The US industry deployed more than 5GWh of energy storage in the third quarter of 2022, the highest Q3 figure on record and close to half the entire amount of storage installed in the country in 2021.

That’s according to the latest edition of analysis and research group Wood Mackenzie Power & Renewables’ US Energy Storage Monitor, which recorded that 1,444MW/5,189MWh of storage was deployed in Q3 2022.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Of that, a big majority was once again in the grid-scale market segment, 1,257MW/4,733MWh of the total. That was the highest grid-scale deployment figure Wood Mackenzie has observed, smashing out Q1 2021’s record 4,598MWh of grid-scale installations.

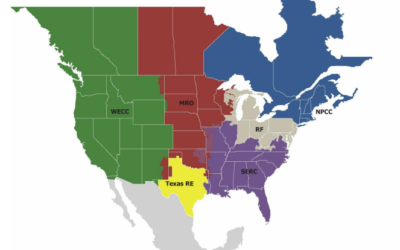

Of those grid-scale projects, the leaders California and Texas – or perhaps more accurately the California Independent System Operator (CAISO) market and Electricity Reliability Council of Texas (ERCOT) markets, accounted for more than 96%.

Looking back, during 2021, a total 10.5GWh of storage including 9.2GWh of grid-scale was installed, which itself was a massive jump from 3,487MWh of new storage across all market segments in 2020, as recorded by the analysis group and reported by this site at the time.

Although grid-scale continues to dominate the numbers, the residential segment has also seen strong growth.

A total 161MW/400MWh of residential battery systems, equivalent to more than 23,000 installs deployed in Q3 surpasses that segment’s record of 375MWh, which was attained just three months prior in Q2 2022.

California and Texas were also among the leaders in the residential segment, joined by Puerto Rico and Hawaii, both of which are booming markets due to their island grids and reliance on imported fuels for power generation.

Wood Mackenzie also said that the non-residential segment it reports on, comprising commercial and industrial (C&I) and community energy storage, is set for growth in the coming years, like its grid-scale and residential counterparts.

However, it continues to lag versus the other segments significantly, with only 26.6MW/56.2MWh of new installations on record in the quarter from June to September.

That made it one of the least active quarters on record, following similarly low figures in Q2, and in fact was the first time Wood Mac reported less than 26.6MW of new installations in a quarter since Q1 2021’s 26.3MW.

65GW/194GWh of cumulative installs expected within four-year period

Wood Mackenzie anticipated Q4 2022 being another busy three months in grid-scale. Already by mid-November the firm had tracked 600MW of deployments in the segment since the end of September.

Well-documented market headwinds, such as supply chain issues caused by soaring demand for key materials like lithium carbonate and commensurate price rises, and logistics issues caused by the ongoing COVID-19 pandemic, had been expected to cause a dip in installs as projects were delayed.

Another cause of delays, which is not limited to the energy storage market but more broadly across the energy sector is the lengthy queues for interconnection to the grid. That does continue to persist, although efforts are being made by groups including the US Department of Energy (DOE) to rectify an often complex and ad hoc process.

However, the good news is that the delays haven’t caused capacity growth to slow at grid-scale, Wood Mac said. Projects have been delayed rather than cancelled, although it remains to be seen if a recent news story that California utility PG&E requested – and got – permission from regulators to increase the price of contracts signed for BESS procurements might send a cautionary signal to the market.

One other cause of delays that market observers might have expected is the oncoming introduction of the Inflation Reduction Act’s various measures to support clean energy, including an investment tax credit (ITC) incentive for energy storage projects.

Wood Mackenzie senior analyst Vanessa Witte said that this tactic was likely being applied by only a very narrow band of developers within the market. Meanwhile, those other headwinds will remain more prominent.

“Some developers have considered delaying projects into 2023 to receive tax credits from the Inflation Reduction Act, but this only applies to a very niche segment of projects. In general, supply chain challenges and interconnection queue backlogs will push capacity to later in the forecast, with 2024-2026 seeing increases of 9-13% per year due to this,” Witte said.

Wood Mackenzie has forecasted 64.6GW/194GWh of cumulative installs across all segments on the US market between 2022 and 2026. While grid-scale will remain largely dominant, its market share will be around 84%, down from the high watermark of Q3’s figures.

Energy storage’s close relationship with solar PV will continue to be in evidence in a couple of telling ways. One is that ongoing trade tariff rows that have impacted the solar industry continue to slow down execution of solar-plus-storage projects, albeit to a lesser extent now that a two-year freeze has been put on anti-dumping / countervailing duties (AD/CVD).

The other is California’s anticipated introduction of a new net metering regime, dubbed NEM 3.0. If brought in as proposed, it would reduce dramatically the value of residential solar PV, which many have speculated will be an incentiviser for energy storage.

Energy-Storage.news’ publisher Solar Media will host the 5th Energy Storage Summit USA, 28-29 March 2023 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.