ESN Premium speaks with representatives of Lunar Energy and Nomad Power Systems, respectively targeting the tricky VPP and mobile power markets with energy storage-backed solutions.

A couple of recent bankruptcies highlighted the challenges faced by battery storage providers that target distributed or niche segments of an otherwise booming market.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Virtual power plant (VPP) provider Swell Energy and mobile battery energy storage system (BESS) company Moxion Power both claimed to be pushing their respective technology sets and business models toward greater mainstream adoption.

Sadly—and no one likes to see people lose their jobs and hard work put into R&D and solution development ultimately also lost—the pair were among the casualties of a business environment that demands rapid scale-up.

At this year’s RE+ clean energy trade show in Anaheim, California, we spoke to representatives of two companies that could loosely be described as peers to Swell Energy and Moxion Power.

While it would perhaps be unfair to have asked VPP provider Lunar Energy’s Ed Gunn and Nomad Power Systems board member Lyndsay Gorrill for direct comment on Swell and Moxion’s situation specifically, we did want to know what each felt the recipe for success would be in their respective fields.

Here’s what they said.

Lunar Energy: residential virtual power plants

Lunar Energy is a VPP provider with close ties and partnerships with US residential solar and storage giant Sunrun and Japanese conglomerate and home storage market leader Itochu, among others.

The company acquired UK-based grid and battery storage software specialist Moixa a couple of years back. Moixa’s Gridshare monitoring, forecasting, control and dispatch platform powers solar PV and battery-backed VPP aggregation of around 51,000 batteries across the US, with a major focus on California, about 48,000 in Japan, and a smaller fleet in Europe.

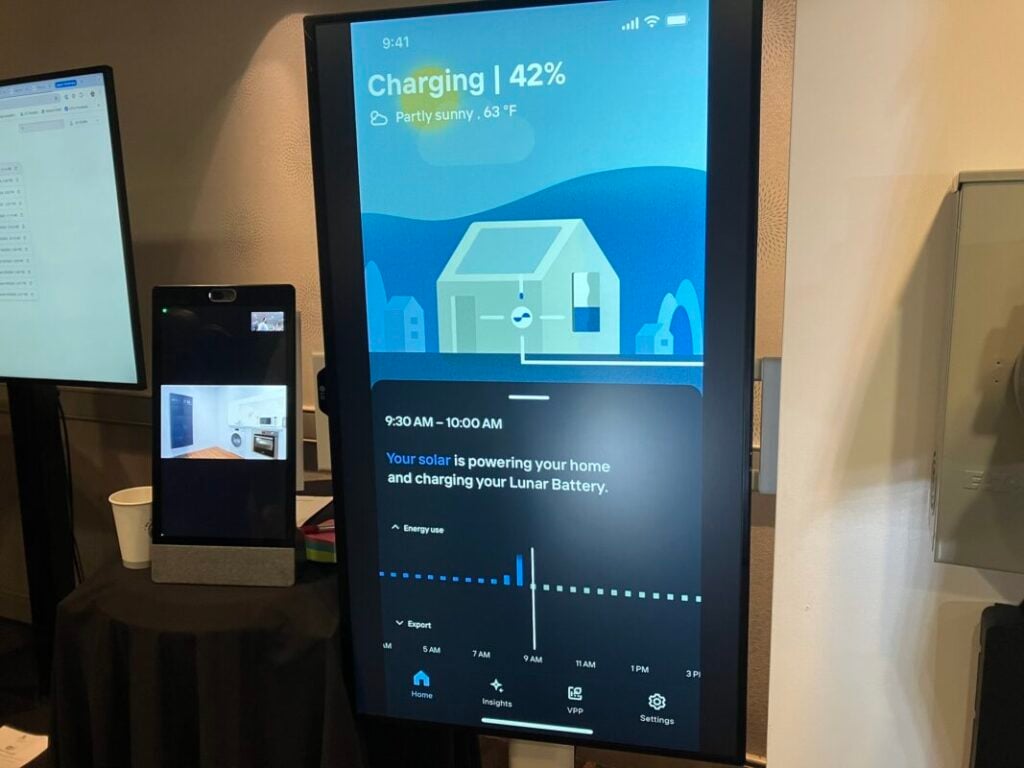

Also ported over to Lunar Energy were key members of the Moixa team, including Ed Gunn, who now serves as Lunar’s senior VP of commercial sales. At this year’s RE+, Lunar was showing off its own-branded battery storage hardware, in addition to the software and consumer apps that manage and monitor its existing fleet of third-party systems.

Customer acquisition, the Achilles heel of many VPP plays

Swell had sought to contract for capacity and grid services with utilities, and market to and enrol those utilities’ customers directly, bringing them into VPP programmes rather than packaging VPP involvement as part of a home solar and storage, or battery-only, offering. Despite raising serious sums of money and talk of a 600MWh VPP pipeline, it ran aground.

In a 2021 interview with Suleiman Khan, CEO of Swell Energy, Energy-Storage.news had heard that customer acquisition for VPP enrolment was the hardest thing to achieve. A basic premise with which Ed Gunn agrees.

“When you’re solving a VPP problem, [when] you’re building out grid services, customer acquisition and maintaining a customer base, are the two big problems. There’s no quick fix for that,” Ed Gunn says.

“We work with partners. We’re not a B-to-C play. We’re not acquiring customers directly. We work with partners who have existing customer bases, but they still need to be ‘acquired’ and brought into a programme.”

Gunn says that preventing customer churn is essential. One ongoing “dialogue” in that respect centres around whether, once contracts are signed between VPP provider and channel partner, customers can be brought on board on an opt-out basis, rather than opt-in.

“This dialogue between opt-in or opt-out programmes is pretty mega in terms of the speed and cost of onboarding customers. We’ve been around for a long time, we’ve seen this, and we’ve done it in a lot of different service territories, in a lot of global energy markets. We’ve seen how to do it, how it can not happen very well, and how it can happen best,” he says.

While there’s no easy answer, no silver bullet to solving that challenge, having that experience of working with a range of different partners and finding best practices in different markets and different contract structures can go a long way to helping, he claims.

The value of VPPs

Virtual power plants are proven to work, through many pilot and demonstrations, as well as commercial offerings, in helping utilities and distribution operators manage everything from grid frequency to peak energy demand. What is less proven, and less readily quantifiable, is the financial value they provide, and how that should be shared between the different stakeholders involved.

Pay customers too little and they won’t want to be part of the project. Pay them too much and the providers could be out of pocket.

Again, Ed Gunn says this is challenging to figure out, but that progress can be made, and the amount of data available to make those calculations is growing constantly.

“I think it’s useful to look at some proxy data in the market to understand just how much value there is to utilities,” Gunn says.

In the US, there’s a balancing act that needs to be pulled off: between utilities, which are starting to understand the value of DERs, which Gunns says, quoting US solar market guru Barry Cinnamon, should perhaps instead be called customer energy resources (“because there’s a customer behind each one,”) and those same customers, for whom the VPP has to also offer value for.

“We have certain utilities in the US, for example, they’re coming out with new programmes that are very, very rich, very rich programmes,” he says, citing the example of a new VPP scheme rolled out by Duke Energy in North Carolina under the direction of storage industry market expert Lon Huber.

“There’s a lot of money there, and it’s really stimulating solar and storage. Lon Huber has done some really good numbers, and he’s been able to justify putting some serious money in the market. That stimulates new customers coming in and deploying solar storage,” Gunn says, and similarly, programmes in Massachusetts are another example of VPPs that entice customers to share their batteries and other DERs with the utility.

Ultimately, Gunn says “there’s a lot more work to be done,” for utilities to be able to properly understand the value of a controllable load that aggregated DERs—or CERs if you will—can provide to them. That, along with customer incentive management, is among the keys to making VPPs work, he says.

Nomad Power Systems: mobile battery storage

Lyndsay Gorrill is CEO and founder of KORE Power, a US-headquartered manufacturer of batteries and energy storage solutions targeting the utility-scale and commercial and industrial (C&I) market segments.

Gorrill has long been vocal that this includes a need to manufacture battery cells domestically, calling them the fundamental building block of a clean energy future in a mid-pandemic online roundtable hosted by US Secretary of Energy Dr Jennifer Granholm.

KORE Power looks to be among the furthest ahead in realising this goal, having moved fairly early to establish a manufacturing base in the US, and the company’s gigafactory in Buckeye, Arizona, could be moving ahead to production in the next few years.

In addition, Gorrill is a director of Nomad Transportable Power Systems. Like the recently defunct Moxion Power, Nomad is targeting applications for battery storage that involve temporary deployment, such as large outdoor events like concerts and festivals, to electric system maintenance, in many cases doing the job traditionally done by diesel generator sets.

Gorrill begins by expressing his sadness at the demise of Moxion, and his best wishes for the employees that lost their jobs. Again, while he chose not to comment directly on the out-of-business competitor and its strategy, he explains why he thinks Nomad can succeed.

Getting the solution right before going commercial

Nomad is a partnership between two companies: KORE Power, and Northern Reliability Inc. (NRI), the equipment provider and system integrator that KORE acquired in 2021.

NRI replaced Samsung and LG as its cell provider with KORE Power, which is currently supplying cells from a factory in China until its US supply chain is up and running. NRI wanted to create a mobile power system, and so its new parent company suggested the creation of a joint venture (JV).

In co-developing a mobile solution, Gorrill says the batteries are bespoke to those applications, and different to what is found in KORE Power’s stationary BESS solutions.

“It’s a different battery, a very different configuration. We spent over a year and a half developing the first Nomad, and we built a big Nomad, over 2MWh,” Gorrill says.

“We knew, if we could prove it on a big scale, we could downgrade it to a smaller scale in the future.”

KORE continues to provide support to Nomad on the technology side, not only in terms of designing and supplying a battery that Gorrill claims is tailored for mobile applications, but also in terms of controls. That includes KORE Power’s energy management system (EMS), controls and other software.

“Moxion had a big market presence. We were a bit different, we wanted to prove the product ourselves,” Gorrill says, with the first Nomad having been wheeled out and used at events across the US and Canada, racking up more than 70,000 miles in the process.

Now that it’s commercially available, the Nomad solution is being marketed as both standalone and tied with diesel gensets. The mobile power solutions JV will likely be one of KORE’s biggest customers in years to come, the CEO claims.

That belief is based on the market research and analysis conducted prior to the JV’s launch. At the same time, KORE has skin in the game: as Nomad’s exclusive battery and controls technology partner, it has to make sure nothing goes wrong with any of its portable systems.

“We also want to make sure that our battery is going into the right system, because if something happens to that system, it looks bad for us.”

Meanwhile, Gorrill claims the use cases for mobile BESS “have snowballed,” and Nomad has contracts with three utilities, as well as several power solutions rental companies interested in using it.

“We think we’ve created the right product,” he says.