According to the American Clean Power Association’s (ACP’s) Q1 2025 market report, US clean power deployment totalled 7.4GW in the first quarter of the year.

The 7.4GW tallied by the national trade association represents projects across utility-scale solar, wind and energy storage brought online during Q1 2025.

Of that total, battery energy storage system (BESS) capacity represents 1.6GW. ACP says more BESS capacity was connected in Q1 2025 than in any other first quarter on record.

These installations place the cumulative operational storage capacity for the US above 30GW, which ACP notes is a growth of 65% year-on-year from Q1 2024.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Battery storage accounted for 27% of all pipeline capacity, with ACP noting its ‘robust’ growth of increasing 57% year-over-year.

A total of 28 battery storage projects were commissioned during Q1 2025, 22 standalone and 6 paired with wind or solar.

ACP notes that the two largest storage projects to come online during this time were NextEra Energy Resources’ 200MW/800MWh Silver State South Storage in Nevada and AES Indiana’s 200MW/800MWh Pike County Energy Storage.

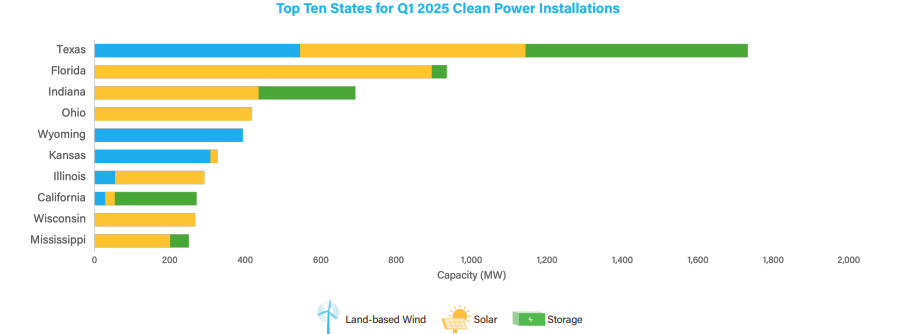

Texas installed near equal amounts of land-based wind, solar and storage in Q1 across its approximately 1,800MW of clean power installations.

California’s clean power installations were mostly energy storage during Q1.

Indiana saw the second-largest increase in storage capacity and the third-largest addition of utility-scale solar in Q1. The state expanded its storage by 256MW, four times its previous installed capacity.

Notably, of the top ten states for Q1 clean power installations, eight voted to elect Donald Trump in the most recent US presidential election.

In order of installations, these states include Texas, Florida, Indiana, Ohio, Wyoming, Kansas, Wisconsin and Mississippi. The remaining two states are Illinois and California.

Tax credits supported by the Inflation Reduction Act (IRA) for clean energy development are currently under threat from the budget reconciliation bill, or ‘One, Big, Beautiful Bill’, passed by the House of Representatives, the lower house of Congress on 22 May.

The bill aims to remove production tax credits (PTCs) and investment tax credits (ITCs) for various technologies, such as energy storage.

Should the Senate approve the bill as is, it would restrict tax credits to projects that commence construction within 60 days of US President Donald Trump signing it into law and that are operational by the end of 2028.

Nonetheless, as mentioned, ACP’s report shows that clean energy projects are expanding in Republican states.

US Republican Senator John Curtis recently praised energy tax credits during a visit to Fluence’s Utah factory, stating:

“In Utah, we’ve seen firsthand how smart policies—like energy tax credits—can drive innovation, strengthen our economy, and create real opportunity.”