versus 2022 however, corporate funding was down 55% year-on-year. There were 59 deals reported accounting for US$7.1 billion in H1 2023, versus 60 deals that totalled US$15.8 billion in H1 2022.

However, as Mercom Capital pointed out, the US$10.7 billion IPO by LG Energy Solution that took place early in Q1 2022 distorts the year-on-year comparison. Without that IPO being included, the first half of last year’s figure of US$5.1 billion puts this year’s activity so far in a more favourable light.

Still, 2022 was a breakout year for the sector’s corporate funding activity, with an all-time high of US$26 billion raised, jumping 55% from the US$17 billion raised during 2021.

In both years prior to this one the sector fared much better than it did in a pandemic-depressed 2020, when just US$6.5 billion was recorded by Mercom for the entire year. That said, the sector raised more than double even in 2020 than it did in 2019, when just US$2.8 billion was reported by the group.

Nonetheless, strong tailwinds for the market, particularly in the US following the passing of the Inflation Reduction Act (IRA) late last year made energy storage companies “across the supply chain, from materials to developers” an attractive destination for investors, Mercom said.

VC funding chart (mostly) topped by battery makers

Venture capital (VC) funding recorded in the first half of 2023 was up 27% year-on-year. In H1 2022, US$3 billion VC funding went into the sector from 48 deals, and in H1 2023, US$3.8 billion funding was pumped in via 43 deals.

The quarterly comparison was even more pronounced, seeing a 148% increase from Q1 2023 to Q2 2023, with US$2.7 billion VC funding committed across 24 deals in Q2, and US$1.1 billion in 19 deals during Q1 of this year.

That being said about the whole supply chain attracting investment, of the five top recipients of VC funding in the quarter just gone, four are upstream battery companies and just one is more focused on downstream energy storage systems and deployment.

South Korea’s SK Innovation took both first and second place with two VC deals of US$944 million and US$400 million respectively, while Chinese battery manufacturer Libode was in third place with a US$375 million deal. Electriq Power, a residential battery storage company headquartered in the US and currently planning to publicly list through a special purpose acquisition company (SPAC) combination, came fourth with its recent US$300 million financing. Another US company, battery manufacturing startup Our Next Energy (ONE), was in joint fourth place with US$300 million also raised.