Another edition of news in brief, this time from regulators in the US states of Connecticut and Oregon and flow battery maker Quino Energy.

Connecticut’s DEEP picks 518MW of solar, 200MW BESS project through RFPs

Connecticut’s public utility and energy policy regulator has selected 518MW of solar PV and a 200MW energy storage project through competitive solicitations.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The Connecticut Department of Energy and Environmental Protection (DEEP) announced last week (20 December) that three large-scale solar PV projects and one standalone battery energy storage system (BESS) project were successful in reverse auctions for zero-carbon energy resources and storage.

DEEP held three requests for proposals (RFPs) launched from October 2023 to March 2024. They included a separate RFP through which 2,878MW of offshore wind projects were selected, while the state agency received more than 50 project submissions from 27 developers for the renewables and storage solicitations.

The BESS project, called Naugatuck Avenue, was submitted by developer Jupiter Power and is the first to be awarded by the state.

The three solar PV projects comprise D.E. Shaw Renewables Investments’ (DESRI’s) 200MW Solar Nursery plant, the 250MW Freedom Pine Solar, also from DESRI, and the 68MW Crooked Trail Solar project from developer Verogy.

Naugatuck Avenue and Solar Nursery will be located within Connecticut, while Crooked Trail and Freedom Pine Solar are in Maine.

The BESS project will contribute towards Connecticut’s 1,000MW by 2030 energy storage policy goal. DEEP estimated that the four clean energy projects between them will save ratepayers approximately US$424 million in energy supply costs over 20 years of operation.

Oregon regulators invite Portland General Electric to submit BESS project cost application

The Oregon Public Utility Commission (OPUC) has invited utility Portland General Electric (PGE) to apply for recovery of the costs of investing in a large-scale BESS facility.

The state regulator issued a decision last week (20 December) in a PGE rate review request, approving the utility’s application to increase rates by 5.5% for residential customers and 7.7% for non-residential from the beginning of 2025.

The rate hike will support investments and upgrades in transmission and distribution (T&D) infrastructure and low-carbon technologies, including hardening the grid from the impacts of extreme weather events and deploying a battery storage system.

PGE is seeking to raise its revenues by around US$98 million, around 54% of the cost of the utility’s open brief filing of US$182 million. The PUC approved a 50% debt and 50% equity capital structure with return on equity (ROE) of 9.34%.

PGE will now evaluate the impact of the order on its planned investments in operations and maintenance (O&M), fleet electrification and Clearwater Wind Energy Center, a 750MW wind power plant in development by NextEra Energy Resources.

Meanwhile, the PUC made its invitation to the utility to file a separate revenue recovery request for its proposed investment in Seaside Grid, a 200MW/800MWh battery storage project.

Developer Eolian submitted the Seaside project to PGE’s 2021 all-source RFP, where the utility sought up to 375MW of ‘non-emitting dispatchable capacity’—such as battery storage—alongside 500MW of renewable energy.

As reported by Energy-Storage.news in May 2023, PGE selected Seaside Grid through the procurement. PGE will co-develop the project with Eolian and own it.

At the time of the selection being announced, the estimated total cost of the Seaside project was US$360 million, minus the cost of construction.

Another project of the same output and capacity, Troutdale Grid, was also selected from the RFP, originally developed by Eolian and sold to NextEra Energy Resources, but rather than taking an ownership stake, PGE intends to contract with the developer for its capacity over a 20-year term.

US DOE awards funding to organic flow battery manufacturer for oil tank repurposing

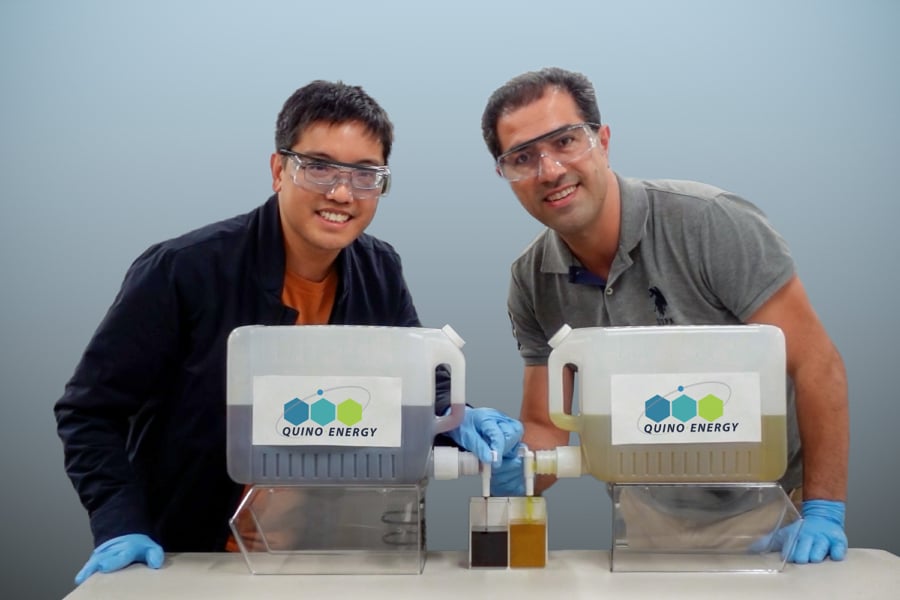

The US Department of Energy (DOE) has made a US$2.6 million grant award to flow battery startup Quino Energy for a demonstration project.

The DOE’s Advanced Materials and Manufacturing Technology Office (AMMTO) made the award via its programme Platform Technologies for Transformative Battery Manufacturing, Quino Energy said on Friday (20 December).

The project is set to demonstrate that Quino Energy’s organic electrolyte can be stored in carbon steel tanks used for the storage of oil and other fuels, potentially opening the path to repurposing fossil fuel industry infrastructure and constructing very large-scale long-duration energy storage (LDES) facilities at low cost.

Quino Energy is commercialising its aqueous organic quinone redox flow battery (QRFB) technology that uses quinone-based electrolytes. The company claims that the organic electrolyte is less corrosive than vanadium pentoxide, which is more commonly used in the industry in vanadium redox flow batteries (VRFBs).

Quino Energy will build two systems, one of 3kW/24kWh at lab scale and the other a commercial-scale field demonstrator of 200kW/2,000kWh. The systems are expected to go into operation by the end of 2026, and their performance will be assessed over at least 18 months.

The manufacturer claimed the combination of its new flow battery technology and existing oil tank storage infrastructure could enable QRFB installed cost around 30% lower than lithium iron phosphate (LFP) battery storage and 40% lower than vanadium flow battery installations.

Once it gets up to gigawatt-hour scale, it could also enable around three times the energy density of LFP BESS, Quino claimed.

AMMTO announced 11 projects in total to receive a combined US$25 million in funding through the Platform Technologies for Transformative Battery Manufacturing programme last week. Alongside Quino Energy’s flow battery project were sodium-ion battery processing and machining projects, two other flow battery-related grants and nanolayer materials.