Three executives from the world’s largest battery company CATL gave a Q&A at ees Europe last week, with Energy-Storage.news in attendance.

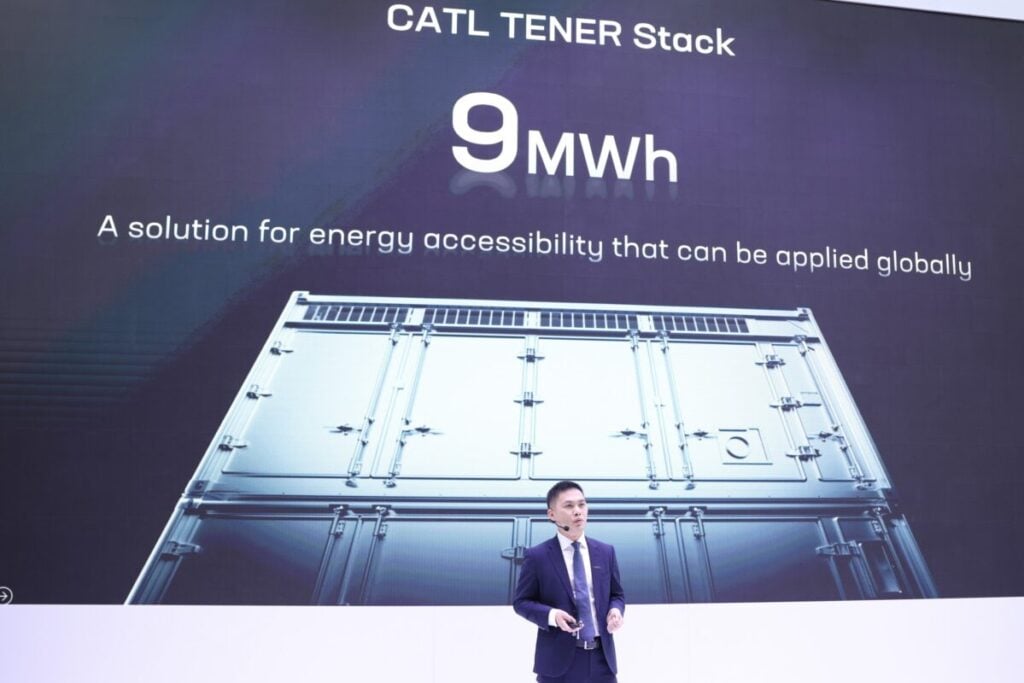

The Q&A followed the launch of the company’s Tener Stack, its latest grid-scale battery energy storage system (BESS) which features a modular, ‘stackable’ design with two 4.5MWh units totalling 9MWh per 20-foot container footprint.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In this article, ESN Premium hears the company’s views on sodium-ion for BESS, European manufacturing, a move to more self-integration amongst European project owners and the firm’s approach to the upcoming Battery Passport requirement under European Union (EU) regulations.

The team also discussed the topic of US tariffs on Chinese products, and we will publish those comments in a separate article in the coming week following yesterday’s 90-day pause on the very high duties announced by Trump in April.

‘Company always evaluating when it will deploy sodium-ion for storage’

In response to a question from another journalist, CATL’s CTO for ESS Europe Hank Zhou explained that the firm is considering when sodium-ion (Na-ion) will be used for energy storage but that it still has a way to go before becoming able to compete with lithium-ion.

“We are always evaluating when the right time to deploy sodium for BESS is,” Zhou said.

CATL already has sodium-ion battery products for the EV space but not yet for BESS. In terms of the wider industry, sodium-ion has already been deployed globally in battery products for the residential and commercial & industrial (C&I) market, but for grid-scale its adoption is further behind.

But the past year has seen the early shoots of that adoption. The largest sodium-ion BESS projects in the world have online in China – one 100MW pure sodium-ion and one 40MW hybridised with lithium – while CATL’s competitor BYD accidentally revealed the launch of a sodium-ion BESS via a now-deleted post by a UK executive.

“The power aspects of sodium-ion are better, and we could use it in more extreme temperatures. It wouldn’t need as powerful a cooling system. But, overall, it still needs some upgrades,” Zhou added.

CATL Europe gigafactory lines could be switched from EV to ESS

The company’s senior director project management ESS Ji Yi meanwhile discussed its battery manufacturing activities in Europe and the general health of the industry. CATL has one operational gigafactory in Germany, one under construction in Hungary, and a third planned in Spain.

The European battery ecosystem has struggled in the past few years, with some of its most high-profile battery companies like Northvolt and Freyr both ceasing battery activites – Northvolt filing for bankruptcy and Freyr pivoting to become a US solar player, renamed T1 Energy.

Asked what he thought of the state of health of the European market, Yi said: “The principle has not changed so we keep investing in the plants in Europe, we just launched a third. I think our local supply is welcomed. We do need more technicians and engineers for our European projects.”

Note that all of its European battery gigafactories are serving or scheduled to serve the EV industry, not BESS. Asked if this could change, Yi explained it could do this relatively easily. LG Energy Solution for example pivoted one of its lines in its Poland plant from EV to ESS battery manufacturing.

“At this moment, yes our EU production is for the EV business. But we designed the production lines to have capability to comply with ESS, so in future we could switch to ESS,” Yi said.

“We already designed them with these considerations. It really depends on when and how much supply we should provide from local capacity. Once this condition is ready we can start it in a short time.”

Move to owner-operators closening relationship with BESS suppliers in Europe

We also asked the executives for their thoughts on the trend of Europe’s BESS owner-operators closening their relationship with battery and BESS suppliers by taking on more system integration and engineering capabilities themselves, something Energy-Storage.news covered recently.

This one was fielded by Kevin Tang, director of sales, ESS Europe CATL, who said: “We saw this tendency once we had a mature DC block industry from 2020 onwards. It is something unstoppable in the industry.”

“Asset owners and utilities want to maximise economy of investment. It is a balance between risk and economics. Our DC block is compatible with nearly all PCS providers.”

“In the US the PCS and EMS are local – our developers select them and integrate the system themselves. The reason why varies between developers and suppliers.”

We suggested to the team that this closening relationship might mean CATL increasingly competes with its own system integrator customers that buy cells from it, for example if an owner-operator chooses to bypass their previous system integrator relationship and go direct to CATL.

However, Tang said this doesn’t cause any friction, something other BESS suppliers we talked to at ees Europe echoed.

“Our clients respect this, you can see the leading integrated players are trying to improve these capabilities. I think CATL just follows this industry tendency, we keep good relationships with our customers. There’s still big potential market for everyone,” he said.

The interview comes just as CATL pursues a second stock market listing on the Hong Kong Exchange, with its shares already traded on the Shenzhen Stock Exchange. It is reportedly seeking to raise a maximum of HK$41 billion (US$5.3 billion), according to its listing document on 12 May.