Luigi Resta, president of rPlus Energies, discusses the developer’s efforts to be first past the post in building new pumped hydro energy storage projects in the US with ESN Premium.

RPlus Energies just broke ground on a large-scale solar-plus-storage project, but the developer’s pipeline also prominently features a returning ‘legacy’ technology.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

RPlus Energies is a US renewable energy and energy storage developer headquartered in Salt Lake City, Utah. As reported by this site yesterday, it just celebrated the start of construction at Green River Energy Center, a 400MWac solar PV plant with a 400MW/1,600MWh battery energy storage system (BESS) in Utah’s Emery County.

As company president Luigi Resta says in an interview taped earlier this month at the RE+ trade show, bringing clean energy technologies to the rural US, largely in regions connected to the Western Electricity Coordinating Council (WECC), is fundamental to rPlus Energies’ strategy.

The company works with four main technologies: solar PV, wind, batteries and long-duration pumped hydro energy storage (PHES).

While PHES development in the US—and indeed the world at large—has remained mostly dormant for 30-40 years, the technology has made a comeback, with new plants under construction, or existing facilities refurbished and expanded, in Portugal, Switzerland, Australia, the UK and India.

Luigi Resta says that when he started up rPlus six years ago, however, PHES was already on his mind as a viable storage technology to develop, even ahead of the lithium-ion (Li-ion) battery plants the developer has since gone on to build.

“When I started [rPlus Energies], I really saw that there was going to be a significant need for energy storage as a result of all of this intermittent resource coming online, solar and wind over the last 20 years. Batteries, or energy storage, hadn’t really started taking off,” he says.

“So, we leaned into the pumped storage hydro world, which is a very proven, robust technology, but which hasn’t been built in 35 years.”

PHES were originally paired with nuclear power plants or conventional fossil fuel plants, but when the price of natural gas fell in the latter 20th Century, pumped storage began to be replaced with gas peaker plants.

Today, with the drive to decarbonise, and the role of variable renewable energy (VRE) on the grid growing rapidly, pumped hydro once again “starts making a lot of sense,” as a long-duration energy storage (LDES) technology, Resta says.

Licensing pumped hydro: ‘Expensive and time consuming’

With backing from its founding investor, commercial real estate company Gardner Group, and a US$460 million commitment from sustainable infrastructure investor Sandbrook Capital raised in February, rPlus is pushing on with its renewables and storage pipeline.

While that has meant bringing into operation or construction between 1.5-2GW of solar, wind and battery projects to date, the PHES development timeline is considerably longer, and Resta says rPlus is still “a couple of years out from construction” on its first new-build PHES projects.

“In the United States, most pumped storage is required to get a Federal Energy Regulatory Commission (FERC) license. That licensing process, we’ve found, is quite expensive and very time-consuming,” he says

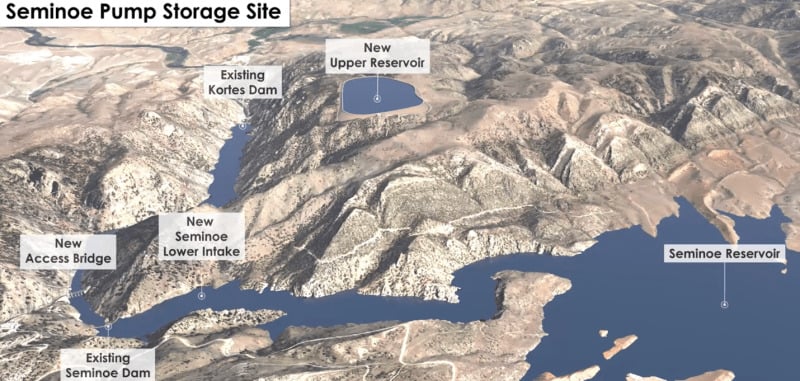

In 2023, rPlus submitted final license applications for two pumped hydro plants on which it began development in 2019. One is the 1GW/8GWh White Pine Pumped Hydro project in White Pine County, Nevada, the other the 900MW/9,000MWh Seminoe Pumped Storage project in Wyoming.

Development of each has cost the developer about US$12 million so far. Resta says a decision is expected in the next 18-24 months, making it a seven-year process just to get that license.

“Once we have the FERC licenses, then we can kind of get down to real significant engineering, construction planning, and it’ll probably take another year before we’d be able to start construction,” Resta says.

On the other hand, another project in the developer’s pipeline is FERC-exempt, and could instead be permitted at the local level. With some preliminary engineering already done, that asset could be construction-ready in 2026, while, like most PHES projects, it would be expected to take about another four to six years to build.

That lengthy development timeline is perhaps understandable given the scale of these civil infrastructure projects and the fact they will be in action for many decades to come; the developer calls them “100-year asset class investments.”

Despite the legacy nature of pumped hydro, the plants rPlus is developing are intended to be state-of-the-art and somewhat similar to some newer projects commissioned in Switzerland within the last five years, which Resta and his team recently visited.

Locational value of strategic sites along transmission lines

The business case for pumped hydro, which is expensive to build but cheap to operate, lies largely in picking the right strategically located spot on the transmission system, the rPlus president says. It also lies within the technology’s ability to robustly deliver and replace services historically provided by fossil fuels.

“Strategic location is hypercritical. Locating in a heavy renewable energy intensity zone, where you’re going to have curtailment is a great co-location spot, with solar or wind,” he says.

Additionally, a couple of rPlus’ PHES projects are planned to be “really centrally located in the big transmission system perspective,” Resta says. That means they would be well-placed to inertia as a vital system service, which Resta says is an often-overlooked topic in the power industry when it comes to grid reliability and resource adequacy (RA).

“Inertia is something that the utilities take for granted because they have big coal thermal spinning reserve units to force that. Our pumped hydro plants will provide that [inertia],” Resta says.

The company would make off-take contracts for its pumped hydro plants through tolling agreements with utilities, in a very similar way to how it contracts for battery or capacity payments.

As utilities’ needs to manage their systems and ensure resource adequacy grow, and coal power plants, currently dominating the WECC electricity generation mix, come offline, Resta says the value of pumped storage will likely “only go up”.

Couple that with constantly revised forecasts and expectations on electricity demand and load growth in the age of the data centre, and Resta says the need to accommodate more energy generation and dispatchable capacity is one safe bet in an uncertain world.

“The concern is that nobody is prepared to accommodate the load growth that is out there right now. If you look at onshoring manufacturing and the data centre AI movement, which is relatively recent, the utilities are not staffed to accommodate, as developers, we’re not equipped, necessarily, to be able to react and develop as quick as that load is coming on,” Resta says.

“Historically, over the last 20 years, the United States has had pretty flat load growth, so the engine, the infrastructure, is not there to accommodate, from a zero load growth over 20 years to a 5-10% annual load growth with transmission, generation, load, dispatch, all of that. We’re going into a brave new world.”

RPlus is far from alone in seeking out pumped hydro development opportunities. FERC’s webpage for PHES licensing links to four maps of the US showing: licensed pumped storage plants (18,897MW total capacity), pending licenses and relicenses for pumped storage (7,908MW total capacity), issued preliminary permits for pumped hydro (29,657MW total capacity) and pending preliminary permits for pumped hydro (26,282MW).