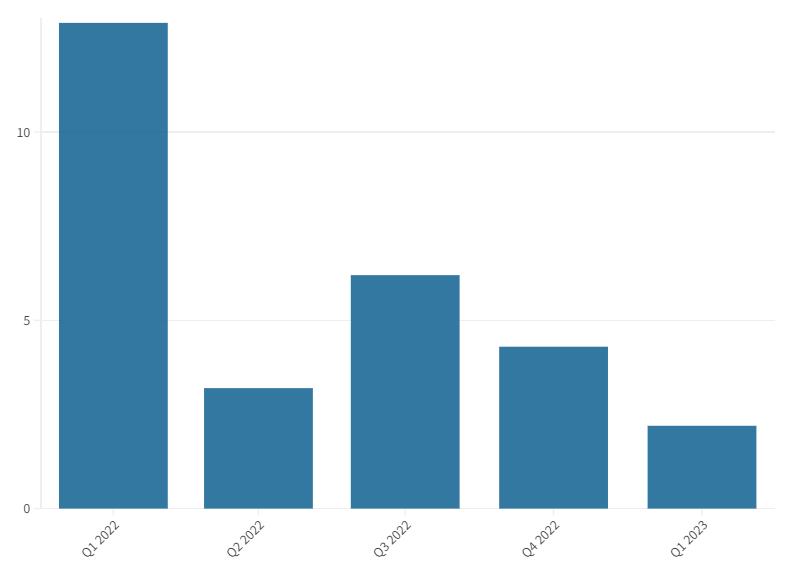

Corporate funding activity into battery storage companies in the first quarter of 2023 fell considerably year-on-year and quarter-on-quarter, according to research from Mercom Capital.

The group’s latest edition of its quarterly reports into corporate funding, including venture capital (VC) funding and mergers and acquisitions (M&A), found that in Q1 2023, US$2.2 billion was raised across 27 deals.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

That’s a drop of 83% from the US$12.9 billion recorded in Q1 2022 from the same number of deals, and a 50% quarter-on-quarter decrease from Q4 2022’s 31 deals, worth US$4.3 billion.

There is however a big caveat to account for. As Mercom pointed out, in Q1 2022, LG Energy Solution floated its US$10.7 billion IPO, which skewed the figures – removing the IPO from the quarterly numbers actually puts the two first quarters on an even footing at US$2.2 billion each.

Nonetheless, looking at previous yearly totals, activity will have to pick up pace quickly this year to catch up to the more than US$26 billion corporate funding recorded for the whole of 2022, which in itself was a massive 50% jump from 2021’s US$17 billion total, and represented more than three times the total of US$8.1 billion reported by Mercom for 2020.

There were decreases in both VC funding and debt and public market funding compared to Q4 2022: there was a 35% drop in VC funding quarter-on-quarter, from US$1.7 billion in 22 deals, to US$1.1 billion in 19 deals. The year-on-year comparison was more favourable, with just an 8% decrease from Q1 2022’s US$1.2 billion VC funding.

It remains to be seen if the sector will go back to attracting funds on the scale it did in 2021, which came after a year of depressed activity during the global pandemic and its related disruptions. Indeed, recent editions of the Mercom report have fairly consistently mentioned record activity, such as Q3 2022, the point at which the previous year’s total corporate funding levels were surpassed.

One area where things appear to have improved in Q1 2023, is the growth in energy storage project funding, as well as the profile of the projects funded. From nine project deals, US$2 billion was raised in Q1 2023, compared to seven deals worth US$749 million in Q4 2022.

Of the top five project deals, Indian developer and independent power producer (IPP) Greenko which offers 24/7 renewable power purchase agreements (PPAs) based on pumped hydro energy storage (PHES) paired with solar and wind got the biggest wedge, at US$700 million, while in second place was Blackstone-owned developer Aypa Power’s US$320 million of corporate credit facilities the Canadian company secured for a 15GW+ pipeline of North American BESS projects.

Rounding out the top three were US developer Leeward Renewable Energy’s US$260 million construction financing raised for its Chaparral Springs solar-plus-storage project in California, UK battery storage and e-mobility infrastructure specialist Zenobe Energy’s £235 million (US$252 million) long-term debt facility for two BESS projects, and US$200 million of project financing and development capital secured by Canadian commercial and industrial (C&I) BESS developer Peak Power.

One other trend Mercom identified last time out was a lean towards debt and public market financing, which grew while VC funding declined, as did private equity financing during 2022.

This time, debt and public market financing levels showed a much greater decline than seen in VC funding. Nine deals worth US$2.6 billion were recorded in Q4 2022, which dropped by 57% in dollar terms to US$1.1 billion debt and public market financing across eight deals in Q1 2023.

Year-on-year, that decline was even more pronounced, with a 91% drop from Q1 2022’s US$11.7 billion raised across just five deals, although again the LG IPO will have skewed this.

Recent M&A activity in the sector has been more difficult to track, with all four M&A deals recorded in the space by energy storage companies in the first quarter of this year on undisclosed financial terms. There were also 12 energy storage project M&A deals, of which three disclosed the transaction amount.

Read Energy-Storage.news’ related coverage of Mercom Capital’s quarterly reports here.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Asia, 11-12 July 2023 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.