While energy storage can be considered “critical” to Australia’s transformation to a distributed, low carbon energy mix, a lack of investment and planning for the technology could have negative consequences for the network.

Security of electricity supplies could be threatened and customers’ bills could rise unchecked, if the flexibility energy storage can add to grids is not fully exploited, a report published today by the Australian Council of Learned Academies (ACOLA) said.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“Without effective planning, appropriate investment and also incentives to develop and deploy energy storage technologies, the costs of electricity in Australia will continue to increase and there will be less reliable (adequate and secure) electricity supply,” the report, delivered by ACOLA in conjunction with the office of Australia’s chief scientist, Alan Finkel, said.

The interdisciplinary ACOLA group has produced the 158-page report, covering everything from modelling Australia’s energy storage requirements to opportunities for Australian companies in producing equipment and raw materials, the environmental benefits and potential risks of widespread energy storage deployment as well as current barriers to the mainstream adoption of advanced batteries and related technologies.

ACOLA looked at some specific real-world cases, such as South Australia’s major blackouts of September 2016, concluding that adequate levels of energy storage, deployed in the right places, could have prevented most or all of the negative effects of generators and infrastructure being affected by storms.

Acknowledging that energy storage can be diverse both in the applications it is used for as well as the different technologies available, ACOLA looked at grid-scale storage in front-of-the-meter and aggregated behind-the-meter household systems. The ‘Role of energy storage in Australia’s future energy supply mix’ was published on Monday morning.

Even AU$22 billion spent by 2030 would be economically viable

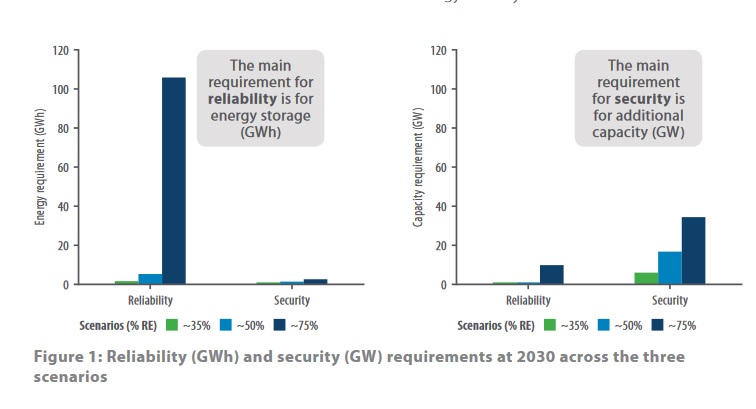

In Australia’s National Energy Market (NEM), which is vast but actually only covers territories in eastern and southern Australia despite the name, ACOLA modelled that by 2030 under a low renewable energy scenario, around AU$3.6 billion (US$2.72 billion) of spending on energy storage would be required. Conversely, under a scenario with a high share of renewables in the NEM, the cost could rise to AU$22 billion. Under current spending projections, NEM is expected to invest AU$70 billion in the cost of running the network alone by that year.

In other words, the academics found energy storage to be “both a technically feasible and an economically viable approach to responding to Australia’s energy security and reliability needs to 2030,” even with higher shares of renewables in the mix.

There is a lack of confidence in Australia’s policymakers among the general public when it comes to energy issues, ACOLA said, but there is an appetite at household level for batteries, to save money, secure energy supplies and help the environment. Nonetheless, homeowners need better access to ways they can calculate and determine the benefits of home energy storage, as well as assurances on the safety of installing lithium batteries in their houses, the report said. From 1,000 people surveyed, ACOLA found that 60% of respondents wanted to see high levels of renewables, with close to 75% of those seeing energy storage as one of the best ways to facilitate this.

In September, the CEO of AGL, Australia’s biggest utility company, said that electricity sector investors were already convinced that renewables backed with energy storage were likely to be the most cost-effective long-term resources available. AGL has a planned phase-out of its coal generation by 2050.

Opportunities and recommendations

Supply chains for existing lithium battery manufacturers are well established, representing something of a closed shop. However, Australia is blessed with an abundance of lithium and other raw materials for battery manufacturing. ACOLA says that while opportunities may be limited in existing manufacturing chains for battery technologies, there may be a chance to get in early in the next generation of battery manufacturers.

There may be unexplored niches where products developed to deal with Australia’s hot weather conditions may prove more suitable than current lithium battery technology, for example. ACOLA said that while Australia has a good track record in research for batteries and other tech such as hydrogen, commercialising those findings has been less successful to date.

Finally, while energy storage could enable disruptive changes to the existing order, redefining power markets and helping enable decentralisation and decarbonisation, ACOLA recommends that policymakers support the technology and play as much of a “policy leadership” role as possible. The academics argued that a “proactive approach” could also help create jobs and economic benefits down the supply chain from raw materials mining to manufacturing and eventually stimulating consumer spending.

Australia’s government recently revealed it had dropped plans to introduce a national Clean Energy Target (CET) post-2020, with those plans appearing to ignore the advice of chief scientist Alan Finkel. One industry commentator said it was “hard to imagine a worse policy” than the technology-neutral plan the government claims would prioritise reliability and bringing prices down.