The US is likely to install record setting amounts of battery storage this year, demonstrating the acceptance the technology has found in the power sector and as an integral part of the clean energy transition.

That’s according to Wood Mackenzie Power & Renewables senior energy storage analyst Vanessa Witte, commenting on the latest quarterly edition of the research firm’s US Energy Storage Monitor market report.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

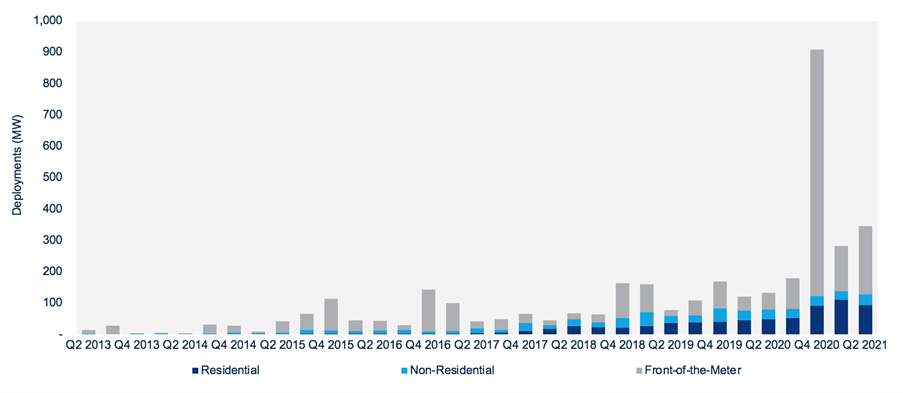

In total, 345MW of battery storage was deployed around the country, including 218MW / 729MWh of front-of-the-meter deployments, in the last three months. A significant portion of that front-of-the-meter figure came from the 100MW / 400MWh Saticoy Energy Storage project in California, which notably was chosen as an alternative form of peaking capacity to a new natural gas peaking power plant.

Two smaller front-of-the-meter utility-scale projects that combined solar PV with battery storage contributed the next largest share, located in Texas and Arizona and bringing online 40MWac and 30MW of batteries respectively for Danish multinational utility Ørsted and Arizona utility Tucson Electric Power. Both were announced as commissioned in mid-May.

Ørsted’s Permian Energy Center in Andrews County, Texas, was the Danish company’s first US solar-plus-storage project, while Tucson Electric Power’s Wilmot Energy Center marks a push forward for a utility which anticipates growing its energy storage deployments from about 50MW this year to 1,400MW by 2035.

“The United States remains on course for a record setting year, further demonstrating battery storage’s growing acceptance within the power market and underlining its importance to the energy transition,” Wood Mackenzie’s Vanessa Witte said.

While slightly more than the previous quarter was installed in Q2, the 345MW total was a 162% increase over Q2 2020, which admittedly saw the impacts of the COVID-19 pandemic begin to bite across the world. Nonetheless, Wood Mackenzie noted that Q2 2021 was the second-largest quarter on record for storage additions by megawatt.

‘Unprecedented volume’ on the way this year

Wood Mackenzie’s tracking of the market over the previous few years shows that historically, the third and especially fourth quarter of each year has seen a surge in deployments. The research firm believes that this will be the case once again, resulting in an “unprecedented volume” of storage coming online in the second half of the year.

More than US$5 billion of investment will come online in 2021, the firm has asserted.

Wood Mackenzie did say however that residential energy storage deployments saw their first dip since the fourth quarter of 2018 — nine consecutive quarters ago — which was a result of equipment and supply chain constraints hampering growth in the segment. Meanwhile non-residential (community and commercial & industrial) deployments rose 31% quarter-on-quarter. Massachusetts’ community storage market has enjoyed a recent period of growth which contributed to that.

State-level policy drivers continue to be important to the fortunes of energy storage all around the US. Wood Mackenzie noted several new state incentives were introduced during the quarter, most of which applied to the behind-the-meter segments of residential and non-residential.

Among the notable policy developments that Energy-Storage.news reported during the quarter were Connecticut and Maine becoming the eighth and ninth states respectively to adopt statewide energy storage deployment targets, with Connecticut introducing a programme to incentivise 580MW of behind-the-meter storage by 2030.

As noted in the previous edition of the US Energy Storage Monitor, the introduction of an investment tax credit (ITC) incentive for standalone energy storage could create a significant uplift to deployments, Wood Mackenzie said. Last week the House of Representatives Ways & Means Committee published its series of recommendations towards Budget Reconciliation measures that are meant to be pushed through later this year. The Committee included the storage ITC, as well as extended and new tax credit eligibility for renewable energy technologies.

Wood Mackenzie has previously said that as much as 12GWh could be installed in the US this year. The firm’s high expectations of the energy storage market appear to tally with some other statistical indicators: the US Department of Energy’s Energy Information Administration (EIA) said a few weeks ago that 10,000MW of new energy storage is expected to be installed in utility service areas around the country by the end of 2023. The vast majority of this capacity is planned to be solar-plus-storage, although the introduction of the ITC could be reasonably expected to give the standalone battery segment a big boost.